NEW YORK (CNN/Money) - Carl Smith never really thought about his money.

The modest paycheck he earned as a school teacher somehow got frittered away. When the next paycheck came, he'd spend it and continue the cycle.

Then his father, a former minister, turned 75. Smith realized that his dad didn't have a retirement fund, or any other savings.

"He had a house because, out of the blue, someone from the church just gave him a home," he said. "I woke up one day and said, 'I won't repeat the same thing.'"

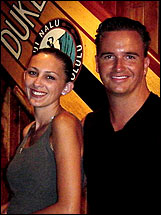

That was 10 years ago. Today, Smith, 33, and his wife, Tahana, 32, have more than $540,000 in retirement funds, cash savings and investments. Add the equity in their home, and the Smiths are worth about $880,000.

How did the couple, who live in Rancho Mirage, Calif., manage to go from limping paycheck to paycheck to cruising along with six figures to their name?

"I followed the rule 'pay yourself first,'" says Smith, who admits that amassing wealth has been a long process that's required patience, discipline -- and a few hard lessons along the way.

Working harder

The first thing the Smiths did was to work harder. Literally. Carl supplemented his teaching salary with tutoring gigs. Meanwhile, Tahana was "working her tail off" at two different retail jobs.

"We couldn't have done it without a dual income," says Carl.

The couple also started budgeting. For fun, they went to the $1 cinema instead of the full-priced movie complex. They hung out and watched the sunset instead of going to restaurants.

Smith had been putting $50 a month from his paycheck into a retirement plan at school. In 1994, he also starting working with a broker to save even more.

"My huge goal back then was to get $1,000 into a brokerage account so we could have savings," said Smith. "Then he convinced me to invest." His first stock purchase was $2,500 worth of McDonald's.

They had some help, too. Carl's mother looked after their first child, a daughter who's now 12. That saved thousands of dollars in potential child-care costs and enabled Tahana to work more. The private Christian school where Carl works also provides discounted tuition for his children. (Their second daughter was born three years ago.)

Doing well in real estate

It got easier to save when Smith began getting promoted. (He is now vice principal at the school.) His wife was able to quit her retail jobs and now works one job, as a mortgage broker. Today, their annual combined income ranges from $90,000 to $120,000, depending on how well Tahana's mortgage business does.

As for their own real estate deals, the couple had asked a wealthy cousin to co-sign a mortgage loan. When he refused, the Smiths found a federal HUD program and bought a repossessed 1,000 square-foot townhouse. It cost $61,500 -- a lot of money for the couple but still far less than what they might have paid.

"When my cousin turned me down, I was devastated," Smith recalls. "I wanted to have a house so bad, it made us save."

They sold it for $126,000 three years ago, plowing their profits into a two-bedroom Spanish-style home that boasts a swimming pool, Jacuzzi and three-quarters of an acre of land. The property is now worth about $600,000. The couple owes $270,000 in loans.

Like many investors, the Smiths got burned in the dot-com bust. By the late 1990s, his portfolio was full of tech stocks. But Carl ignored his broker's suggestion to lighten his holdings.

"I was buying stocks as though I could do no wrong," he said. "Since the market correction, I decided I don't know it all."

He quit buying individual stocks, and stopped dreaming of early retirement. Now, the family portfolio features a blend of mutual funds and investing styles.

His financial goals are evolving, as well.

"I used to think if we had a security net of $100,000 we'd be so comfortable," he says. "Then I thought $500,000 was the important mark. Now it's $1 million."

While Smith and his wife have done a great job reaching their financial goals, they still have one more task to put on their to-do list: getting more life insurance. These days, term life insurance policies are a relatively inexpensive way to provide additional protection for loved ones. (For more information about selecting the right kind and amount of life insurance click here.)

In the meantime, Smith is trying to impart money lessons to his oldest daughter and his students. He tells the seniors in his school that they can become millionaires by saving $50 a month, thanks to compounding interest. (To find out how much savings are worth in the future, use our online calculator.)

Recently, a 23-year-old former student returned to tell him that he followed his advice and now owns three homes.

"He came to me and said, 'Thank you for sharing it with me because it really works,'" said Smith. "To me, that's really neat."

|