|

DVD or download? Early adopters may think that movie downloads are cool but it's too soon to declare the death of the DVD. NEW YORK (CNNMoney.com) -- How are you going to watch movies at home in the future? Are you going to download them on your computer and then watch them on your TV or an iPod? Continue to buy or rent DVDs? Order them through a video on demand service from your cable company?

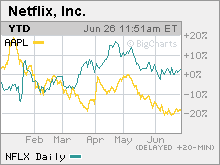

There are many possibilities. And with that, a lot of confusion on Wall Street about just who will ultimately wind up making the most money from movie downloads. Clearly, the so-called "content providers" - media companies that produce and distribute films - should be winners, assuming they are able to find the right price that will stimulate healthy demand while not sacrificing profits. But investors don't seem willing to make any major bets on just who will emerge as the winner from a distribution standpoint just yet. Downloads will go mainstream...but not tomorrow Consider that shares of Apple (Charts), which is in talks with major movie studios about the possibility of selling movies on its popular iTunes store, have fallen nearly 20 percent this year. There has also been speculation that Microsoft is in discussions with media companies about selling movie downloads. In addition, there has been chatter that Microsoft (Charts) may also want to begin selling a mobile hardware media device to challenge Apple's iPod. And shares of Netflix (Charts), the online DVD rental service, have fallen more than 11 percent in the past month and a half, partly due to concerns about increased competition from Apple down the road. Part of the recent uncertainty could be due to the fact that all the talk about movie download services becoming prevalent in the near-future is probably a bit overdone. "There is no doubt that digital distribution is coming sooner or later. But sometime we get excited and think it is coming sooner than it is," said John Barrett, director of research with Park Associates, a market research firm focusing on digital entertainment and communications trends. As such, one analyst thinks that it's way too premature to ring the death knell for the DVD...and Netflix for that matter. "We continue to believe that DVDs will remain the primary distribution medium for movies for the next 5+ years," wrote Cowen & Co. analyst Jim Friedland in a recent report. He added that he did not think an iTunes movie service would have a significant impact on Netflix sales in the near-term simply because he thinks DVDs are a better way to watch a movie. "iTunes videos are great for use on a plane, but offer low quality video and sound," he wrote. Still, it seems likely that over time the technology issue will be taken care of and people will not be able to tell the difference between a movie on DVD and something they have downloaded. "While the lack of video home-networking solutions limits the ability to watch programming on the TV today, newer solutions introduced over the next few years could greatly expand the appeal of video downloads and steaming media," wrote Safa Rashtchy, an analyst with Piper Jaffray in a report on Monday. Apple may not be the winner However, this doesn't necessarily mean that Apple will make a huge killing from movie downloads. First off, while many techies and media folk are all atwitter about the prospect of buying movies from iTunes, the reality is that iTunes is still just a small contributor to Apple's sales. In the first two quarters of the company's latest fiscal year, less than 10 percent of Apple's total sales came from its "other music related products and services" unit, which includes iTunes. And Phil Leigh, senior analyst with Inside Digital Media, an independent research firm, said that Yahoo! (Charts) and Google (Charts) will probably become more formidable competitors to Apple in the online video market. "You are going to see new winners and the likely candidates will be Yahoo and Google. You'll be able to search for video in the way we search for text now and some videos will be free and ad supported and some may be sold," he said. David Card, an analyst with Jupiter Research, agreed that it may not be easy for Apple to replicate the success it's had with music in the movie market. "Music is portable. But there is only so much demand for portable long-form video," he said. Card adds that there already is a fair amount of competition in the movie download business from services such as Movelink and CinemaNow in addition to video on demand services from cable and satellite TV providers. "Even if Apple were to get into the movie business, I don't think they'd carry as much as pull. You want movies on the big screen and there are a lot of other options for doing that," he said. In other words, don't throw away your DVDs or cancel your Netflix subscription just yet. _____________________ Related: Wastler on the price of online movies Related: Big media: Adapt or die |

|