NEW YORK (CNN/Money) -

It isn't often that a stock shoots up 75 percent in 3-1/2 weeks and could still be considered a potential bargain.

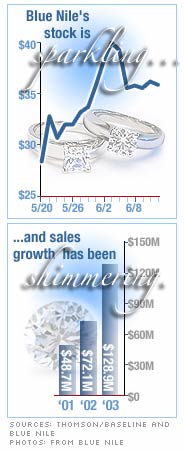

But for online jewelry retailer Blue Nile, which went public on May 20, that just might be the case.

Sure, the company's success may bring back painful memories of failed online commerce stock offerings such as Pets.com, eToys and WebVan.

Heck, this isn't even the first time an online jeweler has tried going public in an initial public offering (IPO). Ashford.com went public in 1999 and subsequently saw its stock tank. (GSI Commerce bought Ashford in 2001 and later sold it to closely held Diamond.com in 2002.)

But comparing Blue Nile to the dot-bombs of yesteryear would be entirely unfair. That's because Blue Nile (NILE: Research, Estimates) has something that most of the late 90's e-tailing fluff did not: profits.

That's right. Blue Nile is making money.

"Blue Nile is obviously proving that its business works and that it can be quite profitable in the process," said Paul Bard, an analyst with IPO research firm Renaissance Capital. "That's the appeal to investors."

Diamonds an investor's best friend?

The company lost $7.4 million in 2001 but followed that up with net profits of $1.6 million in 2002 and $27 million last year. Blue Nile earned $1.9 million on $35.7 million in sales during the first quarter of 2004.

Yet when you look at Blue Nile's stock price, even after factoring in the run-up, the stock could still be (get ready to groan) a diamond in the rough. (I told you it would be groan-worthy.)

Shares of Blue Nile trade at about 22 times last year's earnings. To be sure, that's a premium to brick and mortar jewelry competitors Zale (ZLC: Research, Estimates) and Britain's Signet Group (SIGY: Research, Estimates), which owns Kay Jewelers on this side of the pond. They both trade at about 15 times trailing earnings.

But Blue Nile actually trades at a discount to Tiffany & Co. (TIF: Research, Estimates), the crown jewel (there I go again) of the industry, which sports a P/E of 27 times earnings from 2003.

And shares of Blue Nile are cubic zirconium cheap when compared to other prominent online retailers.

Amazon.com (AMZN: Research, Estimates) is trading at 82 times last year's earnings and about 50 times 2004 estimates. eBay (EBAY: Research, Estimates) trades at 116 times 2003 earnings and 73 times this year's profit projections. And Overstock.com (OSTK: Research, Estimates), which wasn't profitable in 2003 and isn't expected to post a profit this year either, trades at 162 times next year's earnings estimates.

Martin Pyykkonen, an analyst with Janco Partners, said Blue Nile's business model should help keep profits relatively high. The company doesn't carry a lot of inventory. Instead, it goes out and buys diamonds from suppliers only after an order has been placed.

"This is a more specialized version of e-tailing, on demand ordering. If someone specifies a certain diamond, they go find it," Pyykkonen said. "A leaner inventory should lead to better margins."

To that end, Blue Nile posted net margins of 5.3 percent in the first quarter. While that's not as lustrous as Tiffany's net margins of 8.8 percent, they're in line with Signet's 5.2 percent net margins and much shinier than Zale's net margins of 2.4 percent.

Caution should be the fifth C

Still, investors should probably tread somewhat carefully with Blue Nile. For one, no analysts have launched coverage on the stock yet. Hence, there are no official sales or earnings estimates for 2004.

| Recently in Tech Biz

|

|

|

|

|

And in addition to competition from companies like Tiffany and Zale, Blue Nile will have to fend off Amazon as well, which recently began selling jewelry.

Amazon has said it plans to keep prices relatively low, which could put pressure on Blue Nile if it feels the need to cut prices as well.

With all this in mind, Renaissance Capital's Bard said Blue Nile's stock might be a bit ahead of itself. The major risk is that Blue Nile will have to meet the fickle demands of Wall Street analysts and traders.

But this risk is no different than the ones facing an investor in any IPO. Usually, it's not a bad idea to wait a couple of quarters before buying a newly public company.

The difference here is that Blue Nile, because of its history and relatively reasonable valuation, probably won't be as volatile as other IPOs. Bard was quick to note that Blue Nile is less of a gamble than many other IPOs since it has already demonstrated that it can grow sales profitably.

"Blue Nile is an attractive story," said Bard. "There's a separation between premium companies like Google and Blue Nile and companies that don't have their track record and have a lot to prove."

Finally, it's also worth noting that an improving economy probably bodes well for Blue Nile and all its competitors as people would feel more comfortable spending on some bling bling.

In fact, shares of Zale, Signet and Tiffany have enjoyed nice gains lately as well. Tiffany's stock is up more than 10 percent in the past few weeks.

Janco's Pyykkonen follows several e-commerce companies but does not have immediate plans to pick up coverage of Blue Nile. He doesn't own the stock and Janco Partners hasn't done banking for Blue Nile either.

Sign up to receive the Tech Investor column by e-mail.

Plus, see more tech commentary and get the latest tech news.

|