NEW YORK (CNN/Money) -

Here's the good news. A telecom related stock went public Thursday and actually gained ground. Woo-hoo!

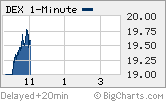

Dex Media, which publishes phone books (yellow pages and white pages) for Baby Bell Qwest in 14 states, rose nearly 4 percent in its debut on the New York Stock Exchange Tuesday, to about $19.54 in early trading.

But here's the bad news. Dex (DEX: Research, Estimates) was originally hoping to price its 53.06 million share offering at between $23 and $26 a share. Oops.

Nonetheless, Dex still wound up raising more than $1 billion from the offering, a significant chunk of change. It's going to need it.

Qwest (Q: Research, Estimates) sold Dex in 2002 and 2003 in two chunks to a group led by private equity firms the Carlyle Group and Welsh, Carson, Anderson & Stowe for about $7 billion in order to lower its massive debt load.

But Dex got dumped with a lot of debt in its own right. As of the end of March, it had $6.25 billion in debt on its balance sheet.

The company plans to use a portion of the proceeds from the IPO to pay down debt, which should lower interest expenses, the biggest drainer on profits. Dex's interest expenses were $277.6 million last year and another $124.6 million in the first quarter of this year.

Dex lost $75 million in 2003 and another $10.5 million in the first quarter of 2004. And that's a problem.

Pros look for a quick killing

There's no good reason why Dex shouldn't be profitable. The directory business, while boring, is a pretty steady cash generator, thanks to local advertising. So the fact that Dex is not profitable could (and should) scare off many prospective investors.

|

|

| Dex Media's IPO got off to an encouraging start but will the gains last? |

"Dex is a turnaround. But generally when you see turnarounds come out in the market, they are at least profitable. This one is still having losses," said Ben Holmes, managing member with Protege Funds, an investment firm that focuses on IPOs.

Holmes, however, said he did decide to buy some Dex after the company cut its price range. "We were on the fence until we saw the pricing and that's what attracted us. It's a reasonable discount."

Now that could turn out to be a savvy move for professional investors looking at a short-term gain. But for the average, long-term individual investor, it's tough to fathom why buying Dex makes sense.

| Recently in Tech Biz

|

|

|

|

|

To that end, investors need to keep in mind who the major players in the Dex deal are in the first place: financial firms that make their living from investing for relatively quick profits, not strategic telecom executives with a goal of rejuvenating the business for the long haul.

"This is a leveraged buyout play," said Greg Gorbatenko, a telecom analyst with Marquis Investment Research. "The investors' goal was to milk the thing, lever the baby up and take it public so they can focus on their next deal."

Ever hear of this thing called the Internet?

But even if Dex can lower its debt and return to the black, the phone book business is not all that exciting as a standalone entity.

Verizon's (VZ: Research, Estimates) Information Services unit, which includes SuperPages, one of Dex's biggest competitors, has reported relatively flat growth in revenues and operating income for the past two years.

Plus, Dex has formidable competition from Internet companies now that more people are letting their fingers do their walking across a keyboard instead of through the yellow pages when looking for the number of their local plumber.

InfoSpace (INSP: Research, Estimates) recently acquired Web directory Switchboard. Barry Diller's IAC/InterActive (IACI: Research, Estimates) owns Citysearch. And oh yeah, Yahoo! (YHOO: Research, Estimates) and Google have both expanded into local online search.. Those are some fierce competitors.

In fact, Dex is a perfect example of how telecom in general is such a tough business right now. New technologies are increasingly making old telecom firms, if not obsolete, then certainly less relevant. (Or have you not looked at AT&T's stock performance lately? Yikes!)

"The directories business is not going away. But everything telecom related is in a state of flux," said Jeff Kagan, an independent telecom analyst based in Atlanta.

Analysts quoted in this story do not own shares of the companies mentioned and their firms have no investment banking ties to them.

Sign up to receive the Tech Biz column by e-mail.

Plus, see more tech commentary and get the latest tech news.

|