NEW YORK (CNN/Money) -

Merck & Co. on Thursday recalled its arthritis drug Vioxx after an ongoing trial confirmed the medication increases the risk of heart attack and strokes. The news sent stock down nearly 27 percent and erased $25 billion from its market value.

The Whitehouse Station, N.J.-based drugmaker said the immediate withdrawal was based on data from a three-year colon-cancer clinical trial that showed a heightened risk of cardiovascular complications began 18 months after patients started taking Vioxx. Results were compared to those taking dummy pills.

The colon cancer trial of 2,600 patients began in 2000 and was designed to evaluate the effectiveness of the standard 25-milligram Vioxx dose in preventing the recurrence of colon polyp, which can become cancerous.

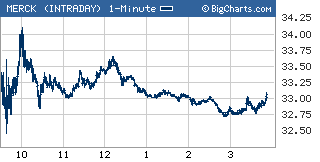

Shares of Merck (MRK: Research, Estimates) plunged on the New York Stock Exchange, falling nearly 27 percent to close at $33 and fueling a drop in the Dow Jones industrial average.

"We are taking this action, because we believe it best serves the interests of patients," Merck CEO Raymond Gilmartin, said in a press conference Thursday.

"Although we believe it would have been possible to continue to market Vioxx with labeling that would incorporate these new data, given the availability of alternative therapies and the questions raised by the data, we concluded that a voluntary withdrawal is the responsible course to take," Gilmartin said.

Separately, a lawsuit was filed after Merck pulled Vioxx off the market, charging that the drug company misled patients about the safety of its popular drug.

"If they could have kept it on the market, they would have," William Federman, a lawyer at Federman & Sherwood, one of the firms that filed suit in federal court in Oklahoma City against Merck, told Reuters. He said comments from Merck executives indicate that the company thought it could continue to sell the drug by adding label warnings.

Gilmartin said people who are currently taking Vioxx should consult their health-care provider about whether they should continue to take Vioxx as part of their treatment. He also advised such patients to obtain information on alternative treatments.

"We urge people to go to our Web sites -- www.merck.com or www.vioxx.com -- for more information about withdrawal of the drug. They can also call the Merck information hotline, 1-888-36-VIOXX," he said.

Separately, the Food and Drug Administration (FDA) announced Thursday it will closely watch drugs in the same class as Vioxx for any sign that they might also raise the risk of serious heart problems. Merck had received FDA approval for Vioxx prior to commencement of the cancer clinical trial.

Merck launched Vioxx in the United States in 1999, and it has been marketed in more than 80 countries. The drug's worldwide sales in 2003 were $2.5 billion.

The arthritis medicine essentially works on an affected area by decreasing and inhibiting inflammation and pain.

Vioxx sales have suffered in recent years after past clinical test results indicated the medicine increased the risk of blood clots, leading to heart attacks and strokes.

"The reason some people opted for Vioxx, despite these previous concerns, is because the medicine is generally considered to be a safer alternative to other options, causing fewer gastrointestinal side effects such as a stomach upset," said Karen Reed, a pharmacist with Kmart (KMRT: Research, Estimates).

"Anytime something like this happens, people panic. The right course of action for consumers taking Vioxx is to talk to their pharmacist or doctor, know what medicines they are taking and get an alternative course of treatment," Reed said. "Under no circumstances should people resort to self-medication by buying over-the-counter alternatives."

Regarding Vioxx's competing drugs, Celebrex and Bextra, Reed advised that people consult their health-care provider to see if similar concerns are now valid with respect to those two drugs.

Merck CEO says he will not resign

Merck also slashed its full-year earnings estimate, saying it expects Vioxx's withdrawal to negatively impact earnings per share by 50 cents to 60 cents a share.

Prior to Thursday's announcement, the company had forecast a full-year profit between $3.11 to $3.17 a share. Analysts had forecast a profit of $3.14 a share for the year, according to Thomson First Call.

The company also retracted its third-quarter earnings guidance. Analysts had expected Merck to earn 82 cents a share in the period.

| Related stories

|

|

|

|

|

"This is a major blow for Merck, because Vioxx was one of their five key drugs," said Sena Lund, analyst with Cathay Financial. "The implications of this are that now the company will have to depend on lesser drugs to boost sales."

According to Lund, Merck was anticipating total global sales of Vioxx this year to reach between $2.8 billion and $3 billion dollars.

Said Lund: "This news also puts pressure on Merck to get approval for Arcoxia, the second-version of Vioxx, which is already in the market overseas."

Vioxx's withdrawal, however, could be good news for drugmaker Pfizer (PFE: Research, Estimates) and its arthritis medication, Celebrex, Lund said.

Pfizer shares rose in morning trade.

Gilmartin also said he would not resign from his post because of the Vioxx decision, adding that Merck remains "very strong financially, with very strong cash flow."

"We're in a situation where, because of the flexibility of manufacturing, there is no need for us to close plants. We will deploy our resources and sales force in other areas," he said.

With regard to Arcoxia, which is already marketed in 47 countries outside the U.S., Merck said it would continue to seek approval to market the medication domestically.

However, Dr. Peter Kim, president of Merck Research Laboratories, said at Thursday's press conference that Merck will work with international regulatory authorities to assess whether changes were necessary in the way doctors prescribe Arcoxia to patients.

"I believe this is a Vioxx-specific issue that does not implicate Celebrex," said Robert Hazlett, analyst with Suntrust Robinson Humphrey. "Merck is pursuing a responsible course of action. The long-term implication could be significant for the company, if there are any residual concerns surrounding Arcoxia."

--CNN/Money staff writer Parija Bhatnagar contributed to t his story.

|