NEW YORK (CNN/Money) -

JetBlue Airways, the rapidly growing low-fare carrier, is taking a step backward Thursday as it flies its last flight out of Atlanta, but the retreat is being noticed far outside that city by the nation's airlines.

The New York-based carrier, which has grown into the nation's 10th-biggest airline even before it turns three years old, is quitting the Atlanta market that it entered only last May.

Its entry there prompted the two carriers based in Atlanta -- Delta Air Lines (DAL: Research, Estimates), the nation's No. 3 airline, and AirTran (AAI: Research, Estimates), another fast-growing discounter -- to boost their flight schedules and slash fares.

But JetBlue's (JBLU: Research, Estimates) troubles in Atlanta raise questions for both travelers and airline investors alike about how much longer the no-frill, low-fare carriers can continue to post higher profits, and deliver rising stock prices.

JetBlue late Thursday cut its fourth-quarter operating margin to between 13 percent and 14 percent due to lower fares and the California wildfires, a move that could further fuel speculation about its long-term profitability. The low-cost carrier had posted a 19.7 percent third-quarter operating margin, and a margin of 16.8 percent a year earlier.

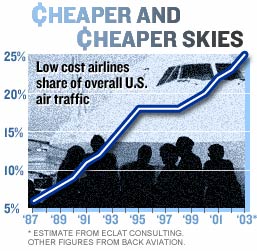

By some estimates, low-fare carriers now carry about one quarter of the nation's air traffic, up from less than 10 percent in 1990. But the rapid growth and new entries mean the market is rapidly getting crowded, posing challenges for growth.

"I think we've entered a new phase," said Jim Craun, analyst with Eclat Consulting, a Washington, D.C.-area aviation consulting firm. "I don't think we've reached the saturation point yet. But while they will try to avoid each other, it'll be harder to do." He said even if double-digit growth in traffic and revenue continues the next few years, it could then tail off due to saturation.

Big boys entering low-fare segment

Still, more and more carriers are trying the discount model. Delta started Song, its low-fare carrier, last spring, competing directly with JetBlue on some routes and offering some of JetBlue's signature amenities, such as televisions at each seat, on some flights.

|

|

| United's low fare airline, Ted, is set to start flights Feb. 12. |

No. 2 United Airlines last month unveiled plans for Ted (from Uni-Ted), a discount carrier that will start flying in February, mainly out of Denver, home to the independent discount carrier Frontier Airlines (FRNT: Research, Estimates). Chicago-based United has been operating in bankruptcy for almost a year.

Officials at Song and Ted say they'll have a big edge over the established low-fare carriers, since they will allow passengers to connect to more flights on their parent airlines and accumulate frequent flier miles on the parent and discount carrier alike.

But some analysts question how successful the new operations will be.

"I think they will take back some market share, but I don't think their cost structure is such that they can charge low-cost carrier fares and make money," said Craun, who doesn't have any contracts with low-fare carriers, but is advising one group looking to enter this segment of the market.

Even with the growing competition in the sector, executives at discount airlines insist they still have room for growth. Frontier is planning for 50 percent growth in cities served and aircraft in the next five years, even with the new competition from Ted.

Goodbye Atlanta, hello Boston

For its part, JetBlue says the retreat from Atlanta isn't a defeat. The move will allow the airline to grow faster when it enters the Boston market early next month.

| Related stories

|

|

|

|

|

"We'll go where we can make the most money," JetBlue spokesman Gareth Edmondson-Jones said. "There's no sense in staying in a slow growth market to slug it out when there's still a lot of the country that doesn't have access to low fares."

Executives at Southwest Airlines (LUV: Research, Estimates), by far the largest and oldest of the low-fare carriers, also argue there's still room for the segment to grow.

"Each carrier is going after its own geographic niche -- AirTran is growing in Atlanta, JetBlue out of [New York's] JFK. It's not like AirTran, JetBlue and Southwest are competing on all our routes," Southwest Chief Financial Officer Gary Kelly said.

"You say, 'Is it getting crowded?' but this is a big country. There's bound to be some competition in the future, but right now there's relatively little overlap." Kelly said even without adding new cities, the carriers can grow by adding flights between existing airports served.

Click here for a look at airline stocks

Still, Southwest is clearly seeing more discount competition today. America West Airlines, which like Southwest has its prime hub in Phoenix, has changed to become more of a discount carrier than it was before Sept. 11. AirTran is poised to move into the Dallas market where Southwest started.

But even in that situation, there will be relatively little overlap in routes served.

Southwest's Dallas operation is based at Love Field, the city's older airport, from which carriers can fly only to nearby states. AirTran is moving into Dallas-Fort Worth, and will focus on longer-distance routes. Thus it probably will pose more of a threat to American Airlines, the world's No. 1 carrier, which has a major hub at DFW, than to Southwest, according to Tom Parsons, president of BestFares.com.

Parsons also said that given the stronger financial position of the low-cost carriers, there is no immediate threat to their growth even with the sector becoming more crowded.

"Southwest is putting money in the bank. AirTran and JetBlue are also running positive cash flow," Parsons said. "The biggest concern is what we saw with past low-fare carrier failures, like People Express, was they decided to grow too fast. But all the low-cost airlines learned from People Express."

--from staff and wire reports

|