|

Yahoo sees weakness, stock tumbles Online media giant's CFO cites softness in auto and financial advertising; Google shares also hit. NEW YORK (CNNMoney.com) -- The online advertising market has been red hot this year but the chief financial officer of search leader Yahoo! said Tuesday that demand was weakening a bit as the economy shows signs of slowing. Sue Decker, Yahoo's CFO, said that due to some softness in online advertising, she expected Yahoo (down $3.25 to $25.75, Charts) would report third-quarter sales that are in the lower end of the guidance that the company gave investors in July.

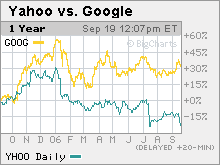

Yahoo said back then that it expected third-quarter revenue, excluding sales it shares with advertising affiliates, to be from $1.115 billion to $1.225 billion. Wall Street was expecting sales of $1.18 billion excluding the shared revenue. Yahoo is due to report third-quarter results next month. Decker said that softness in auto and financial advertising was having an effect and that it was uncertain if this was just a one-quarter phenomenon or part of a broader trend. Shares of Yahoo tumbled about 11 percent on the news, and shares of rival Google (down $10.88 to $403.81, Charts) slid about 4 percent, both in active trading on Nasdaq. Decker made the comments at a Goldman Sachs conference in New York. Auto makers GM (down $0.08 to $31.40, Charts) and Ford (down $0.16 to $7.66, Charts) are big online advertisers and both companies have had high-profile struggles lately. A slowdown in the housing market could also be having an effect on advertising demand from mortgage lenders. Still, some investors at the conference said they were surprised by Decker's comments. "The weakness that Yahoo's seeing may be specific to Yahoo and is not indicative of an overall slowdown in online advertising," one said. Walt Disney (up $0.41 to $30.47, Charts) CEO Bob Iger, asked about Decker's comments at the conference, said he did not see any sluggishness in advertising from the auto or financial services industries. And Tim Boyd, an analyst with Caris & Co., said that it sounded like the weakness Yahoo talked about was due more to slowing demand for so-called display advertising or branded advertising - sales of banners, video ads and other types of Internet ads that are not tied to keyword searches. Google does not have a big presence in the display ad market. Most of its revenue comes from paid search. So Boyd said Google investors may be overreacting to the Yahoo news. "Weakness in display advertising would have no implication for Google," Boyd said. But another analyst said investors in other Internet stocks should not dismiss Yahoo's warning. Martin Pyykkonen, an analyst with Global Crown Capital, said Google would be less affected by the weakness that Yahoo talked about, but that there could be some impact. "It's not a case of Yahoo's got a problem and Google's fine. It's not that black and white," he said. Pyykkonen said it's too soon to tell if a weakening economy could cause a broader pullback in online advertising. But if that does happen, he argues that Google and Yahoo would be affected equally since the smaller and mid-sized businesses that make up the bulk of Google's customers would probably reduce their ad budgets. Still, Yahoo clearly has more to worry about than Google right now. Yahoo is in the process of updating its online advertising platform. The new technology, code named Project Panama, was originally supposed to be rolled out during the third quarter but Yahoo announced in July that it would need to push the launch to the fourth quarter. Some investors feared that the delay could give rival Google a chance to increase its lead over Yahoo in search advertising. To that end, reports from Internet traffic tracking firms comScore Networks and Nielsen//NetRatings released on Tuesday both showed that the gap between Google and Yahoo widened in August. ---------------------------------------------------- Murdoch unveils MySpace ambitions Time Warner confident to be online media giant Analysts quoted in this story do not own shares of the companies mentioned and their firm has no investment banking ties to the companies. |

Sponsors

|