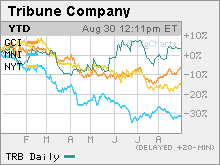

Extra! Extra! Tribune's a buy! Even if shareholders don't pressure Tribune to spin-off its TV business or sell the company, analysts think the stock is worth a look. NEW YORK (CNNMoney.com) -- Ever watch Sesame Street and see the game they play where they show three things that are similar and one thing that is different from the group? Let's play that game with newspaper stocks, shall we? New York Times, Tribune, Gannett, McClatchy. "One of these things is not like the others. One of these things just doesn't belong." If you guessed that Tribune is not like the others, then you're absolutely ... right! Shares of Tribune (Charts) are up more than 5 percent this year. By way of comparison, 12 other U.S.-based newspaper publishing stocks with a market value of at least $250 million are down, on average, nearly 20 percent in 2006. It's not a big secret why newspaper stocks have been hurting lately. The Internet is eating their lunch. Readership is down and that means both declining circulation revenue as well as lower ad sales. Time for a break-up? So why is Tribune, which owns eleven newspapers, including the Los Angeles Times, Chicago Tribune and Newsday, as well as 25 television stations, bucking the bearish trend in the newspaper biz? It's not because Tribune is a picture of health. Quite the contrary. It's because investors are hoping that the company will be broken up or sold outright. The Chandler family, which became Tribune shareholders after the company they controlled, Times-Mirror, sold out to Tribune in 2000, sent a letter to Tribune's board in June urging the company to spin-off its broadcast division or even look for a buyer for the whole company. According to data from FactSet Research, the Chandlers own 15 percent of Tribune. And earlier this month, activist shareholder Nelson Peltz, who is in the midst of a proxy fight with H.J. Heinz and has also pressured fast food chain Wendy's to make shareholder-friendly changes, disclosed in a regulatory filing that his investment firm bought 2.83 million shares of Tribune, a 1.2 percent stake, during the second quarter. That news caused Tribune's stock to rise since Peltz has a history of getting what he wants. Although it's unclear whether Peltz agrees with the Chandler family about whether Tribune should sell off divisions or the entire company, one analyst said it's obvious that Peltz bought into Tribune because he wants some changes to be made. "I don't think Peltz is in there to sit on the sidelines," said Edward Atorino, an analyst with The Benchmark Company, an independent research firm following media stocks. Will the Chandlers and Peltz succeed in getting Tribune to break up? Analysts aren't so sure. After all, the Chandlers only control three Tribune board seats and the remaining eight board members are backing the strategy of Tribune CEO Dennis FitzSimons, which includes a big stock buyback and the sale of some assets. Atorino thinks that the odds of a break-up right now are about 50-50. Getting a boost from the CW and online Yes, some of the spin-off and sale talk may already be priced into the stock. But even if Tribune remains intact, some analysts think that the stock is still among the better values in the newspaper industry. James Walden, an equity analyst with Morningstar, said that without a breakup, a fair value for Tribune is $50 a share, 60 percent higher than its current stock price. Sure, fundamentals stink right now. The company's total sales are down 1.3 percent through July. Circulation revenues have fallen 4.7 percent and national ad sales (which exclude retail ads) have plunged more than 7 percent. The broadcast side isn't doing much better, with TV sales down 2 percent. Still, analysts see some hope for a turnaround. Walden said the TV business for Tribune should improve this fall once the new CW network debuts. Tribune owns several local stations that used to carry Time Warner's WB network, which is merging with CBS's (Charts) UPN, to create the CW. (Time Warner (Charts) also owns CNNMoney.com) The hope is that the CW will be more successful in targeting younger viewers that advertisers covet since the WB and UPN have joined forces and will no longer be competing against each other for this demographic. "We expect to see upside from the launch of the CW," said Walden. Investors may also be underestimating Tribune's online efforts. It's not as if Tribune is idly sitting by watching the likes of Google, Yahoo!, Monster.com and Craigslist steal all its classified ad dollars. Tribune recently increased its stake in online job site CareerBuilder.com to 42.5 percent. Fellow newspaper publisher Gannett (Charts) also owns 42.5 percent while McClatchy (Charts) owns 15 percent. "It's a good thing for Tribune to buy more of CareerBuilder. CareerBuilder has been a winner and that certainly has been a big plus for Tribune," said James Goss, an analyst with Barrington Research. "When people say that old media is irrelevant, they don't realize that many of these companies could be leaders in new areas." To that end, Tribune also recently boosted its stake in online comparison shopping site ShopLocal, which it also owns with Gannett and McClatchy. Tribune also owns a stake in Cars.com. Gannett, McClatchy, Belo (Charts) and The Washington Post (Charts) also own a piece of Cars.com. But for most investors, it's the potential boardroom drama, and not fundamentals, which will likely drive the stock for the foreseeable future. Atorino said that if the company continues to struggle, more investors may align with the Chandlers and Peltz. And that could eventually force Tribune's board into a corner, similar to what happened with Knight Ridder. Shareholder pressure caused Knight Ridder to put itself up on the shopping block last year and the company sold out to McClatchy earlier this year. "Things may percolate a bit in the fall. We'll see how the combination of the Chandlers and Peltz develops," Atorino said. "This is the beginning of the end game." -------------------------------------------------------------- Barrington's Goss owns shares of Tribune but his firm has not done investment banking for the company. Other analysts quoted in this piece do not owns shares of Tribune and their firms have no investment banking relationships with the company. The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

| |||||||||