SAN FRANCISCO (CNN/Money) -

It's been a long time -- a very long time -- since I've gotten e-mails from friends asking me how they can get in on a tech company's IPO.

It's a pretty silly question, since most IPOs are locked up for institutional investors (and I wouldn't know anyway, because as a technology columnist, I don't own any technology company shares).

But when Google filed to go public yesterday, the e-mails and phone calls came in at a steady clip.

Seems everyone wants in.

My friends weren't the only ones interested, apparently. When I tried to access the Securities and Exchange Commission's Web site (www.sec.gov) yesterday afternoon, I found that it was down for a while -- possibly from the heavy load caused by everyone and their grandmother trying to get a peek at Google's heretofore closely guarded financials.

Once they got into the site, what they found was impressive. As the actual numbers now attest, Google has strong revenue with healthy margins.

With the release of those numbers, industry observers and laypeople alike are all but crowning Google the new king of online search. When I finally get around to returning my gold-seeking friends' e-mails, however, I'll give them a different message, one they may not be ready to hear: Invest in Yahoo! instead.

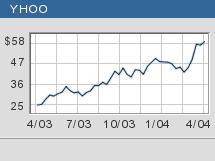

I'm certainly not giving that advice because Yahoo! is a value right now. Trading in the mid-50s, very near its 52-week high, and with a price/earnings ratio of 124, clearly it's not for everyone. But there's one key factor about Yahoo! that makes me like it -- right now -- more than Google: its diversification.

Back when CEO Terry Semel joined Yahoo! in early 2001, his main charge was to find new revenue streams for the then almost wholly advertising-reliant company. Of course, in 2001, that charge was born of necessity -- the Internet advertising market was tanking.

With that market now back in full bloom, Semel's accomplishment diminishes in investors' eyes as attention shifts to the ability of companies such as Google to collect as much ad revenue as possible.

Ad revenue is back -- but for how long?

That's a mistake. Yes, times are good right now for Internet advertising, but we thought the future was endlessly bright in 1999 too, remember? According to Google's SEC filing, the company made 95 percent of its revenue last year (and 96 percent this past quarter) on advertising.

So what happens if Google's brand of keyword advertising falls out of favor in light of a new technology (such as full-motion video ads, which I wrote about a few months ago)? Or what if the advertising industry finds itself in another recessionary lull? Google would be in a pretty bad spot.

Truth be told, Yahoo! would also be in trouble -- but not as desperately as Google. Twenty-six percent of Yahoo's 2003 revenue came from non-advertising sources.

The breakdown is as follows: 18 percent was from fees associated with its premium services, such as extra e-mail storage space, and from distribution partnerships with companies such as SBC, and 8 percent was largely through its acquisition of HotJobs.

Yahoo's percentage of alternative-source revenue reached a high of 32 percent of total revenue in 2002, and has shrunk only because the slice occupied by Internet advertising has grown so much. Total revenue increased year over year.

With its IPO now officially in the pipeline, Google clearly has market momentum on its side. Yahoo!, with its keyword, sponsorship, and banner advertisements, brings in more ad revenue than Google, but the fact that Google has made almost $1 billion from keywords alone is very impressive.

The only thing that Google could do to make me revisit my pro-Yahoo! stance would be to take its IPO proceeds and quickly make some big, instantly accretive acquisitions that would help balance and grow its income sheet.

Sign up to receive the Tech Investor column by e-mail.

Plus, see more tech commentary and get the latest tech news.

|