|

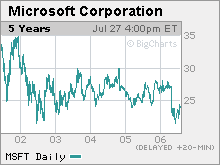

Microsoft's makeover: Will the bet pay off? Microsoft's executives touted 'a new era' for the software giant at its annual meeting, but is the gamble worthwhile? NEW YORK (CNNMoney.com) -- At its annual financial analyst meeting, Microsoft's executives enthusiastically spoke of "a new era" in which the company will shift its focus from the PC to the Internet. But it remains to be seen whether investors will embrace the company's new plan of melding online services with core Microsoft (down $0.50 to $23.87, Charts) software and making money from subscription fees and online ads.

Microsoft's executives chose the analyst day to present a picture of a company in transition, and one that will be better able to deliver value to its shareholders. Investors are certainly hoping that's the case. Shares of Microsoft have been in a rut for going on five years, and the stock took another tumble Thursday over fears that it may have to delay the launch of the newest version of its Windows operating system, Windows Vista, yet again. Microsoft's executives acknowledged that investors have repeatedly expressed concern about the stock price and have raised questions about areas of the business, such as its online division, that have underperformed. At the same time, the company is undergoing management changes. Co-founder and company chairman Bill Gates will be stepping down from his day-to-day role and will go part time in 2008 to spend more time focusing on his philanthropic foundation. Despite the speculation about Microsoft's future, CEO Steve Ballmer expressed optimism that its new strategy will pay off. "I know there are also questions people have, but this next era will be more exciting, [and we'll be] able to generate more shareholder value," said Ballmer at the meeting, which was held at its headquarters in Redmond, Wash., and monitored via Webcast in New York. Ballmer said Microsoft is focusing on "four pillars" - desktop, server, entertainment and devices, and online - and said the company expects strong future growth in Internet-based software and services and in its entertainment division, which includes its Xbox 360 gaming console. Microsoft executives speaking at the meeting repeatedly talked of using the Internet as a means of delivering its products and services in the future, for both business and home entertainment. "We're in a new era in which the Internet is at the center of so much of what we do with our PCs," said Ray Ozzie, Microsoft's chief software architect. "We must frame all our products and services from an online, end user, connected perspective." But Microsoft faces several challenges along the way. For starters, it's late to the online services party, where rivals Google (Charts) and Yahoo! (Charts) have a huge footprint already. Investing in an iPod killer Still, the company is spending hundreds of millions and investing big bucks on its online efforts as well as in its entertainment division. Robbie Bach, president of Microsoft's entertainment and devices division, said over the next few years the company plans to invest "hundreds of millions" in Zune, Microsoft's so-called iPod killer that is meant to take a bite out of Apple's (Charts) 75 percent share of the MP3 player market in the United States. Bach also said he expects the company's gaming division to become profitable by fiscal 2008. Microsoft loses money on each Xbox 360 console, but the company generates revenue from related software and services. The company also said it expects revenue growth of 7 to 11 percent in the company's online services division, which includes MSN and its adCenter paid-search software, as well as the new Windows Live platform of Internet-based services. Kevin Johnson, co-president of Microsoft's platforms and services division, said he expects sales of $2.5 billion to $2.6 billion in that division for fiscal 2007. But the entertainment segment is expected to post losses through fiscal 2008 because of its investment in Zune. Bach said the company plans to take a more "integrated approach" with Zune, akin to Apple's model of controlling both the hardware, with the iPod, and software, with iTunes. "We will be involved in hardware, software and services. We have to tie those things together like we have in the Xbox world," said Bach. Microsoft not only makes the Xbox 360 consoles but also creates software for the console and has created the Xbox Live platform, an online network that allows Xbox 360 owners to download additional content and play against each other over the Internet. Bach said the company views Zune as more than a portable music player, rather as a tool that will complete Microsoft's footprint in the "digital living room," or how digital movies, music and other forms of entertainment are stored and used in the home. Bach said the company's Media Center software, its Xbox platforms and its forays into IPTV are meant to provide customers with an integrated entertainment experience. "Put all those things together and then take Zune and put it in context of that," he said. "It enables us to complete the picture. The experience of having Zune in that connected environment is going to be a dramatically better experience than just having a portable music player." Software still king As for now, software for the PC is still the company's cash cow. Microsoft expects sales in its popular Windows division to grow 8 to 10 percent in the coming fiscal year, a senior executive said Thursday. The No. 1 computer software maker expects sales of between $14.3 billion and $14.5 in its Windows operating system division in its current fiscal year, Johnson said. Microsoft has announced it will launch Windows Vista, the newest version of its ubiquitous Windows operating system, in November for businesses and in January for consumers, later than the company had originally expected. While the company hasn't changed those dates and said at the meeting that it sees no reason for a delay, company executives said they will not release the product before they feel it is ready, even if that means missing target release dates. "There are no data points that say November or January availability [won't happen] but there is more work to get done," said Johnson. "I'm being pragmatic about the fact that the priority is shipping a great product." Analysts have speculated that the company may delay the launch yet again, and company executives failed to reiterate the November and January launch dates at the analyst meeting. Shares of Microsoft fell more than 2 percent in early afternoon trading. Microsoft is expecting 14 to 15 percent growth in its server and tools division, which makes software for the servers that power corporate networks. That division is expected to generate sales of $11 billion to $11.1 billion in the coming fiscal year. Microsoft said last week it expects total sales for its fiscal year ending next June to hit a range between $49.7 billion to $50.7 billion. |

|