|

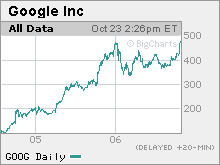

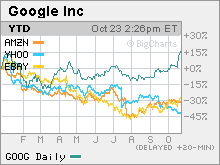

Google stock closes at new all-time high Shares of No. 1 search engine crack $480 thanks to optimism about earnings and YouTube deal. NEW YORK (CNNMoney.com) -- Google stock closed at a record high Monday as investors kept cheering the company's strong third-quarter earnings and its recent $1.65 billion deal to buy online video kingpin YouTube. Google stock gained 4.6 percent Monday to close at $480 78 in active trading on the Nasdaq. The stock hit a trading high of $484.64 earlier in the session. Google's previous all-time high was $475.11, hit in January. Google (Charts) reported third-quarter sales and earnings last week that soundly beat Wall Street's expectations. It marked the seventh time in eight quarters since Google went public in August 2004 that the company surpassed analysts' consensus estimates. Following the earnings report, several analysts boosted their price target on Google to well above $500 a share, and one even raised his target to $600. The company also announced earlier this month that it was buying YouTube, a deal that analysts said should give the company an edge over rivals like Yahoo!, Microsoft's (Charts) MSN and News Corp.'s (Charts) MySpace in the burgeoning world of online video advertising. Shares of Google are now up 15 percent this year, making it one of the only large Internet stocks to be in positive territory in 2006. Shares of top rival Yahoo! (Charts) have plunged more than 40 percent this year, while shares of online commerce companies eBay (Charts) and Amazon.com (Charts) have each slid about 30 percent. Google's stock is now up more than 465 percent since it went public. But several analysts said that despite Google's big move, there still may be more room to run. "This is a stock you should stick with. Google is working because of the earnings performance. Their numbers are mind boggling compared to what everyone else is putting up," said Steve Weinstein, an analyst with Pacific Crest Securities. Google has benefited from strong demand for online advertising, particularly ads tied to keyword searches. And last week, Web traffic firm Nielsen//NetRatings reported that Google widened its lead in search over Yahoo and MSN and controlled a 50 percent share of the market. "In search, there are really only three players. Google is doing everything right. Microsoft is doing everything wrong and Yahoo is stumbling somewhere in between," said Sasa Zorovic, an analyst with Oppenheimer & Co., who has a $540 target on Google. Last week, Yahoo reported third-quarter earnings that were in line with expectations but lowered its fourth-quarter sales guidance. However, some analysts were relieved that Yahoo finally unveiled its long-awaited new search technology for advertisers, code-named Project Panama. And Martin Pyykkonen, an analyst with Global Crown Capital, said he has a $550 target on Google, and that's based on a multiple of about 40 times 2007 earnings estimates, which he raised last week after Google reported its third-quarter results. This valuation, while not cheap, may be reasonable considering that Google is expected to report an earnings increase of about 35 percent in 2007. Pyykkonen added that the YouTube deal should give Google a boost in the nascent world of online video advertising. He argues that many companies, particularly those in the travel, auto and entertainment industries, would be willing to pay a premium price for online video ads since they could be more effective than text-based ads.

Analysts quoted in this story do not own shares of Google and their firms have no investment banking relationships with the companies. |

Sponsors

|