|

Smartphones: Not ready for prime time - yet Consumers may be a difficult market for smartphone makers to crack, analysts say. NEW YORK (CNNMoney.com) -- Smartphone makers are aiming to extend their reach beyond corporate walls, but consumers may not heed the call. Phones that support email and other applications have been booming. Some 123 million units are forecast to be shipped worldwide this year, giving smartphones almost a 15 percent share of the mobile phone market, according to tech research firm ABI Research.

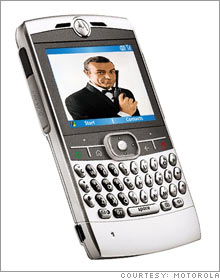

Smartphones offer it all - users can access e-mail, open attachments, work on spreadsheets and organize their calendars with a single device. It's no wonder then they've won popularity among business professionals, but now handset manufacturers have consumers on their mind, who may be more difficult to win over, analysts said. "We're absolutely seeing more fairly sophisticated devices that were once only tools for executives going mainstream with consumer features as well as consumer marketing," said Michael Gartenberg, an analyst at Jupiter Research. Many of the latest smartphones to be launched emphasize features important to consumers, such as camera phones, MP3 players and instant messaging, he said. Part of the reason consumers may be hesitant to pick up multimedia devices: cost. Most people aren't ready to fork over the usual $300 to $500 for a smartphone, plus take on the additional cost of a monthly plan, said Neil Strother, research director for mobile devices at market research firm NPD Group. More lower-cost alternatives are hitting the market - Nokia (Charts) said its recently unveiled E62, which will be available from Cingular next week, will sell for as low as $150. The Motorola (Charts) Q and Research in Motion's (Charts) recently launched BlackBerry Pearl also offer models in the $200 range. But the productivity applications on these devices are primarily a business benefit, Bill Hughes, a principal analyst with research firm In-Stat, said. "Targeting consumer applications for a business device is a mistake," he said. The devices also have a tough image to overcome. Smartphones have been aimed at corporate users and they've been marketed as a way to get more organized and improve productivity. "That just might not be as fun and sexy as watching videos or listening to music," NPD's Strother said. But handset makers are making an effort to make their devices more consumer-friendly. The BlackBerry Pearl, which debuted earlier this month, comes with a digital camera, MP3 player and compact design. As more functionality is packed into these phones, more individuals will buy them, Gartenberg said. "Look for prices to drop, features to increase and more sleek forms to emerge," he added. And while there are people who want to play on their phone and those who want to work on their phone, eventually there's going to be a blending of the two, said Kathleen Maher, senior analyst at market research firm Jon Peddie Research. It's too early to tell whether smartphone manufacturers are gaining any traction among consumers, but the upcoming holiday season could help turn the tide. "There hasn't been a huge uptake so far, but the Christmas season could change that. We'll have to wait and see," Strother said. |

Sponsors

|