|

Millionaires, luv that 401(k)

Couple raises kids, pays the mortgage, saves half a million.

NEW YORK (CNNMoney.com) - Most people move into a bigger house when they have kids. Not the Lees. To both give their two children a good education and continue saving for retirement, 13 years ago the Lee's downsized from a new 3,200 square foot, 5-bedroom colonial to a 30-year-old, 2,200 square foot four bedroom home.

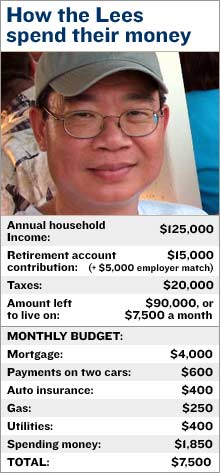

The smaller house was in a better school district and thus avoided the need to send the kids to expensive private schools. Instead they plowed that money into their 401(k)s. Now, despite the costs of raising two children and a comfortable-but-not-excessive annual household income of $125,000, they sit on half a million dollars in savings. And that doesn't even count the $500,000 they have in home equity. "It doesn't take a rocket scientist to figure out that a 401(k) is a pretty good deal," said 48-year old Han-Lin Lee. Han-Lin and his wife, Fu-Lin, met at graduate school in Illinois. They both had come over from Taiwan and had won scholarships to study -- she educational psychology, he civil engineering. At the age of 30, soon after Han-Lin got his first job out of school with an environmental consulting firm, the couple bought a town house for $97,000. Although Han-Lin was making only $35,000 a year, he contributed 10-12 percent to his 401(k), which also had a company match of 4 percent. Before long, and with regular raises, he was socking away nearly $14,000 a year. The couple had their first child, a boy, in 1988. A year later they sold the town house and bought the big colonial for $242,000. By this time Han-Lin said he was making more money, and with Fu-Lin's paid internship they were bringing in $60,000 a year. In 1992 Fu-Lin got a job as a counselor at George Mason University. The Lees also had another child by then, a 2-year-old girl. "I looked around and figured I probably needed to downsize just to get to a better school district," said Han-Lin. So they traded the big colonial in Lanham, Md. for a smaller house in the nicer neighborhood of McLean, Va. But the housing slump of the early 90s took its toll and they had to rent out the colonial until they finally sold it 1996 for $200,000, a loss of over $40,000. Nonetheless, the Lees persisted with their 401(k) contributions, maxing them out each year and getting the full employer match. In 2004, with the housing market hot, they finally decided to trade up. They sold the 2200 square foot house for $680,000, more than twice what they paid for it, and bought a 4,000 square foot, six bedroom home for nearly $1 million also in McLean. Now they juggle a mortgage, for which they pay a hefty $4,000 a month. Fu-Lin has her own psychology practice so it's just Han-Lin contributing $15,000 a year to his retirement plan, which changed to a Thrift Savings Plan with a $5,000 match when he took a job as a Department of Energy analyst. And their kids, now age 15 and 18, are looking at college. Although the Lees never set up a separate college savings plan, they aren't worried. Han-Lin said he was more comfortable saving his money in retirement accounts or in real estate than using a separate college savings account. He said they will pay for college through a variety of means, including scholarships, loans, raises at work and part time jobs for the kids. "I'm kind of still playing it by ear right now, keeping my options open," he said. He also pointed to Virginia's well-regarded public universities and said his kids might go to one of them, helping to keep the costs down. Over the next ten years, through a combination of continued 401(k) investment, paying off the house and stock market appreciation Han-Lin expects to double the family's assets to over $2 million. And after that? "I'm going to travel to a lot of places but not spend a lot of money," he said. __________________________ Paul and Audrey Yazbeck are taking control of their money and they're having fun doing it. Click here For more millionaires in the making, click here.

If you interested in a free portfolio makeover by a certified financial planner, and you're willing to have your photograph and story appear in MONEY magazine, please contact us at makeover@moneymail.com. Please include contact information in addition to a photo and your household members' ages. Additionally, please provide a general description of your current financial picture: income, investment goals and the amount of your savings, debt and investments. |

|