|

Tech pain may end, but not soon

The sector could recover this year, but analysts and investors say it won't happen overnight.

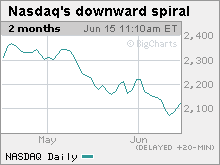

NEW YORK (CNNMoney.com) - The first half of 2006 has proven brutal for tech investors, who saw all of their gains for the year wiped out in May and endured more pain when the tech-heavy Nasdaq composite hit a seven-month low last week. Fears of a possible economic slowdown, worries about inflation and stock prices that may have gotten ahead of themselves are all factors that have affected the sector, which is down 11 percent from its high in April.

And a brouhaha involving how - and when - top executives at some technology companies received stock option grants has not helped the sector, with dozens of companies announcing either formal investigations or informal inquiries from the SEC and federal prosecutors into their options-granting practices. Given that the second half of the year is typically better for tech, what with back to school and holiday season sales, could we actually be on track for a decent second half? Or will inflation jitters, concerns about the economy and the ongoing options saga continue to haunt the sector? Tech bears - and even some optimists - point out that the industry is battling a number of head winds. Mark Demos, a research analyst with Fifth Third Asset Management, said that in addition to crummy sentiment, the technology sector is also grappling with a fundamental problem: slowing growth in the demand for PCs, particularly laptops. Demand for laptops was "phenomenal" in 2004 and 2005, Demos said, but has been cooling off since then. The U.S. PC market grew 5.3 percent in the first quarter of 2006, below a forecast of 6.7 percent, according to industry tracker IDC. "It's difficult for the tech sector to perform well when a big piece of it is seeing decelerating growth," said Demos. "About 40 percent of silicon content goes into the PC area, so it's a big piece (of the tech sector). It's too big not to matter." Demand in the dumps

The cooling demand could get worse before it gets better, according to one analyst. "Our checks continue to show the PC market in the doldrums with things getting progressively worse," wrote RBC Capital Markets analyst Apjit Walia in a note to clients. Walia was writing specifically about Intel (up $0.18 to $17.91, Charts), but he thinks the PC market's doldrums will have a negative effect on other stocks as well if the economy gets worse. "We recommend investors stay clear of jumping into the long Intel/PC trade right now, and use rallies as a gift to sell," Walia wrote. Demos added that there's no near-term catalyst in sight that could stop the slowdown in PC demand. With the delay of Windows Vista, the long-awaited upgrade to Microsoft's (up $0.14 to $22.02, Charts) ubiquitous Windows operating system, pushed back to 2007, many consumers will likely wait to buy a new PC, he said. That malaise has spread to corporate buyers too, he said. "You really haven't seen the corporate enterprise step up and show a big commitment to spend money on tech products," said Demos. "Demand has just been okay. I think there is a fear of slowing economic growth." Indeed, fears that Federal Reserve will go too far in its interest rate-hiking campaign and induce a slowing economy could hurt tech stocks, which are particularly sensitive to concerns about economic growth, said Neil Wolfson, chief investment officer of Wilmington Trust Investment Management. "Technology is an area that does get caught when the economy softens," said Wolfson. "Companies start electing not to upgrade systems or do major technology spends. That fear of an economic slowdown is a factor that affects the overall segment." Rudy Torrijos, a vice president at fund manager Delaware Investments who oversees the emerging growth portion of the firm's technology portfolio, said that chief information officers (CIOs), who oversee the buying of technology equipment for the companies they work for, need to feel that the economy is on strong footing before they feel comfortable authorizing millions of dollars of spending on new equipment. Following a strong fourth quarter in 2005, CIOs had been feeling that the economy would be strong in 2006. But that was before Bernanke. "What we didn't count on was the Fed," said Torrijos. Fundamentally speaking

But not everyone is bearish on technology, however. Some point out that while the economy is indeed jittery, many tech companies are in fundamentally good shape. "It feels to me like what we've got is rotten sentiment but pretty decent fundamentals for tech companies," said Kevin Landis, portfolio manager of Firsthand Capital Management, a mutual fund firm specializing in tech stocks. "If you had to choose between having good sentiment and poor fundamentals or poor sentiment and good fundamentals, you'd choose the latter." And while corporate spending on technology is not going gangbusters, the same cannot be said for consumers, who are still spending big bucks on things such as flat-screen TVs, cell phones and portable music players despite higher gas prices and interest rates. Electronics retailer Best Buy reported blowout earnings this week, beating analysts' expectations by 11 cents a share. "The consumer has been remarkably resilient," said Torrijos, who pointed out that prices on big-ticket items such as flat-screen TVs have come down significantly, making them more attractive to consumers. Furthermore, the release of Windows Vista later this year for corporate customers - and its anticipated release to consumers early next year - could give Microsoft's stock a boost ahead of the product's release, and that rising tide could lift other stocks in the sector, analysts and investors say. "Vista could pump up the PC market a little bit," said Landis of Firsthand. "It'll create arguments to buy more expensive PCs." While the environment is difficult now, the head winds facing the tech sector are unlikely to carry through all the way to the end of the year, analysts and investors say. Demos of Fifth Third thinks that a lot of the bad news is starting to get priced into the stocks and the fourth quarter could be strong. But he advises investors to sit tight for now. "I would not be in a hurry to add exposure right now," he said. "Estimates are still coming down. There's no reason why you want to get in front of that." But he thinks that opportunities could pick up again by the end of the year. "It's setting up to be typical fourth-quarter rally," he said. RBC's Walia does not own shares of Intel, but his firm has provided non-investment banking services to the company. Fifth Third's Demos does not own shares of Microsoft, but his firm owns shares of the company in some of its mutual funds. ------------------ Related: |

|