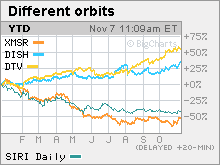

Satellite showdownShares of radio firms XM and Sirius have sunk this year, while satellite TV stocks EchoStar and DirecTV have soared. Here's why that might be about to change.NEW YORK (CNNMoney.com) -- Satellite radio stocks have had a difficult time lifting off this year, while shares of the top two satellite television firms have soared to the stratosphere. But after the latest round of earnings reports from XM Satellite Radio, Sirius Satellite Radio, EchoStar Communications and DirecTV, some think that the radio stocks may finally find themselves rising higher while the TV stocks fall from orbit. On Monday, XM reported a smaller than expected loss for the third quarter and the stock surged 15.6 percent on the news. Even with that big gain, though, shares of XM (Charts) are still down more than 50 percent year-to-date. XM's top rival, Sirius, has also had a rough year. Its stock, despite a 7 percent pop on Monday, is down 40 percent this year. Sirius (Charts) will report its third quarter results on Wednesday. The two stocks have taken a hit due to concerns that subscriber growth may not be as robust as many had originally hoped, even though the two firms both continue to sign more deals with auto manufacturers to have their radios factory-installed in new cars. Some investors have also been concerned about mounting costs at the two firms as they wage an expensive marketing battle against each other for subscribers and also sign on more high-profile personalities. Shock jock Howard Stern began airing on Sirius earlier this year, for example; his contract will cost the company $500 million over five years. Satellite TV stocks, on the other hand, have skyrocketed this year. Shares of EchoStar (Charts), which owns the DISH network, are up 30 percent in 2006. But the company reported third-quarter results Tuesday that were mixed; sales beat expectations but earnings were below consensus estimates. And shares of DirecTV (Charts), which will report its third-quarter earnings Wednesday, have shot up nearly 60 percent. So what should investors do now? Have satellite radio stocks finally bottomed? And if so, are they now more attractive than satellite TV firms? Greg Gorbatenko, an analyst with Jackson Securities who covers all four companies, thinks that the radio stocks are a better buy right now because they are just in the beginning stages of many years of solid growth. "Satellite radio is a viable business model. Every car is going to have satellite radio eventually. Think of the number of cars out there, and how more people are getting used to the service," he said. Thomas Eagan, an analyst with Oppenheimer & Co. who also follows all four stocks, added that XM's guidance -- the company said it expects to report positive cash flow from operations during the fourth quarter -- is a positive sign. Investors have been waiting for XM and Sirius to show that they will be able to generate positive cash flow on a sustainable basis. The two companies are not expected to report an actual profit for several years, though, as start-up costs and other expenses take a big bite out of earnings. One analyst thinks that investors should not be betting on both satellite radio firms, however. Banc of America Securities analyst Jonathan Jacoby wrote in a research note following XM's earnings release that Sirius may struggle to hit its year-end subscriber target, since retail demand for satellite radios may be weak during the holidays. Sirius has more exposure to the retail market than XM, which gets more subscribers than Sirius from auto manufacturers. With this in mind, Jacoby wrote that he thinks the two stocks won't continue to trade in tandem and that investors might be better off buying XM now. As for the TV firms, Gorbatenko thinks EchoStar and DirecTV will face tough challenges ahead as cable companies more aggressively market their "triple play" packages of video, high-speed Internet and phone services. And big telecoms are now starting to dip their toes in video as well. "The cable guys can deliver everything, and phone companies are starting to do that too. Satellite TV can offer only one thing: video. Satellite TV subscriber growth is going to slow," he said. And Eagan thinks that since both DirecTV and EchoStar have already enjoyed a healthy pop this year, the stocks are no longer bargains. "The satellite TV names are fairly priced," he said. In addition, some of the run-up in both stocks is due more to deal speculation as opposed to optimism about the companies' fundamentals. That's particularly the case with DirecTV, as there has been talk that the company's controlling shareholder, media giant News Corp (Charts)., is thinking of swapping its stake in DirecTV to John Malone's Liberty Media in exchange for the shares of News Corp. owned by Liberty. There has also been chatter for the past year or so that AT&T (Charts) might want to try and buy EchoStar. But not everyone agrees that satellite radio is now a better bet than satellite TV. Connor Browne, co-portfolio manager of Thornburg Value fund, said his fund sold its stake in XM in July and unloaded its Sirius holdings in September. "We are not convinced that Sirius and XM will be able to add subscribers at a fast enough rate that they can generate growth for shareholders," Browne said. The fund, however, does still own a stake in DirecTV. Browne said that even though satellite TV companies may not have a counter to cable's "triple play" services he thinks the satellite firms will still be able to attract new subscribers, thanks to their high-definition video offerings. But Browne said that his fund only owns a stake in DirecTV, and not EchoStar, because of valuation. He points out that even after DirecTV's big rise this year, its stock is still slightly cheaper than EchoStar's. Shares of DirecTV trade at 18 times earnings estimates for 2007 while EchoStar trades at 19 times profit projections for next year. The analysts quoted in this story do not own shares of the firms mentioned. Banc of America has investment banking relationships with Sirius and XM. |

Sponsors

|