|

Falling mortgage rates can do only so much Lower rates will help buyers stretch -- but there are other forces pushing down real estate prices. NEW YORK (CNNMoney.com) -- Low mortgage rates were a big factor driving the housing boom of the past few years and their climb was expected to play a big role in the market's undoing. But now rates are sliding again - is it time to breathe a sigh of relief?

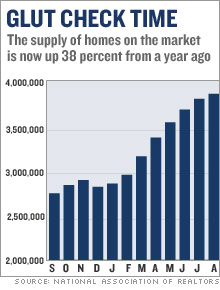

The slowing process has already begun: Not only are inventories up and sales down, but, for the first time in more than 10 years, average home prices have actually gone down over a 12-month period. Rates have dropped from July highs of about 6.79 percent for a 30-year fixed mortgage to 6.40 percent last week, according to Freddie Mac. That, however, is still higher than a year ago, when they were 5.8 percent. Since mid-2001, the average 30-year, fixed-rate mortgage has rarely exceeded 7 percent. Rates bottomed out at 5.2 percent in June 2003. Rates have a direct impact on monthly payments - the lower the rate, the lower the payment - and therefore on how much home a buyer can afford. Ellen Bitton, founder of the Park Avenue Mortgage Group, says today's lower fixed-rate mortgages have the potential to lift the market, because markets often run on emotion. "[Lower rates] make people more optimistic," says Bitton. "The markets may not go all gangbusters again, but overall, they're good for the business." Joel Rassman, the chief financial officer for homebuilder Toll Brothers (TOL (Charts)), agrees the lower interest rates have a "positive effect on the psychology of buyers." And, he points out, there is significant pent-up demand for housing that low interest rates could help free up. The impact on falling rates, however, will depend on the market. Dianne Saatchi, vice president with the Corcoran Group, a New York based real estate broker, thinks declining rates will have little impact on her buyers. "The mortgage rates never got very high. They're still, looking at the last 30 years, outrageously low." Allen Hardester, a senior executive with a Maryland-based lender, Hyland Financial Services, says most of the demand for homes is in the affordable price range - $200,000 to $300,000 - and that's where lower interest rates will help. Many buyers are stretching the limits of their budgets. Lower interest will make those limits a bit more elastic. But in Hardester's opinion, even if rates do drop further, it may not be enough to offset another factor that was a feature of the boom - the decline speculative investing. NAR reported that 40 percent of all home sales in 2005 were purchased primarily for investment (28 percent) or for second homes (12 percent). Many of those speculators have stopped buying. Some have even put their properties on sale, helping to fuel the inventory glut (see table). There were 3.9 million homes on the market in August, up 38 percent from a year earlier.That will work against sellers trying to keep prices from falling further. In addition, interest on adjustable rate mortgages, which added lots of fuel to some of the nation's hottest housing regions, have not returned to the very low levels they hit in 2003, when a one-year ARM could be had for 3.40 percent, or less. That's more than 2 percentage points below where they are now. Neil Garfinkel, a real estate and banking law attorney with Abrams Garfinkel Margolis Bergson, LLP, says the current mortgage rates are merely keeping a tough real estate market from getting worse. "I think that if anything has saved the market, it's the low interest rates. Consumers have been gun shy. They hear about bubbles and what disaster is going to happen. If interest rates had shot through the roof it would have been a big problem."

|

|