|

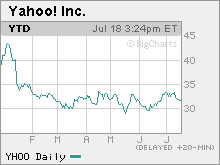

No joy for Yahoo World's No. 2 search engine reports results and guidance that disappoint investors; stock tumbles to new 52-week low. NEW YORK (CNNMoney.com) -- It looks like Yahoo! investors won't have any reason to yodel following the company's slightly disappointing second-quarter results and forecast for the third quarter issued Tuesday. The company also announced during a conference call with analysts that long-awaited improvements to its search technology, which were expected to be rolled out at the end of the summer, will now be delayed until the fourth quarter. The stock nosedived Wednesday morning and hit a new 52-week low. The Sunnyvale, Calif.-based search engine reported second-quarter sales excluding ad revenue it shares with partners of $1.12 billion, up 28 percent from $875 million a year ago. Analysts were expecting Yahoo to post sales of $1.14 billion, according to First Call. Earnings came in at $164 million, or 11 cents a share, in line with analysts' consensus forecasts of 11 cents. Last year, Yahoo reported a profit of 10 cents a share, after factoring in the effect of stock options and excluding a large gain from the sale of an investment. Yahoo also gave what some may view as tepid guidance for the third quarter. The company said it expects sales excluding partnership costs to be between $1.115 billion and $1.225 billion. The $1.17 billion midpoint of this forecast is slightly below the $1.2 billion in sales that Wall Street was expecting. Shares of Yahoo (Charts) tumbled more than 18 percent in heavy trading on the Nasdaq Wednesday. Google (Charts), Yahoo's top rival, fell nearly 1 percent Wednesday. Google is due to report its second-quarter results Thursday. Prior to Tuesday's report, Yahoo's stock had fallen nearly 20 percent this year but had rebounded lately on hopes of strong sales and earnings for the second-quarter and the latter half of the year. Clearly, investors were wrong. "This is disappointing," said Tim Boyd, an analyst with Caris & Co. "Expectations maybe did get too high." To be sure, Yahoo continues to benefit from a massive shift of advertising dollars from traditional media like print, TV and radio to the Internet. During the conference call, Yahoo chief executive officer Terry Semel stressed that the company was seeing significant increases in so-called graphical or display advertising, which include banners, video and other forms of online ads. He also said the company's partnership with online auction firm eBay (Charts), which was announced in May, will benefit both companies. But analysts say the company is not cashing in on the hot demand for ads tied to keyword searches as much as Google has. Delay of "Panama" causes investors to panic Influential market research firm comScore Networks, which tracks online traffic, reported Tuesday that search queries at Yahoo sites in the second quarter were up 13 percent from the first quarter and 21 percent higher than a year ago, while Google's search volume increased 15 percent from the first quarter and 55 percent from the same period last year. comScore also reported that Google maintained its wide lead in search over Yahoo during June. Google finished the month with a 44.7 percent share of the search market, compared to 28.5 percent market share for Yahoo. And with that in mind, Boyd thinks that the after-hours dumping of Google may be an overreaction. "The Google sell-off is a little bit panic-induced. I still expect Google to beat on the top line. Google should have another strong quarter in search," Boyd said. However, investors may also be worried that Digitas, an interactive marketing firm, lowered its 2006 earnings guidance when it reported second-quarter results Tuesday. Shares of Digitas (Charts) plunged 22 percent in early morning trading Wednesday. Clayton Moran, an analyst with Stanford Financial, said that since Yahoo did not raise guidance for the third quarter, some might interpret that to mean that the economy may be slowing more drastically than thought and that this would curb demand for online advertising. He does not think this is the case though. Yahoo is also in the process of upgrading its search tools for advertisers in an attempt to catch up with Google and generate more revenue from its search business. The company was expected to unveil its new search technology, codenamed Panama, by the end of the summer, but Semel said during the call that the rollout would not take place until the fourth quarter. Analysts should not factor in any improved results from the new search tools into their financial models until the first quarter of 2007, Semel said. During the call, several analysts expressed their frustration that Yahoo chose to delay Panama because Yahoo said as recently as its analyst meeting in May that it was on track to release the new tools during the third quarter. One analyst said investors have reason to worry about whether Yahoo's capital spending plans (the company also recently redesigned its home page and has introduced several new services) are going to lead to stronger results anytime soon. David Garrity, an analyst with Dinosaur Securities, said it was a negative that Yahoo's cash flow growth was lower than its sales growth. "Investors are probably left wondering where the ultimate payoff will come from," he said. And Stanford's Moran said that even though Yahoo is pushing back Panama by just a quarter, Google should benefit. "The most interesting thing is that delaying improvements to Yahoo's search adds to the book of evidence that other companies are not able to keep up with Google," Moran said. "Yahoo is saying we're not there yet and all the while Google is gaining share and showing better results." Analysts quoted in this story do not own shares of the companies mentioned and their firms have no investment banking ties with the companies. -------------------------------------------------------------- Related: Yahoo, Google search for fans on Wall Street Related: AOL as Yahoo wannabe |

|