NEW YORK (CNN/Money) -

Longing for a dotcom adrenaline rush? Check out the homeland security frenzy.

Shares of companies that make bomb detectors, fingerprint recognizers, pepper sprays and listening devices have been soaring in recent days as investors rush to buy into a groundswell of terrorism concerns, driven by violence in Iraq and talk of intelligence failures in advance of the Sept. 11 terror attacks.

Speculators have rushed into the sector, pumping up prices. Investors who wander in now, drawn by all the commotion, are playing a dangerous game, according to some analysts.

To be sure, the war on terror isn't going to be won any time soon, and the homeland security business will be a $15 billion-per-year industry, according to an estimate by the Congressional Budget Office. And many of the companies enjoying skyrocketing stock gains are functioning companies with good products, some of which will infiltrate our daily lives.

But however great the need for listening devices, should shares of Digital Recorders Inc. (TBUS: Research, Estimates) really be up 433 percent since the end of March?

However much we'll need security cameras, is the past month's 838 percent gain in IPIX (IPIX: Research, Estimates) shares based on a sober assessment of business prospects and stock valuations?

| Related stories

|

|

|

|

|

Pepper spray may be a great thing to carry on the subway, but is the 387-percent gain in the past month of Mace Security International (MACE: Research, Estimates) really justified?

"What's going on today with these security-related stocks is really the same psychological process as in the dotcom run-up in the late '90s," said Jay Meier, an analyst with Miller Johnson Steichen Kinnard. "The thinking is, 'I'm in the homeland security business, therefore my business must be hot' -- that's not exactly the way it works."

|

|

| One of Taser's guns |

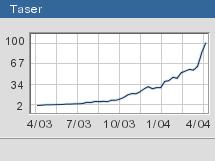

The poster child of this trend has been stun-gun maker Taser International (TASR: Research, Estimates), whose shares have gained a shocking 5,845 percent in the past year to $99. They're trading at 98.5 times future earnings; describing them as "rich" is hardly adequate.

"Like a lot of other stocks in the sector, Taser is moving up on momentum and retail money moving in, without investors dissecting and looking at the core business," said Steven Gish, analyst at Roth Capital Partners. "It's worrisome, in my opinion."

Reasons not to fear security

Not all analysts are so worried. Joe Blankenship, analyst at Source Capital Group, believes Taser, for example, is right about where it should be. Profit-taking by speculators could cause some volatility in the days ahead, but share prices should recover, Blankenship argues.

Taser's revenue grew 148 percent in 2003, and Blankenship believes it could grow 100 percent per year for the next year or two, having barely begun to scratch new markets among consumers, private security firms and overseas.

"It's fairly valued now -- I wouldn't be selling it short," Blankenship said.

And some of these companies could be prime acquisition targets for bigger companies. Shares of Invision Technologies (INVN: Research, Estimates) more than doubled in the year before GE (GE: Research, Estimates)'s March announcement that it would pay $900 million for the maker of bomb-detection devices. Now all those gains are frozen in amber.

And security stocks can come back from the dead, if their technology is finally adopted by governments or private outfits.

Identix (IDNX: Research, Estimates), a biometrics firm that makes fingerprint and face-recognition technology, saw its share price more than quadruple in the months following the Sept. 11 terror attacks, as traders hoped the U.S. government would soon come calling for its services.

The government didn't come calling, however, and Identix fell back into obscurity. By March 2003, it was trading at $4.01 a share, compared with $4 a share on Sept. 10, 2001.

But early this month, the government gave Identix a $1 million contract to do research into face recognition, and the stock jumped to $8.36.

Its competitor, Viisage Technology (VISG: Research, Estimates), won a government contract for ID cards, and the State Department on Tuesday asked both it and Identix for more information about their technology -- a sign more government business is on the way for both, news that's helped drive Viisage shares up 124 percent in the past month.

"I am surprised at how fast the stock's gone up," said Joel Fishbein, an analyst at Janney Montgomery Scott. "Is it too much, too soon? If it continues to win contracts, grow revenue and expand its cash flow, then its current price is justified."

-- Note: None of the quoted analysts owns any of the mentioned companies' shares. Roth Capital Partners makes a market in Taser shares, but none of the other firms has a banking relationship with any of the companies.

|