NEW YORK (CNN/Money) -

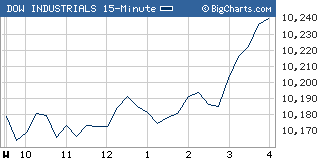

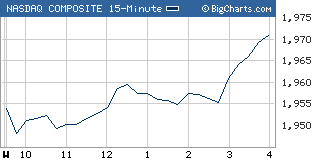

Stocks staged a late rally Wednesday as investors shook off record high oil prices and sought bargains ahead of Friday's widely awaited jobs report.

The Dow Jones industrial average (up 62.24 to 10,239.92, Charts) rose 0.6 percent, making broad-based gains, with 24 out of its 30 components rising.

The Standard & Poor's 500 (up 7.57 to 1,142.05, Charts) index gained nearly 0.7 percent and the tech-laden Nasdaq composite (up 15.53 to 1,971.03, Charts) index added roughly 0.8 percent.

"The market is actually putting on a pretty good performance in the face of this oil move up to new highs,'' Jay Finkel, senior equity trader at Lord Abbett, told Reuters.

Among the issues leading the charge: Exxon Mobil (XOM: up $0.70 to $50.03, Research, Estimates), which benefited from the latest surge in oil prices, and 3M (MMM: up $2.38 to $81.14, Research, Estimates), which gained on bullish comments from Deutsche Bank.

Big-cap techs also gained, in particular Cisco Systems (CSCO: up $0.43 to $19.53, Research, Estimates). The Amex Networking (up 4.08 to 224.45, Charts) index popped 2 percent.

Stocks had struggled Tuesday and for most of the session Wednesday as investors eyed rising oil prices and a slew of negative pre-announcements. The period for reporting quarterly results kicks off in earnest Thursday with earnings from Alcoa (AA: up $0.60 to $34.16, Research, Estimates), followed by General Electric (GE: up $0.33 to $34.38, Research, Estimates), due Friday.

U.S. light crude oil for November delivery jumped 93 cents to settle at $52.02 a barrel on the New York Mercantile Exchange, a record closing high. Oil prices have been hitting record highs almost daily on concerns about supply as the U.S. prepares for the winter heating season.

Also influencing trade: anticipation about the September payrolls report.

Due before the open Friday, employers probably added around 150,000 jobs to their payrolls, according to economists surveyed by Briefing.com. Employers added around 144,000 new jobs in August. Analysts predict the unemployment rate will hold steady at 5.4 percent.

Investors will be looking to see what impact the recent hurricanes have had on the figures. There's also a strong political focus, said John Davidson, president and chief investment officer at PartnersRe Asset Management.

"It's the last big number before the election, and I think people are wondering what impact it will have," he said. "It's also the same day as the next presidential debate."

President Bush and the Democratic nominee, Sen. John Kerry, will meet Friday night in the second of three scheduled debates.

Ahead of the payrolls report, Thursday brings weekly jobless claims. Due before the open, the report is expected to show that 355,000 Americans filed new claims for unemployment last week, down from 369,000 the previous week , according to forecasts.

What moved?

Sirius Satellite Radio (SIRI: up $0.52 to $3.87, Research, Estimates) popped 15.5 percent and topped the Nasdaq most-active list on news that shock jock Howard Stern will join its roster starting in 2006.

Netegrity (NETE: up $2.79 to $10.54, Research, Estimates) rallied 35 percent after agreeing to a buyout offer from Computer Associates (CA: up $0.46 to $27.85, Research, Estimates) worth around $430 million in cash.

Separately, Computer Associates said it expects third-quarter results to meet or beat current expectations.

But most of the session's news was more negative.

Merck (MRK: down $1.76 to $31.67, Research, Estimates) lost another 5.2 percent in the fallout from last week's withdrawal of its Vioxx arthritis pain treatment from retail shelves.

In the latest news, Vioxx may have led to at least 27,000 heart attacks and cardiac deaths, a Wall Street Journal article said, citing an unreleased regulatory study.

Joining a host of chip gear makers, Zoran (ZRAN: down $1.69 to $14.56, Research, Estimates) warned late Tuesday that third-quarter earnings and revenue would miss estimates due to customers delaying orders or spending less. The maker of chips for electronic devices sank more than 10 percent in active Nasdaq trading.

YOUR E-MAIL ALERTS

|

Follow the news that matters to you. Create your own alert to be notified on topics you're interested in.

Or, visit Popular Alerts for suggestions.

|

|

|

|

Software maker Open Text (OTEX: down $4.17 to $15.88, Research, Estimates) lost about 21 percent after warning that first-quarter results would miss estimates, due to delays in completing licensing deals.

Market breadth was positive. On the New York Stock Exchange, advancers beat decliners by more than two to one on volume of nearly 1.42 billion shares. On the Nasdaq, winners beat losers three to two on volume of 1.96 billion shares.

Treasury prices fell, pushing the 10-year note yield up to 4.22 percent from 4.17 percent late Tuesday. Treasury prices and yields move in opposite directions.

In currency trading, the dollar rose against the euro and the yen.

|