NEW YORK (CNN/Money) -

Tech stocks tumbled and the broader market closed mixed Friday, with investors shrugging off solid earnings as they worried about rising oil prices and what they mean for inflation.

Friday's action wrapped up a tumultuous week for the market -- one that capped the longest losing streak for the Dow Jones industrial average in more than a year.

While the Dow industrials (up 2.13 to 10012.87, Charts) and the Standard & Poor's 500 (down 0.74 to 1095.70, Charts) both ended little changed Friday, for the week they sank 1 percent and 0.3 percent, respectively.

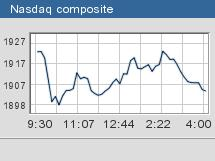

The Nasdaq composite (down 21.78 to 1904.25, Charts) sank 1.1 percent Friday, pressured by earnings news from companies such as Dell and BEA Systems. For the week, it lost 0.7 percent.

All three major indexes closed lower for the third week in a row. For the Dow, it was the worst stretch since January through early February of 2003, when the world's most widely watched stock market gauge sank for four weeks in a row.

"It's been a really volatile week," said Donald Selkin, director of research at Joseph Stevens. "I think the bottoms that we made this week will hold, but that's small consolation."

"I don't see that there's any motivation to move higher," Selkin added. "The concerns about interest rates, oil prices and Iraq aren't going away. I think we're going to stay in a volatile range. The best we can hope for is the market to move sideways for a while."

Next weeks's few economic reports include two regional reads on manufacturing -- the NY Empire State index Monday and the Philadelphia Fed index Thursday -- as well as reads on leading economic indicators and housing starts and building permits.

Although the earnings period is mostly over, a few big companies are due to report next week, including Applied Materials and Hewlett-Packard after the close Tuesday.

Friday's market

Markets were weak and jittery throughout the session Friday, in tune with the trend for the week. Strong earnings from companies such as Walt Disney and Dell were overlooked due to the focus on rates, Iraq and oil.

The major indexes see-sawed for the last two weeks, as investors attempted to prepare for higher interest rates. In this period, everything from comments out of the Federal Reserve, a second month of strong job creation and recent economic indicators have all implied that rates will likely rise next month.

Thursday's stronger-than-forecast rise in the producer price index, and even Friday's mild rise in the consumer price index, both seemed to confirm that rates will rise soon, possibly starting next month.

Meanwhile, soaring oil prices, with crude oil hitting an all-time high, have also sparked worries of inflation and rising rates.

Investors dislike higher rates, which tend to slow economic growth, denting corporate profits and thus stock prices.

In the meantime, the May consumer sentiment report seemed to indicate that the U.S. consumer, long the support pillar of the economy, is beginning to show signs of slowing down.

"The market is very oversold right now and I expect it to move higher over the next week or two," said Michael Sheldon, chief market strategist at Spencer Clarke. "But beyond that, it's going to be very difficult for it to make much headway until we get a clearer sense of how much the Fed is going to move."

What moved?

Technology stocks led the decliners.

Business software maker BEA Systems (BEAS: down $2.43 to $8.35, Research, Estimates) tumbled 22.5 percent and topped the Nasdaq's most-actives list after the release of the company's quarterly earnings report late Thursday.

BEA reported a bigger-than-expected drop in software license sales, due to poor execution in the Americas and competition from IBM, although the company's profit was in line with expectations. The company also issued a second-quarter revenue forecast that is below Wall Street estimates. On Friday, UBS downgraded the stock.

Late Thursday, Dell (DELL: down $1.08 to $34.72, Research, Estimates) reported first-quarter profit and sales that rose from a year earlier and lifted its second-quarter outlook. But the stock took a beating, losing 3 percent as some investors worried about Dell's profit margins, and others were disappointed that the company didn't report an even stronger quarter.

A variety of other heavily-weighted Nasdaq stocks fell as well, including Cisco Systems (CSCO: down $0.52 to $21.24, Research, Estimates), down 2.7 percent.

The Dow's four tech components -- Hewlett-Packard (HPQ: down $0.42 to $19.61, Research, Estimates), Intel (INTC: down $0.40 to $27.04, Research, Estimates), Microsoft (MSFT: down $0.24 to $25.86, Research, Estimates) and IBM (IBM: down $0.78 to $86.41, Research, Estimates) -- also retreated.

But the Dow remained near unchanged, thanks to gains in Procter & Gamble (PG: up $1.10 to $106.41, Research, Estimates), Caterpillar (CAT: up $1.03 to $75.69, Research, Estimates), Altria (MO: up $0.98 to $49.88, Research, Estimates) and Exxon Mobil (XOM: up $0.54 to $43.27, Research, Estimates).

Market breadth was mixed. On the New York Stock Exchange, where 1.33 billion shares changed hands, gainers beat losers by nine to seven. On the Nasdaq, decliners beat advancers by five to three as 1.52 billion shares changed hands.

Released before the start of trading Friday, the "core" component of the CPI, which excludes volatile food and energy prices, rose a bigger-than-expected 0.3 percent in April after an 0.4 percent rise in March. The overall CPI rose 0.2 percent, versus a rise of 0.5 percent in March, an increase that was below expectations. Investors focused on the "core" rise.

The University of Michigan's preliminary reading on its consumer sentiment index for May remained unchanged from April at 94.2. But the number was weaker than economists' predictions and expectations for the future worsened for the fourth month in a row.

NYMEX light sweet crude oil gained 30 cents to settle at $41.30 a barrel, after rising to a record $41.45 per barrel earlier. Among other commodities markets, COMEX gold rose $2.20 to settle at $377.10 an ounce.

Treasury prices rose, pushing the 10-year note's yield down to 4.77 percent from 4.86 percent late Thursday. The dollar fell versus the yen and euro.

|