|

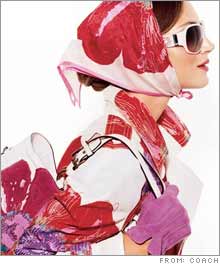

January, perfect time for springwear

Merchants already selling next season's items in bid to boost gift card-driven post-holiday profits.

NEW YORK (CNNMoney.com) - Why are some retailers like Coach, American Eagle Outfitters, Abercrombie and the Gap trotting out their spring merchandise in the dead of winter? Retail industry watchers blame the seemingly ill-timed transition on the growing popularity of the gift card phenomenon.

Industry trade group the National Retail Federation (NRF) estimates that gift card sales for the 2005 holiday season will total about $18.5 billion, a 6.6 percent increase over 2004, when holiday gift card sales hit $17.3 billion. And the group estimates that consumers on average will have spent about $88 on gift cards this year, representing about 16 percent of their total holiday gift budget. For retailers coming off a highly promotional holiday period, analysts say the pressure is for companies to try to salvage crucial fourth-quarter profits any way they can, given that the period typically accounts for more than 50 percent of some retailers' annual profit and sales. One obvious way to boost year-end profit is by going after the post-Christmas gift-card redeemers and getting these shoppers to buy new merchandise at full price rather than the discounted holiday leftovers that generate significantly less profits. This works out well for retailers since they record sales from gift cards when the cards are actually redeemed, not when they are sold. No. 1 retailer Wal-Mart (Research) said it was banking on "huge" gift card sales post-Christmas to prop its holiday sales tally. Wal-Mart Stores vice chairman John Menzer told Reuters last week that the discounter immediately changed gears from Christmas to spring merchandise because it noticed that customers appeared to be using the cards to buy newer products rather than clearance items. Keeping it fresh

George Whalin, an independent retail consultant, sees both an advantage and a risk to retailers shuffling inventory mid-season. "Retailers over the past three to four years have been mixing end-of-season clearance items with high-margin full-priced merchandise," Whalin said. "Since retailers are seeing many more shoppers in the first week or two after Christmas, it's a good strategy to try to capture full-priced sales during this time." At the same time, there is some risk to exposing shoppers a little too early to spring items, particularly if they're not "emotionally" ready for it, he said. For example, a specialty apparel retailer showcasing beachwear in the middle of a snowstorm can be off putting to some consumers. Moreover, when the weather does actually warm up and people are in a mood to buy seasonal clothing, consumers could get turned off by their favorite store not having anything "new" to offer simply because they already saw the spring stuff two months ago. The trick to circumventing that issue is for merchants to create a constant "sense of freshness" and not debut all the new inventory at once," said Marshal Cohen, chief retail analyst with market research firm NPD Group. The most savvy stores create an inventory "group of the month," showing just part of the season's collection and rotating it with newer items every month," he said. "Bringing in spring merchandise now is a good thing," Cohen said. "It creates a sense of excitement for consumers. I think retailers are better off selling less stuff at higher margins than getting into a promotional mode later in the season." Coach (Research), Gap (Research), Aeropostale (Research) and Abercrombie & Fitch (Research) were not immediately available for comment. --------------------------------------------------------------------- Learn more about new gift card gimmicks here.

To read about how retailers fared in 2005, click here. |

|