|

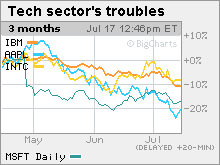

Tech troubles take the spotlight Despite decent fundamentals, leading companies are expected to groan about the economy and the growing options probe. NEW YORK (CNNMoney.com) -- Some of the biggest names in tech report June quarter earnings this week, and analysts and investors say a number of factors could make the quarter - typically a slow one for technology companies - even worse than usual. For starters, Microsoft's announcement earlier this year that it is delaying the consumer version of its newest operating system, Windows Vista, until next year has put a damper on PC sales. Industry watchers say that market is weaker than it has been in several quarters, and the industry is battling slowing growth.

Also, the stock options scandal has cast a pall over the sector as the number of firms being investigated grows. A handful of companies have ousted top executives and restated earnings because of past incidents of backdating options grants, the retroactive changing of the date top executives were granted options to make the options more lucrative. Concerns about the broader economy, including rising interest rates, high energy prices and escalating violence in the Middle East, are also hampering the tech sector, which analysts and investors say is particularly sensitive to economic concerns. Finally, a handful of the companies reporting, such as Intel and Microsoft, are dealing with company-specific problems in addition to economic concerns. While numerous factors are haunting the sector right now, that doesn't mean there's anything fundamentally wrong, said Trip Chowdhry, an analyst with Global Equities Research. Chowdhry believes the overall health of the tech sector as a whole is very strong but that Wall Street expectations for earnings and revenue growth have gotten ahead of themselves. "The first quarter was very strong and people were anticipating that the same level could be sustained for the rest of the year," said Chowdhry. "Those people will be utterly disappointed." Here is a look at what industry watchers are expecting from some of the tech heavyweights reporting this week. IBM The Armonk, N.Y.-based firm is expected to report revenue of $21.9 billion, a 2 percent decline over the year-earlier quarter, and earnings of $1.29 a share, a 15 percent increase in year-over-year growth, when it reports earnings after the close on Tuesday. Expectations for the quarter are mixed. Daniel Morgan, a portfolio manager at Synovus Investment Advisors, said he is "cautiously optimistic" that IBM (down $0.27 to $73.30, Charts) can meet targets, though he notes that the company's services business, its biggest breadwinner, has faced increased competition from India-based IT services firms such as Infosys. Morgan's firm holds shares of IBM in its portfolios but is not actively acquiring the stock. IBM announced last month that it's tripling its investment in India to $6 billion over three years. Tony Ursillo, stock analyst for the Loomis Sayles Research Fund, said he thinks the quarter will prove weaker than expected for IBM because of what he believes will be disappointing services bookings. Ursillo, whose portfolio doesn't hold shares of IBM, also thinks the company's high-end storage products are not performing as well as mid-range storage products such as those offered by competitors like Hewlett-Packard and Sun. Intel The No.-1 maker of chips for PCs has long been considered a bellwether for the tech sector. But company-specific problems have led Intel to trail other semiconductor companies in terms of stock performance for the past several quarters. Analysts expect Intel (up $0.01 to $17.89, Charts) to post revenue of $8.3 billion, a 10 percent decline over the year-earlier quarter, and earnings per share of 13 cents, a 59 percent plunge compared to last year when it reports earnings Wednesday after the close. Morgan of Synovus Advisors said expectations for Intel are low, given its recent restructuring actions, which include spinning off its communications chip business to Marvell, cutting 1,000 manager positions and refocusing its energy on its core desktop PC business. His firm holds shares of Intel but is not actively acquiring the stock. "It's going to be a challenging sled ride the next couple of quarters for Intel," said Morgan, adding that investors are also wondering whether the company's recent price cutting, initiated to win back some market share from rival AMD, will cut into gross margins as well. Intel is also launching a slew of new chips, believed to be its most competitive line in several years, which analysts think could get the company back on track. But that probably won't happen for at least the next two quarters, analysts say, and even if it does, Intel may never again enjoy the overwhelming market share it once had in the space. Apple Analysts are expecting Apple (up $1.71 to $52.38, Charts) to report $4.4 billion in revenue, a 25 percent increase over the same quarter last year, and earnings per share of 44 cents when it reports earnings Wednesday night. That's a 19 percent increase over the year-earlier quarter but well shy of last year's second-quarter income growth of 425 percent. That's in part because of explosive growth in the company's iPod in the year-earlier quarter. "Because of that strong growth, this year's comparisons are much harder to achieve," said Simon Wu, an equity analyst and vice president in Mellon Financial Corp.'s private wealth management group whose portfolio owns shares of Apple. "We'll see some new products released around September that should drive sales." Ursillo of Loomis Sayles points out that iPod sales have slowed in anticipation of new products that could be announced later this year. Apple has typically announced new iPods in the fall season. His firm owned 4.6 million shares of Apple through June 30. Microsoft Like Intel, IBM and Apple, Microsoft (up $0.16 to $22.45, Charts) is undergoing a number of transitions. During the quarter, chairman Bill Gates announced he will leave his day-to-day role at the company starting in two years to spend more time on his charitable foundation. In addition to management changes, the company is also rethinking its MSN Internet division, which has long lagged Google and Yahoo!, and is gearing up for the launch of Vista next year. Analysts and investors are expecting the software giant to report revenue of $11.6 billion, a 14 percent increase over the prior-year quarter, and earnings per share of 30 cents, a 6 percent decline from last year, when it reports earnings Thursday night. Despite all the big changes, Microsoft's stock is still stuck in the holding pattern that has dogged it for five years. "I don't anticipate there being that much upside," said Ursillo of Microsoft's June quarter. Ursillo's firm owned about 1.4 million shares of the company through June 30. "One wild card might be Xbox units, because they have done a good job at ramping the supply." But Ursillo notes that while increased Xbox sales would help revenue growth, it would actually crimp earnings since the company still loses money on each Xbox 360 it sells. |

|