NEW YORK (CNN/Money) -

Yahoo! is due to report second-quarter profits after the closing bell Wednesday and to paraphrase a classic line from Seinfeld, they should be spectacular.

Industry analysts expect the Internet media giant to post earnings (yup, earnings) of 8 cents per share, double last year's amount.

And sales are forecast at $610 million, a 90 percent increase from last year, but that excludes traffic acquisition costs that Yahoo!'s Overture Services subsidiary pays to affiliates. Overture supplies paid search listings to other Web sites and shares advertising revenue with them.

But Yahoo! is the classic case of a stock that is probably not worth buying just yet ... despite extremely strong fundamentals. Here's why.

Expectations for Yahoo! are ridiculously high. The fact that online advertising is a hot growth market is not exactly a huge secret. So if the company merely meets its second-quarter targets, Wall Street would probably throw a major hissy fit and start moaning about how Yahoo! is losing momentum.

That's because Yahoo! destroyed its first-quarter projections . In March, Yahoo! beat Wall Street forecasts by 2 cents a share and reported sales 10 percent higher than the consensus.

Don't believe the hype

So some investors are probably looking for a repeat, which means Yahoo! would have to report earnings of 10 cents a share again.

| |

|

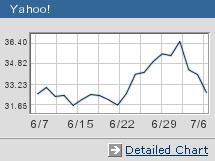

Yahoo! has had a great year but shares have cooled recently on concerns about increased competition.

|

|

Brian Bolan, an analyst with Marquis Investment Research, isn't sure that's doable.

"The earnings announcement will still be very good but I don't know if it will blow people away," said Bolan.

As for the top line, Yahoo! would have to report sales of about $670 million to match the magnitude that it beat revenues by in the first quarter. That's going to be tough too.

"Investors have been expecting strong advertising and search revenues," wrote Piper Jaffray analyst Safa Rashtchy in a report Tuesday. "We believe that significant upside above $620M in revenues is needed to act as a positive catalyst for the stock and we believe potential of such an upside is limited."

| Recently in Tech Biz

|

|

|

|

|

Speaking of search, investors are also starting to have some concerns about increased competition in the lucrative world of keyword-based search advertising after Microsoft revamped its MSN search engine last week. And of course, there's a company about to go public called Google that is getting a fair amount of press lately.

How low can it go?

In fact, shares of Yahoo! have taken a bit of a beating lately, falling more than 10 percent since Microsoft unveiled more details about its search strategy.

| More about search

|

|

|

|

|

But Mark Mahaney, an analyst with American Technology Research, said there could be more downside ahead.

After all, the shares are still up 44 percent year-to-date and the stock trades at nearly 100 times 2004 earnings estimates. So Mahaney said investors are right to question whether Yahoo! should be worth that much considering the two legitimate threats to its business.

What's more, investors will probably hear more about these combatants as the summer wears on: Google's IPO road show should begin soon and Microsoft's eagerly awaited analyst meeting at the end of July could offer more hints about Microsoft's new search technology.

"The Google road show and Microsoft analyst day will be negative catalysts for Yahoo!," Mahaney said.

Of course, nobody is suggesting that Yahoo! is in bad shape. In addition to solid earnings and sales growth from its core advertising business, Yahoo! has also done a better job in the past year or so of getting users to pay up for premium features.

Marquis Investment's Bolan said he'll be keeping a close eye on what percentage of active users are being converted to customers that pay a monthly fee for Yahoo! services such as personals, games, or job listings.

And Mahaney at American Tech said Yahoo! still has room for robust search advertising growth internationally, particularly in hot markets like Taiwan. He just thinks there's no good reason to buy the stock now when there's a decent chance it'll fall further, perhaps soon.

He said short-term worries about growing competition and second-quarter results could cause the Street to get too pessimistic about Yahoo!'s longer term outlook.

Yahoo!'s currently about $33 and Mahaney said he'd be more bullish if it were closer to $30.

"The stock's had a big run. The way to do it on these shares is to wait for the opportunities. I prefer to recommend a stock when the expectations are lower," said Mahaney.

Analysts quoted in this story do not own shares of the companies mentioned and their firms have no investment banking ties to the companies.

CNN/Money has a business relationship with Overture Services, a subsidiary of Yahoo!

Sign up to receive the Tech Investor column by e-mail.

Plus, see more tech commentary and get the latest tech news.

|