|

HP stock weathers boardroom storm Investors say company's fundamentals outweigh boardroom drama. NEW YORK (CNNMoney.com) -- The Hewlett-Packard snafu has its board under fire, but the stock has barely budged as the drama has unfolded at the iconic computer company. Shares of HP (Charts) slipped about 1 percent this week, in line with the Nasdaq's decline for the week.

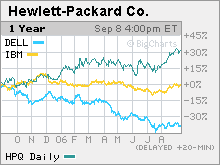

The discovery that HP obtained phone records of its board members and journalists during the course of an internal probe into company leaks is disappointing and unfortunate, shareholders said. But they expressed confidence in the stock, saying they expect it to hold steady -- for now at least. HP hired investigators to find the source of leaks about internal board deliberations to the news media, the company disclosed in a filing with the Securities and Exchange Commission Wednesday. During that investigation, phone records of board members and journalists were obtained through a practice called "pretexting," when someone impersonates someone else to obtain personal information, like phone records. California Attorney General Bill Lockyer is investigating the tactics HP used during the investigation. Pretexting is illegal in California. "It's not the sort of action you would expect from a high-quality firm like HP, which has such a distinguished history," said Gene Sit, chief investment officer of the Sit Science & Technology Growth Fund, which owns shares of HP. But in the end, it's the company's fundamentals that are going to impact the valuation of the stock price, he said. Spying on other board members is highly unethical, said Craig Hester, chief executive officer of Hester Capital Management, which owns about 588,000 shares of HP. But he said he's confident in management and the way the company has been performing and hasn't changed his position or holdings. Long considered a company that couldn't do anything right on Wall Street, HP has mounted an impressive turnaround under the helm of new chief executive Mark Hurd, who joined the company last April. Analysts surveyed by Thomson First Call expect the company's earnings to grow 15 percent and revenue to climb 17 percent in fiscal 2007. "Hurd's done a fantastic job turning around HP and finding value in the franchise," said Mark Demos, an analyst at Fifth Third Asset Management, which owns shares of HP. Shares of the PC maker have rallied 33 percent in the past year, far outperforming rivals Dell (Charts) and IBM (Charts). The fallout of the leak probe could put the brakes on the company's momentum, Demos said, especially if the investigation into the company escalates. Investors said they're watching events closely. The drama could take a turn this weekend, when HP's board meets on Sunday. Chairman Patricia Dunn, who has come under fire in the wake of recent events, doesn't plan to resign but would if the board asked her to, HP has said. |

Sponsors

|