|

Madison Avenue meets Silicon Valley Most big ad agency stocks have held up well this year. Do these companies finally 'get' the Internet? NEW YORK (CNNMoney.com) -- It's no secret that traditional media companies are facing some turbulent times. Newspapers and magazines are losing readers to the Internet. You could say the same thing about TV viewership. And the radio business is struggling to hold onto listeners. As such, ad dollars are increasingly flowing online to the likes of Google, Yahoo! and other Internet leaders.

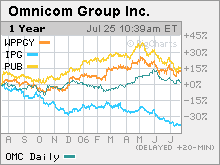

With that in mind, you'd think that stocks of big Madison Avenue advertising agencies, companies that negotiate media buys and conduct public relations for big corporate clients, would also be sinking. But that's not the case. Shares of ad agencies Omnicom (Charts), Publicis (Charts) and WPP Group (Charts) have all outperformed the market this year and for the past 12 months. Interpublic (Charts) is the only top agency not taking part in the rally. The company has lost some key clients in the past few years and is expected to lose money this year. Its stock is down 17 percent so far in 2006. Embracing the Web One reason for the optimism, Interpublic notwithstanding, could be moves the ad agencies have made to embrace the burgeoning online ad market. Earlier this month, WPP established a joint venture with LiveWorld, a marketing agency that creates online communities and social networking sites for corporate clients. Last month, the company bought M80, a firm that specializes in online word-of-mouth marketing. During FORTUNE Magazine's Brainstorm conference last month, WPP's group chief executive Sir Martin Sorrell was incredibly vocal about the need for ad agencies to adapt to the rapidly changing world of advertising. "I am continuously amazed by the speed of transition," he said at the conference. "But it's just like TV in the 1950s and many agencies are terrified by a new medium." WPP is far from being the only agency to move more aggressively online. Omnicom recently bought a majority stake in EVB, an interactive ad agency based in San Francisco. Publicis launched its own in-house digital agency, dubbed Denuo, in February. And Interpublic has made one of the more interesting marketing deals this year. In June, it announced that it will participate in marketing and promotional programs on the popular social networking site Facebook. Interpublic also agreed to buy a tiny stake, less than a half of a percent, in Facebook. Clearly, Madison Avenue has recognized that it needs to embrace Silicon Valley if it hopes to hang on to its top customers and maintain fans on Wall Street. "We've got more evidence to indicate that maybe the big agencies are starting to figure out the online business," said Michael Mahoney, managing director with EGM Capital, a hedge fund based in San Francisco that owns online ad agencies aQuantive (Charts) and Digitas (Charts). aQuantive and Digitas, as well as other online marketing firms such as ValueClick and 24/7 Media, have emerged as tough competition for the Madison Avenue firms. But one money manager said he thinks the Madison Avenue firms will more than hold their own against the upstarts, and that interactive marketing campaigns could wind up being more profitable for them. "Ad agencies are not necessarily disadvantaged by the move online," said Daniel Boone, managing partner with Atlanta Capital, which owns Omnicom in the Calvert Social Investment Equity fund. "Clients may need even more expertise and the agencies may be able to charge more. So this could be an opportunity for margin expansion." And the ad agencies are indeed fighting back. Omnicom claims that it is gaining market share online. "More and more clients are looking for their interactive work to be integrated in their overall campaigns," said Randall Weisenburger, Omnicom's chief financial officer, during a conference call with analysts Tuesday morning. Omnicom, which owns the BBDO Worldwide and DDB Worldwide ad agencies, reported second-quarter results Tuesday. Sales rose 8 percent and earnings increased 15 percent from a year earlier. Both revenue and profits were better than Wall Street's expectations. More online deals? During the conference call, Omnicom chief executive officer John Wren said he did not expect any of his company's blue-chip clients to pull back on ad spending even though there are some fears about an economic slowdown in the second half of the year. "We don't see any trends which are terribly alarming." Wren said. And that could be another reason why ad agency stocks are holding up. For the full year, analysts are predicting that Omnicom's earnings will increase 12 percent from last year. Wall Street is forecasting a 12 percent increase in annual profits for Publicis as well. WPP has the highest expected growth rate, with analysts expecting an increase of 17 percent. "The reality is that the agencies are well-positioned and will ultimately be the conduit for how ad dollars are funneled. It's just a matter of how those dollars are spent," said Tim Fidler, director of research for Ariel Capital Management, which owns shares of Omnicom and Interpublic in the Ariel Appreciation fund. "Just because traditional ad spending is slowing down, it's not true that all ad spending is slowing down." Nonetheless, in order for the agencies to sustain such levels of growth for the foreseeable future, they will need to offer even more digital marketing options, since corporations are increasingly realizing that online advertising may be more effective than TV, print or radio. "Measurability and predictability are much more obvious online," said WPP's Sorrell at Brainstorm. "Media planning and buying has become a more sophisticated business." As such, EGM's Mahoney said that he expects the big agencies to continue looking for smaller Internet-oriented companies to buy in order to further boost their presence online. In fact, he said that Digitas, whose stock has fallen 20 percent since issuing an earnings warning last week, could be vulnerable to a takeover. "One of the big guys might want to snap up Digitas at these valuations," he said. -------------------------------------------------------------- Related: |

|