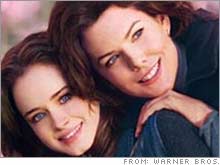

The CW: one plus one doesn't equal threeThe new youth-oriented network, created from the merger of the WB and UPN, is off to a tough start. But some still see hope for a ratings revival.NEW YORK (CNNMoney.com) -- Does the CW stand for Can't Win? The new CW television network, created from the merger of UPN and WB, has gotten off to a rough start since it launched in September. According to data from Nielsen Media Research, the CW has averaged about 3.4 million viewers overall in prime-time during the first seven weeks of the new TV season and 1.9 million in the 18-49 demographic that advertisers desire most. By way of comparison, the WB, owned by media giant Time Warner (Charts), averaged about 3.6 million viewers overall and about 2 million in the 18-49 demographic at this point a year ago. (Time Warner also owns CNNMoney.com.) And the UPN, owned by CBS (Charts), was also pulling in about 3.6 million overall and 1.9 million in the 18-49 age group. And based on figures provided by the CW, the network is off to a sluggish start in the key November "sweeps" period, with overall ratings during the first few days of November flat when compared to the WB and UPN during the same period last year. The "sweeps" months of November, February and May are important since they include the most detailed amount of ratings data and are relied on by the networks and marketers when negotiating advertising rates for the following season. Ratings among 18-49 year olds and 18-34 year olds, the market that the CW is specifically targeting, are also unchanged from a year ago so far this November. When the merger was announced in January, some television industry experts believed that the combination of these two struggling networks would create a stronger network that would be able to compete more effectively with the big four: Walt Disney's (Charts) ABC, CBS, General Electric (Charts)-owned NBC and News Corp.'s (Charts) Fox. "Out of the box, this is disappointing. Most people thought the CW would be slightly above what the UPN and WB had done on an individual basis," said Brad Adgate, senior vice president of corporate research for Horizon Media, a media buying firm. After all, the WB and UPN cherry-picked the best shows from each network to create the CW lineup. The CW launched with only two new shows. The rest were returning series from the other networks, such as the WB's "Gilmore Girls" and "Smallville" and UPN's "America's Top Model" and "Veronica Mars." "There was hope that the way the CW selected the shows, above average performers on the WB and UPN would carry over and find an audience," said Lyle Schwartz, an analyst with Mediaedge:cia, a media buying firm in New York. "But the CW skews to a younger audience that is very quick to move to and away from programs." Paul McGuire, a spokesman for the CW, admitted that it's been a challenging start. Viewers had to get used to an entirely new network. And many people used to watching their favorite UPN shows also had to deal with trying to find the show on a new channel, because in their markets the new CW is running on former WB affiliates. Several shows also switched nights. But he said it's not fair to grade the network's progress after only seven weeks. "We live in an instant gratification snapshot culture but internally we've been preaching patience," he said. McGuire said the network was pleased with the results it has seen from "America's Top Model" on Wednesdays --its ratings are actually higher than a year ago -- and that "Smallville" and "Supernatural" are holding up reasonably well on Thursdays, the night McGuire referred to as "the land of giants" since it features TV's first and third top-rated shows, ABC's "Grey's Anatomy" and CBS' "CSI: Crime Scene Investigation." Mondays and Tuesdays have been problems though. The network moved its block of comedies from Sunday nights to Monday nights and although ratings have improved since the switch, the numbers for "Everybody Hates Chris" and "Girlfriends" are lower than a year ago. On Tuesdays, it's a mixed bag. "Veronica Mars," formerly on the UPN, has enjoyed a slight bump in ratings from a year ago but "Gilmore Girls," one of the WB's signature shows, has seen a notable drop in viewers. Still, despite the network's initial ratings struggles, media buyers say that the CW remains an intriguing option for advertisers, mainly because it has such a devoted core audience of younger viewers. "The CW is the only broadcast network that consistently delivers an audience with a median age under 35 so it's not going away. There are advertisers that covet that demographic," Horizon's Adgate said. But in order for the network to become a bigger success, the CW will need to launch more new hits instead of relying only on older shows from the WB and UPN, media buyers believe. The CW has already cancelled one of this fall's new shows, "Runaway." And its other debut, "The Game" is not a completely new show since it's a spin-off of "Girlfriends." "The biggest challenge for the CW is development. They need more signature shows," said Bill Carroll, vice president and director of programming with Katz Television Group, a media buying and consulting firm. But McGuire defends the network's decision to not launch too many new shows in conjunction with the CW's debut. He argues that a new network with lots of new shows would have led to an even bigger ratings decline. "Some criticized us for not having that much new programming. But given the marketing we had to do with a brand new network and moving shows, if we had a plethora of new shows, we'd be seeing a considerable ratings contraction. We feel vindicated," he said. McGuire added that the CW already has several new shows ready for its mid-season schedule, including another installment of the Ashton Kutcher-developed "Beauty and the Geek," a reality show focusing on the pop group The Pussycat Dolls and "Hidden Palms," a teen-oriented show created by Kevin Williamson, the man responsible for "Dawson's Creek," one of the WB's biggest hits. Still, it may be tough for the CW to make significant gains in the ratings race as the season progresses. That's because Fox, which has had a poor start so far, is likely to come roaring back in January once the network brings back hit shows "24" and "American Idol." McGuire concedes that "Idol" presents a particularly tough challenge for the CW since the show airs on multiple nights and is a big hit with many of the younger viewers that the CW targets. "'American Idol' is a vaunted foe and is something to be obviously highly respected. We have to pick our spots for programming and promoting against it," said McGuire. So advertisers will be keeping a close eye on the network's progress. While the CW's target market is attractive, advertisers may be cautious, especially as the Internet, with video sites like YouTube, which Google (Charts) is in the process of buying, and social networking sites like News Corp.'s MySpace, becomes more and more popular with teens and young adults. "The CW does reach a younger part of the spectrum and that's valuable to advertisers. But the question is will the CW achieve ratings numbers that makes them both effective and efficient for advertisers," Mediaedge:cia's Schwartz said. The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

|