|

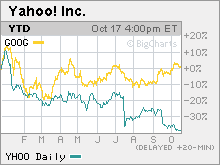

Yahoo: profit down but new search up Online media firm reports sales that miss targets and cuts revenue guidance. But stock climbs after CEO discloses vital new technology is now running. NEW YORK (CNNMoney.com) -- Online media company Yahoo!, which is struggling to keep pace with top rival Google, reported third quarter sales Tuesday that were lower than expected, earnings that matched analysts' forecasts, and a current quarter outlook less robust than previously forecast. But the company also had some good news. Yahoo's chief executive officer said during a conference call with analysts that its long-awaited new search technology was now live. Shares of Yahoo (Charts) seesawed in after-hours trading Tuesday. The stock initially traded higher after the earnings were released but quickly lost ground and at one point were down as much as 4 percent. The stock recovered from these losses though and moved as much as 5 percent higher after Yahoo CEO Terry Semel made the comments about its new search platform for advertisers. Yahoo fell slightly in regular trading on the Nasdaq after the stock was downgraded to a "neutral" by Cowen & Co. The Sunnyvale, Calif.-based Yahoo reported revenue, excluding sales it shares with affiliates, of $1.12 billion, up 20 percent from a year ago, but below Wall Street's consensus estimates of $1.14 billion. The company also said it expects sales for the fourth quarter, excluding shared revenue with partners, to come in between $1.145 billion and $1.265 billion. Analysts had been expecting revenue of $1.3 billion. Tim Boyd, an analyst with Caris & Co., said after Yahoo reported its results that analysts would most likely need to reduce their sales and earnings target for the fourth quarter and for all of 2007 as a result of the lowered guidance. Yahoo posted a net profit of $159 million, or 11 cents a share, in line with consensus estimates. Yahoo reported a profit of $254 million, or 17 cents a share, a year earlier. The company warned in September that sales would be at the lower end of its financial forecasts due to weakened online ad spending by auto manufacturers and financial services firms. "I am not satisfied with our current financial performance and we intend to improve it," said Yahoo chief executive officer Terry Semel during a conference call with analysts. "We are not exploiting our considerable strengths as well as we should be and we are committed to doing better." It also has been hurt by concerns about the delayed launch of its new search platform, codenamed Project Panama, a technology that Yahoo hopes will make its searches more relevant to advertisers as it seeks to regain market share it has lost to Google. Yahoo was supposed to unveil Panama in the third quarter but told analysts in July that it would come out during the fourth quarter instead. But during the conference call, Semel said that Panama was now live and that the company was in the process of shifting advertisers to it over the next few months. Boyd said that it was crucial for Yahoo to not postpone the rollout of this new search technology any further or else many investors would have given up hope on the company. Yahoo's stock has plunged nearly 40 percent this year, making it the second worst performing stock in the S&P 500. Investors and advertisers have flocked to Google (Charts), which will report its latest results Thursday and made waves last week when it announced it would buy online video juggernaut YouTube for $1.65 billion. Yahoo also is facing a tougher challenge from the likes of Microsoft's (Charts) MSN, IAC/InterActive's (Charts) Ask.com and MySpace, the popular social networking site owned by media giant News Corp (Charts). Semel said during the call, however, that Yahoo was not getting enough credit for its own social networking and video offerings, which include the Flickr photo-sharing site, Yahoo Video, bookmark-sharing site del.icio.us as well as its Yahoo Answers, which lets users respond to other users' questions. "Clearly some new players have emerged in this area that has attracted a lot of attention. But we a far bigger player in this space than many people realize," Semel said. And Yahoo did make two moves Tuesday that could improve its standing in the online ad race. The company acquired AdInterax, a privately held company that has tools which can be used to create video ads. Yahoo also said it would buy a 20 percent stake in Right Media, a company that runs an exchange which allows companies to buy and sell online ads. But one analyst said Yahoo still faces an uphill challenge, pointing out that while Yahoo lowered guidance Tuesday, Google's third -quarter results will probably be so strong that analysts will need to boost their financial targets for that company. In other words, the weakness in online advertising that Yahoo has discussed is not something that Google or other competitors have to worry about. "I don't think the lower guidance indicates anything specific about Google. This is Yahoo-specific," said Clayton Moran, an analyst with Stanford Group. Analysts quoted in this story do not own shares of the companies mentioned and their firms have no investment banking ties with the companies. |

Sponsors

|