|

Google: Next stop $500? No. 1 search engine reports earnings, sales that beat forecasts; stock surges as analysts raise price targets. NEW YORK (CNNMoney,com) -- Google reported third-quarter sales and earnings Thursday that beat analysts' estimates as the company continues to benefit from robust demand for online advertising. Shares of Google (Charts) shot up about 7 percent early Friday after the No. 1 search engine reported results after the market closed Thursday.

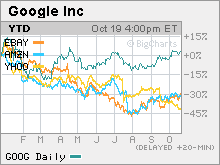

Several Wall Street brokerages upped their price targets for the stock to well over $500 Friday morning. Citigroup boosted its price target to $600. Google's stock soared near $457 early Friday, not far from its all time high. Mountain View, Calif.-based Google reported sales of $2.69 billion, up 70 percent from a year earlier. Excluding advertising revenue that the company shares with partners, Google's sales were $1.87 billion, ahead of Wall Street's forecast of $1.81 billion in sales on this basis. The company reported net income of $733 million, or $2.36 a share, up 92 percent from the same period last year. Google posted a profit, not including certain gains and charges, of $2.62 a share. That exceeded consensus estimates of $2.42 a share. Google has surpassed Wall Street's earnings expectations seven out of eight quarters since going public and has typically done so by a wide margin. Google's solid earnings were the latest bit of good news for the company. Last week, it announced it was buying privately held YouTube for $1.65 billion, a deal that analysts think should give Google a big lead in the burgeoning online video market over Yahoo!, Microsoft's (Charts) MSN and MySpace, the social networking site owned by News Corp (Charts). Google's stock is up about 3 percent this year, making it one of the few large Internet stocks in positive territory. Shares of top rival Yahoo (Charts), which reported earnings that were in line with expectations Tuesday but missed sales targets and lowered its sales outlook for the fourth quarter, have plunged 42 percent this year. Online auction company eBay (Charts), which reported better than anticipated third-quarter results Wednesday, has seen its stock fall 30 percent this year, while shares of online retailer Amazon.com (Charts), which will report its results next week, have also dropped about 30 percent. Google gaining momentum But Google is continuing to gain market share in search at the expense of Yahoo and others, and Wall Street has clearly taken notice. Web traffic research firm Nielsen//NetRatings reported Thursday that Google accounted for half of all searches in September and that the number of searches at Google increased 24 percent from a year ago. Yahoo's search volume rose just 12 percent, by way of comparison, and the company's market share came in at 23.4 percent. Meanwhile, the number of searches at Microsoft's MSN fell 12 percent from the same period last year, leaving MSN with a market share of just 9.2 percent. But some analysts think Yahoo could become a tougher competitor to Google now that Yahoo has finally launched its long-awaited new search technology for advertisers, code-named Project Panama. "Panama is Yahoo catching up to where they should be with Google. And one thing I would say is that advertisers who work with search will work with other search firms," said Emily Riley, advertising analyst with Jupiter Research. Still, Google's strong financials are particularly encouraging since the third quarter tends to be among the slowest for Internet companies, as it takes place during the summer months in the Northern Hemisphere. "Our third quarter results are a testament to the strength of our network of advertisers and partners, as well as our continuing focus on users," said Google chief executive officer Eric Schmidt in a statement. "We were particularly pleased with the contributions of our international business in a seasonally weaker quarter." To that end, Google reported that revenue from outside the United States accounted for 44 percent of Google's total sales in the quarter. Google said that it was seeing strong growth across the globe, but it did not mention China, a market that it has had a tougher time cracking. Eventually, that will have to change. "Longer-term, investors will want to see China pan out for Google so it's important that they make some foothold in that country," said John Aiken, head of equity research with Majestic Research. Google does not give specific sales or earnings guidance. But during a conference call with analysts, Google chief financial officer George Reyes said that the company expected domestic growth to be stronger than international growth in the fourth quarter thanks to increased Internet traffic in the United States in advance of the holidays. One analyst said he was pleased to see Google not only exceed Wall Street's sales expectations but also keep costs relatively low as well so that earnings could outrun forecasts as well. "The results are phenomenal," said Scott Devitt, an analyst with Stifel Nicolaus & Co. "There were some nerves heading into the quarter that revenues would just be in-line so the fact that they beat revenue estimates, controlled expenses and beat earnings is a major positive." Google has been criticized by some for spending too aggressively on new projects and services. And some analysts have suggested that Google has limited success with offerings beyond search. During the call, Google co-founder Sergey Brin conceded that Google is launching so many new products that it sometimes is difficult to find them. But he said the company is working on ways to both improve these new services and make them easier to locate on Google. Brin added that Google's new Google Checkout online payment product, which is viewed as a competitor to eBay's PayPal, is gaining more acceptance among customers. Google executives also raved about the company's prospects in online video advertising thanks to YouTube. But Jupiter's Riley said she does not think traditional media companies need to fear Google because of the YouTube deal. She said it sounded like Google is more interested in using YouTube to increase its presence in video search and that Google would rather partner with, instead of compete against, media firms. If anything, Riley thinks that Microsoft has the most to fear. "If there's any large company that they sound like they are going up against, it's Microsoft. Google mentioned their spreadsheet and business oriented tools more than anything but YouTube," she said. However, another analyst suggested that Google still needs to do a better job of branching out its business beyond advertising. "In spite of Google's growth and powerful position in the ad search market, the company has yet to diversify its revenue base into annuity-driven online services based on keeping users at the Google site," wrote Bill Lesieur, director with industry advisory firm Technology Business Research, in a report after Google's results were released Thursday afternoon. And Citigroup's Mark Mahaney asked during the call whether or not it would make more sense for Google to use cash, instead of stock as it did for YouTube, in future deals. Issuing more shares can often have a negative impact on earnings. Google ended the quarter with $10.4 billion in cash, and Reyes said that it will, in fact, use this for any other acquisitions the companies decides to make. "This is a one-off," Reyes said of the YouTube deal. "Going forward, we will use cash for deals."

Analysts quoted in this story do not own shares of the companies mentioned. Citigroup does have an investment banking relationship with Google. |

Sponsors

|