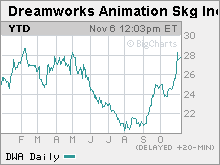

Green ogre = greenbacks for DreamWorksAlthough 'Flushed Away' lost at the box office to 'Borat' and 'The Santa Clause,' the animator is looking ahead to 'Shrek the Third.'NEW YORK (CNNMoney.com) -- The tale of a pair of cartoon rats and their adventures in the sewers of London wasn't enough to beat out Kris Kringle and a faux Kazakh journalist at the box office this past weekend. "Flushed Away," released by DreamWorks Animation SKG, generated $19.1 million in ticket sales. That put it in third place behind Walt Disney's (Charts) "The Santa Clause 3: The Escape Clause" and the surprise box office champ, "Borat: Cultural Learnings of America for Make Benefit of Glorious Nation of Kazakhstan," released by News Corp.'s (Charts) Fox studio. Although "Flushed Away" had a better opening weekend than last year's "Wallace and Gromit: Curse of the Were-Rabbit," a clay animation movie released by DreamWorks that was produced by the same team behind "Flushed Away," the film's returns were not nearly as strong as many other computer-generated (CG) films. DreamWorks' "Over the Hedge," for example, debuted in May with more than $38 million in ticket sales. But for DreamWorks investors, any disappointment about "Flushed Away" ticket sales may be short-lived. In fact, shares of DreamWorks (Charts) rose slightly Monday. And the company is gearing up for potentially a huge 2007 thanks to the presence of a big green ogre. In May, DreamWorks will release "Shrek the Third." The first two movies combined for more than $700 million in U.S. ticket sales, and for more than $1.4 billion worldwide. With that in mind, Wall Street is predicting that the company's sales will more than double next year, to about $710 million, and earnings will nearly triple, to $1.69 a share. But is the good news actually already baked into the stock? The stock is up 12 percent this year, with much of that gain coming in the past week. After DreamWorks reported a surprise third-quarter profit on Oct. 31, the stock surged 7 percent on the news. DreamWorks sold more copies of "Madagascar" DVDs than expected during the quarter. Revenue from "Madagascar" accounted for 43 percent of the company's total sales during the quarter. The company also got a boost from sales of domestic pay TV rights of last year's "Wallace and Gromit" film. That movie accounted for nearly a third of DreamWorks' sales. Cowen & Co. analyst Lowell Singer pointed out in a research note that the extra sales from "Wallace and Gromit" came as a surprise because most analysts did not think the company would recognize this revenue until next year. For this reason, he raised his 2006 sales and earnings estimates for the year. And the company may have more good news before the year is out. DreamWorks is expected to generate healthy sales of "Over the Hedge" DVDs during the holidays. That DVD was released in October. Still, one analyst thinks investors don't yet realize just how big next year could be for the company. "The stock price doesn't fully factor in next year's strength due to "Shrek." Based on some of the trailers I've seen, it looks great and word of mouth will help the movie," said Marla Backer, an analyst with Soleil - Research Associates. Although next summer's movie slate is packed with several big sequels, including Sony's (Charts) "Spider-Man 3," the third "Pirates of the Caribbean" film from Disney and the fifth movie in Warner Bros.' "Harry Potter" franchise, Backer thinks that "Shrek" will more than hold its own against the competition. (Warner Bros. is owned by Time Warner (Charts), which is also the parent company of CNNMoney.com.) In fact, she thinks that the other high-profile movies could wind up eating into each other's box office returns because they all will be going after a similar audience while "Shrek" could benefit by being the surefire hit for kids. "For families with young children, the movie to go with it is 'Shrek.' The other films all skew slightly older so 'Pirates,' 'Spider-Man' and 'Harry Potter,' are more of a risk," she said. In addition, DreamWorks could also have a hit on its hand next November with "Bee Movie," a carton written by, and featuring the voice of, Jerry Seinfeld. Needless to say, Seinfeld's involvement with this movie is generating a lot of, uh, buzz. Greg Roeder, portfolio manager with the Adirondack Small Cap fund, which owns the stock, added that DreamWorks also looks like a relative bargain. Shares trade at about 16 times next year's earnings estimates. By way of comparison, when Disney bought DreamWorks' top rival Pixar in January, the deal valued Pixar at more than 50 times earnings projections for the next full year. Roeder also thinks that DreamWorks will eventually get taken over, which could also be a boost for the stock. Viacom (Charts), for example, could make sense as an acquirer since the company's Paramount studio already has a distribution agreement with DreamWorks Animation. "Eventually, DreamWorks will find a home within a major media conglomerate as Pixar did with Disney," Roeder said. Analysts quoted in this story do not own shares of DreamWorks Animation, and their firms do not have investment banking relationships with the company. The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

|