|

Is 'toy' becoming a dirty word?

Faced with a tough market for traditional toys, companies like Jakks Pacific, MGA and others are keen to rebrand themselves as "consumer products" companies instead.

NEW YORK (CNNMoney.com) - Is it a toy? Is it a game? Is it a "plaything?" Maybe it's none of these. With so many toymakers diversifying into "non-traditional" areas such as pet supplies, stationary products, clothing, home decor and electronics, companies such as Jakks Pacific (Research), MGA Entertainment and Spin Master say they don't want to be known as just "toy companies."

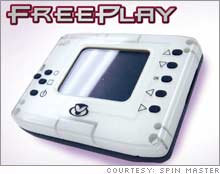

Call them "makers of consumer products," instead. Some senior executives interviewed for this story are adamant that the industry recognize their companies' rebranding efforts, which they feel sets them apart from the competition at a time when the toy industry sales continue to stagnate. "We started as a traditional toy company. But as the retail environment started to change a few year ago and toysellers were going bankrupt, we looked at ourselves and how we could diversify from just making toys," said Stephen Berman, president of Calif.-based Jakks Pacific. Jakks is associated with some of the most iconic toys of all time, including Care Bears and Cabbage Patch dolls manufactured by the Play Along division that it acquired in 2004, and more contemporary brands such as Fly Wheels, WWF licensed figures and its popular TV-plug-and-play games. Berman said the company decided to diversify its business strategy about six years ago by entering new markets through acquisitions. Besides toys, Jakks is now also a maker of stationery products, electronics like the TV plug-and-play games, and this year launched its pet supplies products. "We can't be reliant only on one segment. The more diversified we are the faster we can grow and manage the risk factor by creating alternative retail channels of distribution," Berman said. "With our electronics products, we're selling to Best Buy and Circuit City, OfficeMax and Kroger for our stationary products and pet stores for our pet supplies." What's next? "Maybe we'll look at consumables or luggage for both adults and kids," he said. Jakks sales last year are expected to have grown 14 percent to $655 million, according to First Call, clearly outpacing a very disappointing 4 percent decline in total toy industry sales to just over $21.3 billion in 2005. Jakks reports its fourth-quarter and year-end results on Tuesday. Privately-held Spin Master, an Ontario-based company, officially changed its name from "Spin Master Toys" two years ago. The company's president Anton Rabie said the decision reflected Spin Master's evolution into a consumer products company from a pure toys company. "From the company's standpoint, we don't want to be like Mattel, or just a toymaker. That's why we changed our name and removed 'toys' from our title," Rabie said. Whereas traditional toys represented 100 percent of its product portfolio two years, today it's down to about 65 percent toys, with the balance divided between home decor and electronics, he said. Spin Master is entering the consumer electronics area for the first time this year with seven new products that it showcased this week at the annual American International Toy Fair in New York. "I'm not saying that kids aren't playing with toys. They're just playing less with them," Rabie said. "The toy industry isn't going away, but as toymakers we have to accept the fact that consumers are favoring other things such as electronics. A kid sees the parent with a cellphone and wants it. We want to give kids what they want but with different features more appropriate for them." MGA Entertainment, another privately-held Calif-based company known for its popular Bratz dolls, is also in the midst of an image makeover. At the toy fair, the company unveiled an updated collection of its Bratz home decor line that featured lamps, bedding items and chairs as well as an expanded offering of electronics items like a kids' moonchairs with built-in speakers and a plug-in feature for mp3 players, digital videocameras and Wi-Fi enabled instant messenger devices. "Kids today are very demanding and they're more aware of what they want and what's hot because they're always on the Internet," CEO Isaac Larian said in an interview with CNNMoney.com, during which he also revealed that MGA could go public as early as this year. "We don't think of ourselves as in the toys business but in the 'kids' business," "We have a TV series, sporting goods, home products and a lot more than just toys." Industry watcher Reyne Rice, a toy trend specialist for the Toy Industry Association (TIA), the industry trade group, said the shift away from traditional toys represents the cyclical nature of the industry "We've seen this before when toymakers expanded into new areas and later they went back to their core business," she said. "I think it makes sense for companies to reach their consumers in new markets. So if there's an opportunity to capture them while they are at a sporting event or at a music concert or at a grocery store, why not?" Søren Torp Larsen, president of LEGO Systems, said his company did make a foray into new markets like clothes and other accessories about five years ago. It didn't work. It's not always a good idea to stray too far from the main appeal of the brand, he said. "Our consumers didn't respond well and we went back to improving our core play products." At the same time, he said LEGO is aware that the company needs to stay relevant to its consumers today who are becoming even more tech-savvy at a younger age.

"We will apply technology to our products where it's meaningful and not just for the sake of," Larsen said, citing LEGO Minstorms NXT as an example. It's a line of robotic LEGO toolsets that include programmable LEGO blocks with built-in ultra-sonic sensors. |

|