NEW YORK (CNN/Money) -

Stocks managed modest gains Friday after optimistic comments from Dow heavyweight General Electric, but the major averages finished the week lower after a rash of warnings from the computer services sector.

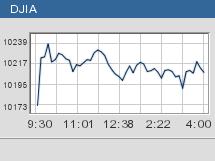

The Dow industrials (up 41.66 to 10,213.22, Charts) rose 0.4 percent Friday, while the Nasdaq composite (up 11.01 to 1,946.33, Charts) gained 0.6 percent and the S&P 500 (up 3.70 to 1,112.81, Charts) added about 0.3 percent.

Shares of GE (GE: Research, Estimates), the world's largest company by stock market worth, rose about 1.4 percent after the company reported a second-quarter profit that topped Wall Street estimates by a penny a share.

"In the cyclical areas such as GE, we're seeing a recovery come along later, whereas consumer and tech spending came along earlier," said Subodh Kumar, market strategist with CIBC World Markets.

"With companies like GE we expect earnings to remain strong through next year, where the momentum with tech may begin to slow."

Although the conglomerate sparked an early rally after saying it's in the midst of the strongest economy it has seen in years, the broader market backed away from session highs in late trading.

For the week, the Dow shed about 0.6 percent, the Nasdaq sank about 2 percent and the S&P 500 lost about 0.7 percent.

Earnings fail to impress

So far, early second-quarter profit results have failed to jolt stocks out of a tight trading range. John Eade, director of research for Argus Research, expects more of the same.

"Next week, the markets will probably drift lower as more news comes out," he said. "This pattern of selling on the news has been in place for a year."

In the tech sector, Unisys and Computer Associates became the latest computer services companies to warn about weaker-than-expected results this week.

Shares of Unisys (UIS: down $1.99 to $10.87, Research, Estimates), an information technology consulting and outsourcing firm, tumbled nearly 16 percent Friday after the company said it will miss second-quarter profit and revenue forecasts due to unexpected order deferrals.

Computer Associates (CA: up $1.27 to $25.81, Research, Estimates) said its quarterly revenue will fall short of estimates as a result of weakness in its services business and lower subscription sales. Despite the warning, CA shares rose as it reported that it will meet profit targets due to cost controls.

In additions to Unisys and Computer Associates, software companies Veritas, Siebel Systems, BMC Software and PeopleSoft warned this week that results will be weaker than expected.

However, there was one piece of positive news from the software sector as German heavyweight SAP said Friday it expects its second-quarter revenue to rise by 9 percent. U.S. traded shares of SAP (SAP: up $2.08 to $40.04, Research, Estimates) gained more than 5 percent in midday trading.

Although the software sector took a beating this week, Jim Glickenhaus, portfolio manager with Glickenhaus & Co., believes the warnings are isolated to the software industry.

"Look at the semiconductors, they're up today and they're the building blocks of tech," he noted. "I expect when chips companies begin to report in the coming weeks, you'll see some strong results."

Intel (INTC: Research, Estimates), the world's largest chipmaker, will report results after the markets close on Tuesday.

In addition, J.P. Morgan (JPM: Research, Estimates), SunTrust Banks (STI: Research, Estimates) and Novellus Systems (NVLS: Research, Estimates) are scheduled to post results Monday as the earnings reporting season gets into full swing.

Oil prices also remained a factor. They remained around the key $40-a-barrel point Friday, although they were off the recent highs set Thursday.

The Commerce Department said wholesale inventories rose 1.2 percent in May after an upwardly revised 0.2 percent gain in April. Analysts had expected a 0.5 percent rise in May wholesale inventories, according to a Reuters survey.

Market breadth was positive on the New York Stock Exchange, where 1.2 billion shares traded, as gainers slightly outnumbered losers. It was also positive on the Nasdaq, where 1.4 billion shares traded and advancers topped decliners by 3-to-2.

U.S. Treasuries edged higher, with the yield on the 10-year note down to 4.46 percent from 4.47 percent late Thursday. Gold fell 30 cents to $407.90, and the dollar was mixed.

In the overseas markets, Asian markets closed higher while European bourses ended mixed.

|