Rebalance your 401(K) A good asset allocation will protect you from market ups and downs, but you still need to keep tabs on that nest egg.

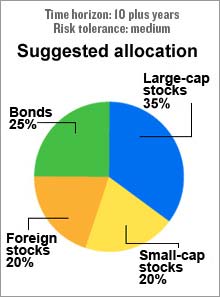

(Fortune Magazine) -- The "set it and forget it" nature of 401(k)s makes automatic saving easy. Once a year, though, check to make sure that your allocation percentages remain consistent with your overall plan. The market makes it necessary: Some assets or investments will grow faster than others - energy stocks have soared in recent years, for example - changing the composition of your portfolio. "A good rule of thumb is to rebalance if certain asset classes get more than 10 to 15 percent out of whack," says Bonnie A. Hughes, a financial planner from Kennesaw, Ga.

Rebalancing can also improve your returns - and reduce your risk - by forcing you to cut back on hot-performing assets, which have a way of falling as abruptly as they rose. But avoid the temptation to make wholesale changes based on your view of the market environment. "You're just chasing performance at that point," says Hughes. Stick to your asset allocation targets. If you aren't happy with them, discuss your goals and risk tolerance with your advisor. Next steps: 3. Sock it away 4. Give smarter 6. Clean up your taxable account 7. Do a property insurance checkup 8. Check the new credits and taxes Previous steps: 1. Rebalance your 401(k) _______________________________ Help reach your goals with the retirement planner. Figure out how to invest your retirement money with the asset allocator. Check in once a year. Surprise: Your 401(k) is one place where you don't want to do much work. Tinker too much and you could end up doing more harm than good. |

| |||||||||||