NEW YORK (CNN/Money) -

The first quarter will come to a close on Wednesday and so far, many companies have issued rosy forecasts.

According to Thomson/First Call, 32 percent of companies that have commented about their first quarter outlook have raised guidance while 53 percent have warned. Typically, more companies lower their forecasts than raise them. But a much higher percentage of companies have raised guidance in this year's first quarter than usual.

At this time last year, only 21 percent of companies preannounced positively while 58 percent lowered guidance.

The numbers look even better in the tech sector, which has enjoyed some of the most dramatic growth lately due to an improving economy: 37 percent of techs have raised guidance for the first quarter and 45 percent have warned. A year ago, just 24 percent of techs upped their outlooks while 49 percent issued downbeat forecasts.

But do investors care?

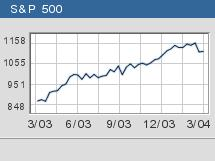

The S&P 500 is flat for the year and down about 4 percent since late January. The Nasdaq is down nearly 2 percent this year and it is 9 percent below its late-January peak. And that's after factoring in Thursday's huge tech stock rally.

Strong earnings aren't a surprise

Part of the problem is that even though there have been a couple of interesting preannouncements here and there, none of the tech industry's bellwethers has issued any guidance recently. (Intel's mid-quarter update was more than three weeks ago, an eternity for data-hungry traders.)

So investors may be just waiting until April when the big companies will begin to report their first quarter results. And in the absence of major news on the earnings front, the past few weeks may have served as a good time to take some profits considering how well tech and the overall market did last year.

"People will get excited about earnings again once they actually start coming out," said Matthew Kelmon, president of Kelmoore Investment Co. "My whole take on this pullback is it's the first mature orderly correction in a long time."

Kelmon said he's taken advantage of this sell-off. He recently bought online travel firm InterActive (IACI: Research, Estimates) for the first time and has added to positions in Electronic Arts (ERTS: Research, Estimates), Dell (DELL: Research, Estimates), Intel (INTC: Research, Estimates), Analog Devices (ADI: Research, Estimates) and Texas Instruments (TXN: Research, Estimates).

But others think that the main reason techs and other stocks have pulled back is because investors already know the first quarter results will be good and that the second quarter probably will be strong as well.

| More about the market

|

|

|

|

|

Analysts are predicting S&P tech earnings growth of 54 percent in the first quarter and earnings growth of 47 percent in the second quarter. For the whole S&P 500, analysts are forecasting year-over-year earnings increases of 16.7 percent in the first quarter and 14.9 percent in the second quarter.

In order to really impress investors, tech companies will need to exceed these forecasts.

"If numbers are better than expected and the news is good for second quarter outlooks, then we could rally on that. But I think the results are pretty much baked into the cake here," said Ken Perkins, a research analyst with Thomson/First Call.

Comparisons get tougher and techs are still pricey

The big question for many is whether or not tech will be able to overcome relatively tough comparisons in the latter part of the year.

|

|  | |  | 1Q EPS Gr. |  | 2Q EPS Gr. |  | 3Q EPS Gr. |  | 4Q EPS Gr. |  | S&P 500 | 17% | 15% | 12% | 13% |  | S&P Tech | 54% | 47% | 32% | 17% |

|  |  |

| Source: Thomson/First Call |

|

Tech earnings growth should remain healthy in the second half but year-over-year growth rates are expected to slow a bit because the latter half of 2003 was so strong. Analysts are forecasting earnings growth of 32 percent in the third quarter and 17 percent in the fourth quarter.

That's the case for the broader market as well. S&P 500 earnings are expected to increase 11.8 percent in the third quarter and 12.9 percent in the fourth quarter.

"Right now it's wonderful to celebrate good earnings growth in the first quarter and nice growth in the second quarter, but it's going to get a heck of a lot harder in the third and fourth quarters," said Wendell Perkins, manager of the JohnsonFamily Large Cap Value fund.

To that end, Perkins said he's sold most of his tech holdings following last year's big run. The only techs he still owns are Microsoft (MSFT: Research, Estimates), Sony (SNE: Research, Estimates) and Check Point Software (CHKP: Research, Estimates).

One buyside analyst said he's concerned that investors have unreasonably high expectations for tech earnings.

"Optimism in the numbers will be a roadblock for further gains. The upside in tech is limited," said Adam Adelman, senior technology analyst with Philippe Investment Management.

Tech stocks also remain fairly pricey despite the recent pullback. And that will make it even more imperative for the companies to post strong results. The S&P Tech sector is trading at 27 times 2004 earnings estimates while the broader market has a P/E of 18. This could scare off some investors, no matter how strong the first quarter numbers are.

"I revisited the idea of adding money to techs but decided not to. I wasn't comfortable with the valuations," said Ted Parrish, co-manager of the Henssler Equity fund.

In fact, Parrish said even though he thinks semiconductor stocks should have a strong year, he recently sold off his stake in Texas Instruments and trimmed his position in Intel because of valuation concerns.

|