NEW YORK (CNN/Money) -

Hurricane Ivan worked its way inland from the U.S. Gulf Coast Thursday, battering homes and businesses and leaving some key crops such as cotton and peanuts devastated.

|

|

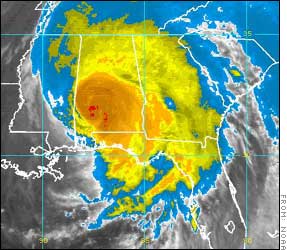

| Radar image of Hurricane Ivan as it moves inland from the U.S. Gulf Coast Thursday. |

The storm, responsible for at least eight deaths, is the third major hurricane to hit the Southeast United States in the past five weeks (Click here for CNN.com complete hurricane coverage).

As of Thursday afternoon, the estimated insured loss from Ivan in the United States was between $2 billion to $7 billion, according to Risk Management Solutions, which does catastrophe modeling estimates for the insurance industry. This comes on top of an estimated $1 billion to $2 billion in losses the storm caused in the Caribbean earlier in the week.

RMS had earlier predicted a loss ranging from $4 billion to $10 billion.

Another firm, AIR Worldwide, on Thursday estimated insured losses at between $3 billion to $6 billion.

The upper end of RMS's the new estimate would make Ivan the nation's second most costly storm, behind only Hurricane Andrew in 1992, which caused inflation-adjusted losses of $20 billion.

Kyle Beatty, meteorologist with RMS, said the reduction in the loss estimate was attributable in part to fact that Ivan had been downgraded to a Category 3 storm. In addition, the worst of the storm missed New Orleans, the largest and most developed city that was threatened by Ivan.

If Ivan comes in at the mid-point of the new range, it could be enough to make it the fourth or fifth most expensive storm in history.

Hurricane Charley, which hit Florida's Gulf Coast Aug. 13, caused estimated insured losses of $6.8 billion, putting it No. 2 to Andrew, while Hurricane Frances, which hit Florida over the Labor Day weekend, caused loss estimates between $3 billion and $10 billion, depending upon who is compiling the estimates. Hurricane Hugo caused inflation-adjusted losses of $6.2 billion in 1989.

|

| |

|

|

|

|

CNNfn's Louise Schiavone reports on the recovery effort getting underway after Hurricane Ivan. CNNfn's Louise Schiavone reports on the recovery effort getting underway after Hurricane Ivan.

|

Play video

Play video

(Real or Windows Media)

|

|

|

|

|

But the insured losses won't give the complete picture of the cost of the storm. Many farmers who have limited or no crop insurance saw crops virtually wiped out by Ivan, said William Birdsong of the Alabama Cooperative Extension System.

"Cotton was hit at just about the absolutely worst time," said Birdsong, who said many of the cotton plants' bolls had started to open, exposing the cotton to the weather, while only about 5 percent of the crop had been harvested. Birdsong said peanuts, which need to be dug up from below ground before they can be harvested, may also be lost if the ground is so saturated with rain that equipment can not get in the fields.

"It's too early to tell the exact damages but it will be hundreds of millions here (in Alabama) alone," said Birdsong. He predicted many farmers could be forced out of business unless there is federal assistance made available.

But cotton futures were actually trading slightly lower Thursday morning following the storm, with the December futures price at 48.95 cents a pound, down 1.34 cents.

Jason Roose, vice president and analyst with U.S. Commodities Inc., said prices tend to drop at harvest time and might have fallen further if not for the storm. In addition, the initial reading on the storm is that it is not as bad as feared during trading earlier in the week. And the Southeast is facing more competition from other regions, particularly overseas.

"We've had huge competition from China. That's why we're sitting near the 50-cent range rather than high of 71 cents a year ago," Roose said. "We also won't know the real extent of damages here for two or three weeks, when we start seeing the yields from this harvest."

Another commodity seeing prices drop in the wake of Ivan was oil, as production began to resume at refineries shut in advance of the storm, and early reports indicated there had been no significant damage to offshore oil platforms in the Gulf.

|