NEW YORK (CNN/Money) -

Ugly.

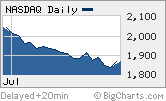

That best sums up how tech stocks have fared during July, with the Nasdaq having plunged more than 10 percent so far this month.

In many respects, this brutal sell-off doesn't make a lot of sense. After all, most tech companies have paraded out stellar second-quarter results and decent third-quarter guidance.

Through July 27, 61 of the 83 tech companies in the S&P 500 have reported calendar second-quarter earnings and the average growth rate is 65 percent from a year ago, according to Thomson First Call. What's more, 40 companies beat estimates and only 5 missed expectations.

However, there have been some nasty warnings, especially from software companies. As a result, analysts now expect S&P tech earnings for the third quarter to be up 36 percent from a year ago. While that's obviously healthy, it is down from projections of 38 percent growth at the beginning of July.

"Overall, we've seen the reports coming in line and guidance hasn't been horrible, it just hasn't been robust either," said Gint Rimas, an analyst with Thomson First Call.

And that has spooked investors. For whatever reason, Wall Street is choosing to accentuate the negative.

Victims of great expectations

Part of the problem is that tech stocks had been -- and continue to be -- trading at pretty heady valuations. So investors are no longer willing to pay up for the potential of strong earnings growth in 2005. Instead, the focus is on how companies are either issuing warnings or missing expectations.

|

|

| Look out below! Techs have taken a tumble in July. |

"Investors are moving from telescopic-themed-excessive-multiple creatures to microscopic-near-term-earnings-fearing-lower-multiple folks," wrote Pip Coburn, global technology strategist with UBS in a report this week.

With little to excite investors, Coburn thinks that tech stocks will continue to face tough times in the months ahead.

There's also the fact that expectations for tech stocks have been extremely high.

Tobias Levkovich, chief U.S. Equity Strategist with Smith Barney, points out in a report earlier this week that techs already enjoyed the gargantuan levels of earnings growth that one would normally expect in the early stages of an economic recovery.

|

|  | Sector� |  | Est. 3Q EPS Gr.� |  | Semiconductors� | 121%� |  | Internet services� | 92%� |  | Communications equipment� | 77%� |  | Hardware� | 21%� |  | Diversified tech services� | 11%� |  | Software� | 8%� |

|  |  |

| �* based on Dow Jones sector indexes | | �Source: Thomson First Call�� |

|

So it's unreasonable to think that techs can keep posting higher and higher levels of earnings growth.

"Within the capital spending sensitive Information Technology arena, the lack of follow through to even higher levels of growth has been very disappointing to the investment community. Yet, one needs to recognize that tech spending has been coming back for almost two years now and is not only now emerging from a long slumber, as many seem to think," Levkovich wrote.

Pick stocks, not sectors

Coburn thinks that investors should focus more on individual tech stocks that should do well for the long-term as opposed to making broad sector or trend bets.

| More about tech stocks

|

|

|

|

|

Coburn singles out Microsoft (MSFT: Research, Estimates), Cisco (CSCO: Research, Estimates), IBM (IBM: Research, Estimates), Dell (DELL: Research, Estimates) and Accenture (ACN: Research, Estimates) as five prime examples.

Sunil Reddy, manager of the Fifth Third Technology fund, also thinks investors would be wise to stick with industry leaders that are doing well now instead of betting on less fundamentally sound companies that soared last year.

"Third and fourth tier companies that bounced sharply last year are having a tough time," said Reddy. "But IBM and EMC did fine. SAP did fine."

And Kent Mergler, president of Northstar Capital Management, which runs the Fremont Large Cap Growth fund, also advocates a stock picking style in tech. His top tech holdings are Microsoft, Cisco, Dell, Symantec (SYMC: Research, Estimates) and Marvell Technology (MRVL: Research, Estimates).

Mergler said that he is starting to get intrigued by valuations for some of these leading companies because the entire sector has taken such a beating lately. But he still thinks investors should sit back and wait for a clearer sign that techs will really be able to post strong earnings gains in the latter half of the year.

There have been too many head fakes for his taste.

"At this point, we're watching tech carefully but we are not ready to pull the trigger yet and buy more with this volatility," Mergler said. "What seems to be consistent is that whoever just went up is likely to get clocked soon afterward."

|