This is an update of a column that originally ran on September 30.

NEW YORK (CNN/Money) -- In an ugly market for techs, investors remain enchanted by satellite radio stocks.

|

|

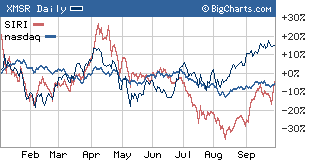

| Sirius has surged in recent weeks but it has lagged rival XM and the Nasdaq over the course of the year. |

Shares of XM Satellite Radio are trading just a hair off their 52-week high. And smaller rival Sirius Satellite Radio, which has surged more than 40 percent in the past month thanks to some analyst upgrades, a distribution agreement with Wal-Mart, and the introduction of several new products, is prepared to really take off Wednesday morning.

That's because Sirius snagged the most lucrative prize in radio. Shock jock Howard Stern announced Wednesday that he will begin airing his show on Sirius in 2006. Sirius's stock shot up more than 30 percent in pre-market trading.

XM, on the other hand, fell about 2 percent.

Still, now that Sirius has enjoyed a bit of a comeback, though, investors shouldn't get duped into thinking that it is the better satellite radio play. I still think XM should be the only way for investors to try and capitalize on the buzz about satellite radio.

XM is expected to post revenues of nearly $500 million in 2005 compared to sales estimates of $200 million for Sirius. XM has more than 2.1 million subscribers while Sirius has more than 600,000.

What's more, XM is expected to post positive free cash flow next year. Sirius is not.

"Sirius will continue to lag," said David Kestenbaum, an analyst with Independent Research Group. "XM has created a brand so that when people have a choice they say give me XM. Consumers equate XM to satellite radio the way people equate Kleenex to tissues."

Sure, Stern will likely lead to a big uptick in subscribers for Sirius. But it remains to be seen how profitable that will wind up being for the company. When I wrote a column about the possibility of Stern moving to Sirius back in March, analysts were skeptical that Sirius would charge extra for Stern. Rather, they expected him to be part of the company's basic monthly package.

And that was, and remains, a concern of mine. Satellite radio companies generate a much smaller amount of revenue per user than satellite TV companies DirecTV and EchoStar.

Skyrocketing valuations

I still think both companies offer a great service (what's not to love about commercial-free music stations?), but I am not a fan of their stocks because their stock prices were in the ionosphere.

| More about satellite radio

|

|

|

|

|

That's still the case, so investors should tread carefully even with XM.

"The companies are doing great. It's just the valuations," said Kestenbaum, who has a "neutral" rating on both stocks.

Analysts don't expect either company to make a profit this year, next year or in 2006, according to First Call. So you need to look at price to sales ratios. And for what it's worth, XM is the "cheaper" stock. It trades at about 12.5 times revenue estimates for 2005 while Sirius Satellite has a price to sales ratio of more than 21.

Steve Mathers, an analyst with Sanders Morris Harris, said he likes both stocks because he thinks the satellite radio market is big enough for both companies. I agree with that last point. I don't think XM is going to put Sirius out of business or vice versa.

YOUR E-MAIL ALERTS

|

Follow the news that matters to you. Create your own alert to be notified on topics you're interested in.

Or, visit Popular Alerts for suggestions.

|

|

|

|

But Sirius and XM are not just competing against each other. There will be more challenges from high definition (HD) digital radios as well as Web-based radio services from the likes of Yahoo! and RealNetwork's Rhapsody. (Both XM and Sirius have launched Internet radio services of their own, however.)

There's also a little thing called the iPod and scores of other digital music players. If you have your entire music library stored in an iPod (which you will be able to plug into your car), that lessens the need for satellite radio.

That's not to say that any of these competing technologies are going to kill satellite radio. But they are risks investors need to at least be thinking about -- and they will probably mean that the two stocks will remain highly erratic.

| Recently in Tech Biz

|

|

|

|

|

"The dilemma with satellite radio stocks is that you have to go out a few years and assume some level of success," said Mathers. "Subscriber forecasts are raised and lowered dramatically and daily assessments of competitive threats make the stocks so volatile."

In the short term, it's probably anyone's guess as to where the stocks head. Sirius clearly has the momentum now. But if investors have a healthy appetite for risk, the larger XM probably makes more sense for the long haul.

Analysts quoted in this story do not own shares of XM or Sirius and their firms have no investment banking relationships with the companies.

Sign up to receive the Tech Investor column by e-mail.

Plus, see more tech commentary and get the latest tech news.

|