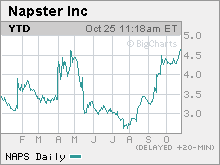

Napster wants to be a sellout The online music service, once an industry renegade, is now looking for a deep-pocketed parent. Here's who might be interested in buying Napster. NEW YORK (CNNMoney.com) -- Napster, once synonymous with illegal file sharing, is now legit: a public company that plays nice with the music industry and is experiencing healthy revenue growth as a result. In fact, Napster Inc. (up $0.26 to $4.71, Charts) is one of the few Internet stocks having a good year - the stock's up more than 25 percent in 2006. But even though it is Wall Street's equivalent of a Billboard number-one hit, Napster does not have strong financials. The company, despite strong sales growth, is expected to post a loss of 27 cents a share when it reports its fiscal second-quarter results on November 8. For the full year, which ends in March 2007, Wall Street is forecasting a loss of $1.03 a share. And Napster's profit picture isn't expected to get much better anytime soon: analysts project a loss of 83 cents a share in fiscal 2008. So why are investors flocking to Napster like college kids circa 1999 looking for free Metallica downloads? The hope is that Napster could be the next YouTube, which cashed in earlier this month by agreeing to sell out to Google (Charts) for $1.65 billion. Digital media, music and video, is ... to quote the New York Dolls' David Johansen's alter ego Buster Poindexter ... hot, hot, hot. With that in mind, Napster announced in September that it hired investment bank UBS to evaluate "strategic alternatives," including the possibility of a sale. If Napster does sell out, this actually would be the second time the company was acquired in the past few years. Software firm Roxio bought it in 2002. In 2004, Roxio decided to sell its software business and changed its name to Napster. But will the company get taken over again? There are some questions about whether or not Napster, which sells music mainly through monthly subscriptions, will ever be able to compete effectively with the likes of Apple's (Charts) ubiquitous iTunes. In addition, Microsoft (Charts) is scheduled to unveil its Zune digital music device next month. That could be a technological lockout since Zune is not expected to work with songs downloaded from Napster. A spokesperson for Napster was not immediately available for comment about the status of takeover discussions. Still, many Wall Street analysts think a Napster deal is likely and could be announced by the end of the year. The logic is that since Napster still is one of the most recognized names on the Internet, it could benefit from having a deeper-pocketed parent. "There are a lot of companies that could acquire Napster, and if you add the Napster value with broader reach, it could be a different story for the company," said Darren Aftahi, an analyst with ThinkEquity Partners. Google, Amazon, RealNetworks seen as bidders So let the speculation begin. Since September, rumors have swirled that Google could be interested in making a play for Napster. And considering that Napster's market value is just about $200 million and that Google has $10 billion in cash, Napster wouldn't be a difficult deal to manage, even with YouTube. There has also been chatter that online retailer Amazon.com (Charts), Barry Diller's Web conglomerate IAC/InterActive or RealNetworks (Charts), which runs rival music service Rhapsody, could be interested. Mark Harding, an analyst with Maxim Group, thinks that Amazon or RealNetworks make the most sense as acquirers since they already are in the business of selling music and have worked with record labels. "If the company were to be acquired by RealNetworks or Amazon, it would be complementary," he said. But other analysts think Napster could be bought by a company that doesn't already have a major presence in digital music distribution. And since Napster already has services up and running in not just the United States but lucrative markets in Europe and Asia as well, that makes Napster even more attractive, said Kaufman Brothers analyst Barbara Coffey. "This becomes a build-versus-buy question for someone. The ability to have the U.S., U.K., Germany and Japan buttoned up is key. If you want to get into music and want it done right away, why not buy Napster?" she said. Along those lines, some have mentioned hardware company SanDisk, the flash memory chip maker that also sells the Sansa line of MP3 music players, as a possible suitor as well. Owning Napster could give SanDisk its own music store, similar to what Apple has with iTunes for its iPod. And Aftahi said that other hardware companies, such as cell phone manufacturers and even wireless carriers, can't be ruled out either. After all, Nokia agreed to buy digital music provider Loudeye this year. The deal closed this month. "Napster is moving beyond the standard MP3 market and is partnering with carriers who don't have the capability or prowess in music. Theoretically, Napster could work on any handset," he said. What's Napster worth? So Napster could be faced with a bevy of interested parties. The big question for investors though is how much any of these companies would be willing to pay. Coffey said she would not be surprised to see Napster sell for at least $5 a share, which is more than a 10 percent premium to its current price. Harding said he thinks a fair price for Napster in a takeover is $6 a share. And Aftahi indicated that the price could go as high as $7. So if Napster does wind up agreeing to a sale, investors are likely to be rewarded handsomely. But any time investors are banking solely on a takeover, there are huge risks. What if Napster doesn't get the price it wants and walks away from a deal? Given that Napster is expected not to turn a profit this year or next if it remains independent, the stock could tank if a takeover falls apart. To that end, Harding said that if Napster doesn't sell out, it's probably worth little more than the cash it has on its balance sheet. And that would value Napster at just $2.18 a share. Analysts quoted in this story do not own shares of Napster. Maxim Group does expect to receive investment banking compensation from the company. |

| |||||||||