|

Bristol CEO Dolan gets fired Company says it heeded request of a federal monitor. NEW YORK (CNNMoney.com) -- Bristol-Myers CEO Peter Dolan was forced from his job by the board of directors on Tuesday, becoming the third top executive in the drug industry to get pushed out since last year. Bristol-Myers Squibb (up $0.03 to $24.69, Charts) board members appointed James Cornelius, a director of the company since January 2005, as interim CEO. Cornelius also held the job of interim CEO at the biotech Guidant Corp. (up $0.57 to $80.10, Charts) from September 2004 through April 2006, and has served as an executive with Eli Lilly & Co. (up $0.21 to $57.70, Charts)

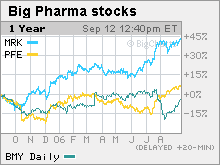

James Robinson, chairman of the board, said during a teleconference with reporters that Dolan had made an "involuntary departure" from the company, but would continue to serve as an adviser, as Bristol makes the transition to new leadership. Robinson said that Dolan "fully understands and concurs that the change in the CEO is in the best interests of the company." Robinson said the details of Dolan's severance package had not been determined. Bristol board members also dismissed the general counsel and senior vice president Richard Willard. Sandra Leung, vice president and corporate secretary, was appointed as interim general counsel. Despite the shake-up, Bristol reported that it maintained a quarterly dividend of 28 cents per share, and expected a dividend of $1.12 per share for the full year of 2007. Bristol shares rose 5 percent in early NYSE trading. Bristol's board heeded the request of a federal monitor, former federal judge Frederick Lacey, who urged the dismissal of Dolan and Willard, according to a statement released by the board. "When the court-appointed monitor says you should go, you probably ought to go," said Les Funtleyder, analyst for Miller Tabak. Lacey's request to terminate the executives was related to a federal investigation into Bristol's attempt to block Apotex, a privately held Canadian drug maker, from producing generic versions of its top-selling drug Plavix, a blood thinner that totaled $3.8 billion in 2005 sales. Bristol has come under federal investigation for its $40 million offer, made with Plavix partner Sanofi-Aventis (down $0.34 to $43.92, Charts), to get Apotex to hold off on generic production for about five years. Apotex started producing a generic version of the drug, even though the Plavix patent runs until 2012. A federal judge granted a preliminary injunction on Aug. 31 supporting Bristol's bid to block generic production of Plavix, at least until the issue goes to court on Jan. 22. But Apotex, which received FDA approval to produce generic Plavix but did not receive legal clearance, had already flooded the market with its cheaper version of the blood thinner. As a result, Bristol announced during the Labor Day weekend that it had lowered earnings projections to 95 cents a share in 2006 from a range of $1.15 to $1.25. The interim CEO Cornelius said, during the teleconference, that the "temporary aberration" created by the launch of generic Plavix had failed to shake the company's dividend, and that Bristol's "financial strength is outstanding." The Apotex debacle is only Dolan's latest - and last - misstep. Bristol managed to elevate its sales during 2001, the year Dolan took the top job, through "channel stuffing," or persuading wholesalers to pack their inventories. But this backfired when sales plunged the following year because wholesalers didn't need any product. Also, months after Dolan became CEO, Bristol bought the New York biotech ImClone for $1.2 billion, with the expectation that the cancer drug Erbitux would be soon be approved for the market, but it was held up by the FDA. Soon afterwards, the company's CEO Sam Waksal became the subject of an insider trading scandal involving domestic diva Martha Stewart. Dolan, CEO since May 1, 2001, is the third top exec in the drug industry to get pushed out since the beginning of last year. Pfizer (down $0.13 to $27.30, Charts) CEO Jeffrey Kindler took the top job this past July 28, replacing Henry "Hank" McKinnell. Richard Clark became CEO of Merck (up $0.07 to $46.14, Charts), replacing Ray Gilmartin in May 2005. Miller Tabak's Funtleyder said that Cornelius, the interim CEO for Bristol, is not as well as known as the executives who now lead Merck and Pfizer, and that Bristol should take its time in selecting a long-term leader. "I don't see this succession process is as far along with Bristol as it was with Merck or Pfizer," said Funtleyder. "This is a bit more sudden, so the board is going to have to play catch up on what they want, or who they want, with this new role. There are some big fundamental issues to be addressed for whoever takes over, so they've got their work cut out for them." Dolan was the worst-performing Big Pharma CEO in terms of stock price. Bristol's price per share plunged 56 percent since he took the top job, compared to a gain of 4 percent in the S&P 500 during the same period. For Sale Sign, or New CEO? Chris Schott, analyst for Bank of America, wrote in a note published this morning that Cornelius, during his tenure as interim CEO for Guidant, had overseen that company's sale to Boston Scientific. According to Schott, this could feed market speculation that Bristol might get taken over by a larger company. "We believe, given Cornelius' background, that the market will continue to raise the possibility of Bristol as a takeover candidate," wrote Schott. David Moskowitz, analyst for Friedman, Billings, Ramsey, said that Bristol is undervalued, considering its robust pipeline and two potential blockbusters: the leukemia drug Sprycel and the rheumatoid arthritis treatment Orencia. Moskowitz said that Bristol is worth $30 to $35 per share and could fetch a good price from potential buyers like the drugmakers Pfizer, Sanofi-Aventis and Astrazeneca. But for the same reasons, the company could attract a new, high-quality CEO and opt not to sell itself, said Moskowitz. "[Bristol] will have no trouble attracting a good CEO because of the prospects going ahead," said Moskowitz. "The bad news is already in the stock, and anything that's happened in the past will likely not be associated with the new CEO. There's a number of executives out there who would love to have this position." The analysts quoted in this story do not own stock in Bristol, but Bank of America has conducted investment banking services for the company, and FBR might have done business with them. |

|