NEW YORK (CNN/Money) -

Semiconductor stocks, the market's equivalent of Smarty Jones in 2003, have performed more like a broken-down nag in recent months.

But after a better than expected mid-quarter update from industry leader Intel (INTC: Research, Estimates) on Thursday and raised sales guidance from broadband communications chip maker PMC-Sierra (PMCS: Research, Estimates) on Friday, chip stocks took off like Secretariat...at least for a day.

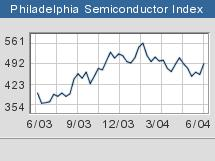

The Philadelphia Semiconductor Index, a collection of 18 prominent chip companies, surged as much as 2.4 percent Friday morning thanks to the good Intel and PMC-Sierra news. But the SOX, as the index is known on Wall Street, is still down 7 percent for the year and is 16 percent below its mid-January high. The SOX gained an astonishing 76 percent in 2003.

Heading into this week's flurry of mid-quarter reports (SOX constituents Altera (ALTR: Research, Estimates) and Xilinx (XLNX: Research, Estimates) also gave fairly positive updates) Wall Street's expectations for chip stocks were decidedly negative.

There were growing concerns that the second quarter would not be as strong as investors had originally hoped for at the beginning of the year and that corporate demand for PCs and servers might cool as interest rates pick up.

Semis may pull away in the backstretch

But Rick Whittington, an analyst with Caris & Co., thinks that chip stocks are primed for a strong second half of the year as investors finally begin to realize that sales and earnings growth should still be fairly robust.

"The second half should be a barn burner," said Whittington. "We've had a good lengthy correction and sentiment has been problematic. There's no irrational exuberance in these stocks."

Still, whether or not a chip rally continues will be largely dependent on what Texas Instruments (TXN: Research, Estimates) says in its mid-quarter update on Monday after the closing bell.

Even though Intel is the world's largest semiconductor company, its fates and fortunes are tied most closely to what's going on with demand for computers and servers.

|

|

| Chip stocks have taken a breather after last year's heady gains. |

Intel did say that sales of flash memory chips used in cell phones were improving, but communications is a small portion of its overall business, accounting for just 13 percent of total revenues in the first quarter.

TI is a far more diverse company, with chips used in cell phones, digital televisions, MP3 players and many other types of consumer electronics devices.

As such, Erach Desai, an analyst with American Technology Research, wrote in a report Friday that "Intel (with its overwhelming reliance on the relatively mature PC market) is no longer an appropriate surrogate for the broader semiconductor market and that Texas Instruments (with its broader end-market exposure) is a great bellwether for the current cycle."

Will TI or other consumer chip firms play the spoiler?

There's no disputing that TI, like Intel and many other chip companies, is doing extremely well. Analysts currently expect the company to report second quarter sales of $3.2 billion, a 37 percent increase from a year ago.

But shares of TI have fallen 17 percent year-to-date and analysts are looking for the company to boost its sales guidance in order to justify another upward move in the stock.

| More about chip stocks

|

|

|

|

|

Wall Street will also be hoping to hear some positive signs from two other semiconductor companies with a heavy consumer focus next week.

OmniVision Technologies, which makes image sensing chips used in camera phones, is due to report its fiscal fourth quarter results on Wednesday while analog chip firm National Semiconductor, which makes chips that convert audio and video into digital signals, is on tap to report its fourth quarter numbers Thursday.

Both companies are expected to post blockbuster results -- analysts are forecasting a nearly 160 percent jump in earnings and 153 percent increase in sales for OmniVision (OVTI: Research, Estimates) and a 400 percent rise in profits at National Semiconductor (NSM: Research, Estimates) on a 31 percent gain in revenue.

Still, shares of each company are also well off their peaks for the year. National Semi has slipped nearly 15 percent since mid-April and OmniVision's stock is trading almost 25 percent below its 52-week high.

But if these and other chip companies can continue to surpass analysts' expectations, semiconductor stocks might once again pull out in front of the Wall Street horse race.

"Historically, growth in revenue and earnings has been what has driven growth in chip stock prices," said Todd Campbell, president of E.B. Capital Markets, an independent research firm catering to institutional clients. "You may get disconnects for short periods of time. But the semiconductor business still remains strong."

Analysts quoted in this story do not own shares of companies mentioned in this story and their firms do not have investment banking relationships with them.

|