Warner-EMI: A sad song A merger between the two music giants could be bad news for both investors and consumers. NEW YORK (CNNMoney.com) -- Wall Street is betting on a big music industry merger. But investors who have been aggressively bidding up shares of Warner Music Group and EMI Group may find themselves singing a sad song if a deal doesn't pan out. Warner Music, the world's fourth largest music company, is currently locked in a game of one-upmanship with EMI, the third largest music firm.

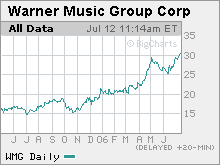

A marriage of the two music firms would bring together EMI's stable of popular artists such as Gorillaz and Coldplay (not to mention the catalogue of some band called the Beatles) with Warner's roster of musicians such as Green Day, Madonna and the Red Hot Chili Peppers. EMI has stated its desire to buy Warner Music but Warner, controlled by media mogul Edgar Bronfman Jr., has also vowed to take over EMI. Many industry experts see Bronfman's brinkmanship as just a ploy to drive up his company's selling price. As such, shares of Warner Music (Charts) have soared about 60 percent this year and have nearly doubled since the stock went public in May 2005. Shares now trade for a whopping 75 times fiscal 2007 earnings estimates. It's interesting that Wall Street is pretty much betting that some sort of deal between the two companies is all but certain. I don't think that's necessarily the case. Here's why. We've been here before Back in 2000, when Warner Music was still a subsidiary of Time Warner, (Bronfman and a group of private equity firms bought Warner Music from Time Warner in 2003), the two companies scrapped plans to combine forces in 2000 due to regulatory concerns. Time Warner (Charts) is the parent company of CNNMoney.com. Keep in mind, the attempt to merge in 2000 came at a time when there were still five major music labels. Since then, Sony (Charts) merged its music division with BMG, the music label owned by German media titan Bertelsmann, to create Sony BMG. So a merger of Warner and EMI now would leave only three labels left. Universal Music Group, which is owned by French media firm Vivendi (Charts), is the other major record company. Sure, some would argue that the record labels are now much less powerful than they were a few years ago thanks to the proliferation of legal music download sites as well as illegal file sharing. But the music industry has made no secret of their desire to charge more money for single and album downloads. So far, the leading distributor of online music, Apple's iTunes, has held firm with the standard prices of 99 cents a single and $9.99 per album. If EMI and Warner Music were to merge, however, it may be tougher for Apple (Charts) and other online music stores to fight off future attempts at price hikes. The music industry would have more leverage and bargaining power if there were only three big labels left. A merger also could make it more difficult for independent music labels to compete against these giants, which also would be bad news for consumers since it would limit choice. In fact, an international trade organization called Impala, which represents independent music labels, has already come out against the prospects of an EMI-Warner merger. Does one + one equal three? There's another reason investors need to be wary of getting caught up in the takeover hype. Even if EMI and Warner merged, the resulting company would not exactly become a hot sexy growth stock. Let's be honest, the move in Warner's stock since its IPO has been almost entirely due to merger speculation, not the fundamentals. Sure, digital sales are growing rapidly for Warner. In its fiscal second quarter, they increased by 157 percent from the same period last year. But digital accounts for just 11 percent of the company's total sales. Warner's overall sales are expected to be up less than 1 percent this fiscal year (which ends in September) and 3 percent in fiscal 2007. What's more, analysts expect earnings to increase at an average clip of only 5.5 percent annually for the next few years. Merger euphoria has also lifted shares of EMI, which trade on the London Stock Exchange. EMI's stock is up nearly 30 percent this year even though analysts following the stock only expect sales to increase by 1.3 percent this fiscal year (which ends in March) and 2.4 percent next year. Given the poor fundamentals of the music industry, at some point it will become too costly for a merger between the two to make sense if they both remain hell-bent on driving up the asking price. EMI said in a statement late last month that it believed its offer of $31 a share, only 1 percent higher than Warner's current price, is attractive, possibly signaling that it won't want to raise its bid much further. "EMI would have a hard time justifying a dramatically higher bid for WMG," wrote Pali Capital analyst Richard Greenfield in a recent report. At this point, it looks like investors can't win. Either Warner and EMI walk away from a merger, which would probably send both stocks tumbling, or they do a deal at an absurd price that cripples the potential for earnings growth for years to come. So here's hoping that the two companies just decide to go their separate ways. At least then, consumers, if not EMI and Warner investors, will have reason to hum a happy tune. ----------------- Related: A big hit for Bronfman Related: Warner Music: The remix The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

| ||||||||||||||||