|

A league of your own It's every fan's fantasy: Your office is a baseball diamond and the perks include hot dogs. One CEO shows how to make it big in the minors.

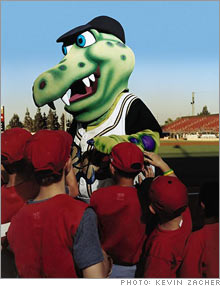

(FORTUNE Magazine) -- It's a lazy summer evening in Rancho Cucamonga, Calif., and the striped outfield of the Class A Rancho Cucamonga Quakes' home field (the "Epicenter") glows like a beacon in the smoggy desert air. Fans sit close enough to the field to hear every pop of the glove, a dinosaur mascot named Tremor (jersey number: 4.8 on the Richter scale) roams the stands, and since it's Weenie Wednesday, hot dogs are only a dollar.

The Quakes are down by one until catcher Michael Collins slams a home run to left to tie the game. Looking at the field, team owner Hank Stickney cracks a wide grin. Minor league tradition mandates a collection for any player who hits a home run, so Stickney gamely pulls out a few bills and throws them into the cap being passed around. "Owning the Quakes is one of the most exciting things I've ever done," says the retired Air Force lieutenant colonel and former healthcare CEO. "And I've done a lot of exciting things." Stickney may be out a few bucks on this particular night, but over two decades he's proved that a team can be a great investment. For anyone tempted to indulge his or her own fantasy, Stickney's story (which began with a modest $90,000 stake) is instructive. "I was always a sports nut," says Stickney, who played hooky from school to watch the Indians win the 1948 World Series. "I never realized that the business side of it was just as interesting." He made his first foray into the minors in 1986. He had just sold his medical specialty company and joined a group of investors led by actor Mark Harmon, paying $90,000 for a 30% stake in a team that became the San Bernadino Spirit. Four years later the Spirit had become a farm team for Seattle and saw its first star, Ken Griffey Jr., pass through on his way to the Show. But it was still bleeding money. Stickney had his own ideas about how to turn a profit, so in 1990 he spent roughly $500,000 to raise his stake to 60% and named himself GM. First he ditched San Bernandino (the Spirit played on an ex-Little League field) and struck a deal with the city of Rancho Cucamonga, which was building an $11.5 million ballpark, one of the first in a wave of major league-grade, single-A stadiums. He also had a revelation. "It's very simple: You can't depend on the baseball to sell your tickets," he says. He nixed ticket giveaways and instead began to draw fans with carnival rides, half-inning skits, promotions, and fireworks. Tremor the mascot was hatched out of an egg at the first game. Stickney's timing was perfect. The 1994 strike drove disgruntled fans to the farm teams, pushing minor league attendance from 33 million in 1994 to 41 million in 2005. With an average of 3,950 fans per game last year, the Quakes have topped California League attendance every season for the past decade. Meanwhile, Stickney teamed up with his son Ken and several other investors to found Mandalay Sports, which bought five other minor league franchises across the country. The teams - notably the Dayton Dragons and Texas's Frisco RoughRiders - have thrived following the lessons Stickney learned at the Epicenter. One caveat for aspiring owners: In the minors, all on-field talent are provided and managed by the major league parent club, a lack of control that can be tough (the Quakes are now affiliated with the Angels). On the upside, the majors pick up salaries, workers' comp, and health insurance bills. Minor league baseball teams are "great properties to have," says sports investment banker John Moag of Moag & Co. "They're almost like utilities: Most provide an annual dividend, they're established, they're fairly conservative, and they appraise well in value." Last year, Stickney says, 40% of the Quakes' $3 million in revenue came from ticket sales, 40% from advertising, and 20% from sales at the park. Profit margins hover between 5% and 10%, and the team Stickney and his partners bought 20 years ago for $250,000 would sell for upwards of $7 million today. "If you're looking for a quick buck, this isn't it," laughs Stickney. But, as Yankee slugger Phil Linz once said of baseball, it sure beats working for a living. Minor Leagues, Major Thrills Baseball's not the only game in town. Here are four other sports where individuals can invest - without breaking the bank. AMERICAN BASKETBALL ASSOCIATION Now 60 teams strong, the ABA plans to add 40 teams by 2008. The entry fee is $20,000, and operating budgets run roughly $500,000 a year. abalive.com; 317-844-7502 UNITED SOCCER LEAGUE The fee for minor league soccer's four franchised leagues ranges from $25,000 to $350,000. Its fastest-growing division--the 59-team development league--includes the likes of the Cape Cod Crusaders and the Sioux Falls SpitFire. Cost of entry is in the mid-five figures. uslsoccer.com; 813-963-3909 NATIONAL LACROSSE LEAGUE When teams in New York and Chicago launch next season, this pro league will have 13 franchises - a number it plans to double by 2010. Expansion fee is $5 million. nll.com; 212-764-1390 ARENA FOOTBALL If indoor football's $20 million expansion fee is out of reach, try the minors: arenafootball2. The 23-team league will grow to 100 franchises by 2016, and fees start at $500,000. af2.com; 773-444-1080 REPORTER ASSOCIATE Marilyn Adamo contributed to this article. |

|