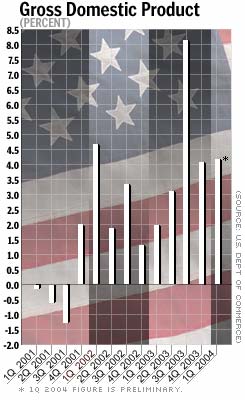

NEW YORK (CNN/Money) - The economy grew at roughly the same pace in the first quarter as it did in the fourth quarter, the government reported Thursday, coming in below forecasts on Wall Street.

Gross domestic product, the broadest measure of the nation's economy, grew at a 4.2 percent rate in the quarter after growth of 4.1 percent at the end of last year. Economists had forecast growth of 5.0 percent for the first quarter, according to a survey by Briefing.com.

The report is closely watched in Washington and on Wall Street, as well as by Alan Greenspan and the Federal Reserve, whose policy-makers meet next week and are widely expected to start raising interest rates, probably later this year.

Though Thursday's report was weaker than analysts had expected, it included increases in two key measures of inflation that could prompt the Fed to change its outlook on inflation when the central bankers meet next Tuesday.

Still, analysts said they didn't think the GDP number was as much of a disappointment as it appears at first glance, and that it could rise as the government refines its numbers since the initial readings on inventories are probably too low.

Part of the increase in GDP came from higher military spending. Overall, federal spending and investment rose at a healthy 10.1 percent rate in the quarter, compared with a 0.7 percent rise in the fourth quarter.

National defense spending jumped 15.1 percent, compared with an increase of 3 percent the previous quarter. Excluding the spike in military spending, overall GDP growth would have come in closer to 3.6 percent.

"Defense spending tends to be very lumpy in terms of the quarter in which it hits," said John Silvia, chief economist for Wachovia Securities. "When you're in the middle of a war, you have to have goods delivered. But even if it had been 3.6, it would still be respectable growth."

By comparison, cash-strapped state and local governments saw spending decrease 2.6 percent in the quarter.

But relatively strong consumer spending helped keep economic growth on track.

Personal consumption grew 3.8 percent in the first quarter, up from 3.2 percent the prior quarter. But overall spending on durable goods dropped 4.7 percent in the quarter, while spending on nondurable goods rose 6.4 percent and spending on services climbed 4.3 percent.

"We know from low inventory levels that they're going to have to rebuild inventories as economy strengthens," said Stephen Stanley, chief economist at RBS Greenwich Capital.

"If it didn't happen in the first quarter, it's going to have to happen at some point. If consumer spending or investment spending was a lot weaker than expected, it'd be a lot more troublesome."

On the inflation front, a key measure of prices paid by Americans jumped 3.2 percent in the quarter -- the biggest increase in three years -- after rising 1.3 percent in the fourth quarter.

And the chain price deflator, another inflation measure watched closely by the Fed, grew at a 2.5 percent rate, up from 1.5 percent in the fourth quarter. That was the highest rate since the second quarter of 2001.

The Fed has held short-term rates at 1 percent, the lowest in more than 40 years, as it has waited for the job market to strengthen.

But several economists said that the report should be seen as further sign that the economy is showing healthy growth once again.

"The economy has settled into a sustainable, self-reinforcing growth path," said a report of Sung Won Sohn, economist with Wells Fargo & Co. "All major categories of the economy have contributed to economic growth. Now that businesses have begun to add to payrolls, the current expansion is self-reinforcing. Only external shocks, such as terrorist attacks or a surge in oil prices, could derail the recovery."

|