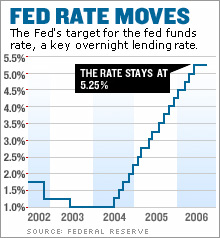

The Fed pauses, but ... Central bank does not raise rates for first time in 2 years; leaves door open for more increases. NEW YORK (CNNMoney.com) -- The Federal Reserve decided Tuesday not to raise interest rates for the first time in more than two years, but the central bank left the door open for more hikes in coming months - news that disappointed Wall Street. The nation's central bank said it was pausing, after 17 straight rate hikes that started in June 2004, because the economy was cooling .

Investor hopes for a pause had grown in recent weeks as more reports pointed to the slowing economy being a bigger risk than rising inflation. Fed chairman Ben Bernanke alluded to these concerns in testimony to the Senate last month. Most notably, the nation's gross domestic product, the broadest measure of economic growth, grew at a weaker-than-expected rate in the second quarter, and job growth missed forecasts in July for the fourth straight month. Concerns about higher oil prices and a slowdown in the housing market also appeared to play a role in the Fed's decision. "Economic growth has moderated from its quite strong pace earlier this year, partly reflecting a gradual cooling of the housing market and the lagged effects of increases in interest rates and energy prices," the Fed said in its heavily scrutinized statement. With the central bank holding off on a rate increase, its target for the federal funds rate, an overnight bank lending rate, remains at 5.25 percent. The fed funds rate affects rates on credit cards, auto loans and home equity lines of credit. Some dissent, and debate But the decision to pause was not unanimous. Jeffrey Lacker, the president of the Federal Reserve Bank of Richmond, voted to raise rates by a quarter of a percentage point. "It's a tenuous pause. The dissenting vote shows that there was heated debate," said Mark Zandi, chief economist with Moody's Economy.com. And the Fed did leave the door open for possible rate hikes in the future. In its statement, the Fed said that "some inflation risks remain" and that more increases would "depend on the evolution of the outlook for both inflation and economic growth, as implied by incoming information." (Read the statement). The Fed used the same language to discuss the rate outlook when it raised rates by a quarter-point in June. Stocks, which were slightly higher before the announcement, rallied right after the Fed said it would pause but soon lost those gains as investors focused more on the Fed implying it may not be done raising rates. (Wall Street not thrilled). "The statement gives the Fed all kinds of room to raise rates at the next meeting and that's probably why the markets don't like this news all that much," said John Norris, chief economist and senior fund manager with Morgan Asset Management. The Fed's next policy meeting takes place on September 20. One attorney who specializes in real estate said that the Fed's pause is a positive sign for not just for housing but in the long run for stocks as well. "This is good for the psyche of the market," said Neil Garfinkel, a partner with Abrams Garfinkel Margolis Bergson, LLP. "It sends a good message to the ordinary consumer and potential home buyers but now it's a question of what the Fed does from here." More rate hikes coming? Margo Cook, head of institutional asset management at the investment arm of the Bank of New York, said it's possible the Fed will still raise rates in September. But even if it does, the Fed probably won't go much further since inflation isn't that big of a risk, she said, noting that bond investors may realize this while the stock market is busy worrying. "You have to believe the Fed is nearing the end. The language does imply that and at some point the stock market will understand this," she said. "Could the fed funds rate get to 5.5 percent? Absolutely. But I don't see why it would go beyond that this year." To that end, bond prices were little changed, leaving the yield on the 10-year Treasury at about 4.92 percent in a sign that bond investors don't expect rates to head much higher. In addition, other traders think the chances of a rate hike in September have diminished. According to future contracts traded on the Chicago Board of Trade, investors are now pricing in about a 30 percent chance of a rate increase in September. Before Tuesday's Fed meeting, traders were betting on a more than 75 percent chance of a rate hike in September following the expected pause in August. But at least one economist said that the Fed's decision to pause sends a confusing message to the markets, especially since the Labor Department's productivity report for the second quarter released Tuesday showed signs that labor costs were picking up. Increased wages are often viewed as a key sign of inflationary pressures. "I think the Fed has made the biggest mistake. They are showing that they are not a vigilant inflation fighter and that's not what we like to see," said Richard Yamarone, chief economist with Argus Research. --------------------------------------------------------------------------------

|

| ||||||||||||||