NEW YORK (CNN/Money) -

The days of free-for-all competition in telecom are long gone...and so are the huge stock returns for once-hot equipment companies.

Networking gear makers were Wall Street superstars in the late 1990s, since there were a slew of upstart service providers that needed equipment -- stuff like optical switches and routers that make networks go.

But after a rash of mergers and bankruptcies, demand isn't nearly as frothy and shares of equipment companies are in the dumps.

Still, there is a glimmer of hope.

Analysts say the established telecom giants (namely the Baby Bells) would prefer to deal with a smaller group of equipment companies that can take care of all their needs.

With this in mind, there is likely to be a wave of takeover activity for the many equipment companies.

"There are fewer service providers and they are bigger and more powerful," said Timm Bechter, an analyst with Legg Mason. "It stands to reason that they want to buy from larger diversified companies. They'd rather not have to train technicians on products from five or six different vendors."

Sizing up the likely targets and buyers

Sycamore Networks, for example, announced last month that it hired investment bank Morgan Stanley to review "strategic and financial alternatives aimed at maximizing shareholder value." On Wall Street, such language is typically viewed as a giant "For Sale" sign.

Allan Tumolillo, chief operating officer of Probe Financial, an independent telecom research firm, said that Sycamore and Ciena could both be attractive fits for companies looking to expand their presence in the optical networking market.

"Companies like Sycamore and Ciena are now more or less one trick ponies," Tumolillo said. And both have market values that are just slightly north of $1 billion, which could make them fairly easy to acquire for a large company like Cisco Systems, he added.

In general, analysts said that companies like Cisco, Lucent, Juniper Networks and European rivals Alcatel and Siemens are probably interested in purchasing niche companies to fill out their product offerings. Nortel, if it clears up its many financial problems, could also be a buyer.

|

|

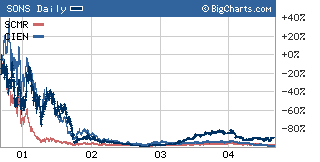

| It has been a rough couple of years for Sonus Networks, Sycamore Networks and Ciena. Are they now ripe to be taken over? |

Along those lines, Bechter thinks that Polycom, which makes equipment used for video and audio conferencing equipment, and Sonus Networks, which manufactures gear used for Internet telephone calling, a technology known as voice over Internet protocol (VoIP) could be attractive takeover targets for Cisco, Juniper and Avaya.

Eric Buck, an analyst with Janco Partners, also thinks Sonus could be a good fit for a larger equipment firm. He added that Carrier Access, which makes broadband communications equipment, might now be vulnerable to a takeover attempt.

Carrier Access issued a third quarter sales warning Wednesday and its stock tumbled nearly 18 percent on the news.

The company specifically mentioned that near-term results would be hurt by reduced spending by wireless carriers due to consolidation in that market. (Cingular, which is purchasing AT&T Wireless, is a top Carrier Access customer.)

This news clearly underscores the need for a similar round of consolidation in the telecom equipment market.

Will investors benefit from merger mania?

However, not everyone is convinced that investors will be able to take advantage of a round of takeovers. Although Buck said that consolidation is necessary, he isn't sure that likely sellers are willing to cash out while valuations are so low.

| Related stories

|

|

|

|

|

"For potential takeover candidates, memories are still relatively fresh as to what they used to sell for. There's little question that there's a need for consolidation but there's a question about whether not deals can be done that are pleasing to both sides," Buck said.

And even if deals get done, they could be at prices that are not appealing to investors, given the current unfavorable market conditions. Tellabs, which in May agreed to buy rival Advanced Fibre Communications for about $1.85 billion, slashed the value of its offer to $1.5 billion on Tuesday.

What's more, many equipment firms that get scooped up may not even be publicly traded.

|

YOUR E-MAIL ALERTS

|

Follow the news that matters to you. Create your own alert to be notified on topics you're interested in.

Or, visit Popular Alerts for suggestions.

|

|

|

"I expect more companies to pick off private players, start-ups that don't have the funding to make it to next level," said Gabriel Lowy, an analyst with Blaylock & Partners. "You're not going to see large public company transactions anymore. History has proven that they don't work since they are too difficult and time consuming."

Lowy points out that Cisco, in particular, has tended to avoid public companies in favor of smaller private firms.

Nonetheless, consolidation is probably inevitable. And if smaller public firms don't decide to sell out, they'll probably need to merge with each other to stay competitive.

"Barring a major economic downturn, the bigger vendors should slowly but surely pull market share from smaller guys," said Tumolillo. "With the world dominated by big carriers, that's the end result."

Legg Mason's Bechter owns shares of Cisco and Juniper and his firm has an investment banking relationship with Sonus Networks.

Janco Partners' Buck owns shares of Lucent but his firm has no banking ties to companies mentioned in this piece.

Blaylock & Partners' Lowy owns shares of Cisco and Nortel but his firm has no banking relationships with firms mentioned in this piece.

Probe Financial's Tumolillo does not own shares of any companies mentioned and his firm does not do investment banking with any of them.

|