Bond and PlayStation 3 can't save SonyDespite a $40 million opening for 'Casino Royale' and long lines for the PS3, Wall Street is still wary of Sony's stock.NEW YORK (CNNMoney.com) -- It was a reasonably good weekend for Sony at the shopping malls and multiplexes...but Wall Street didn't see it that way. Boxes of the company's new PlayStation 3 game consoles flew off the shelves.

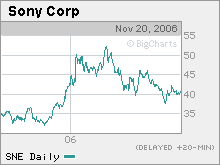

And the Sony-produced "Casino Royale," the latest in the James Bond movie franchise, grossed $40.6 million at the box office in the U.S. Yet shares of Sony (Charts) fell more than 1 percent in trading on the New York Stock Exchange Monday, extending its recent losing streak. Since Sony's stock hit a 52-week high in April, shares have slid nearly 25 percent. Despite the stock's latest struggles, it's still been a fairly strong year and a half for Sir Howard Stringer, who took over as Sony's chief executive officer in June 2005. Under Stringer, Sony's first non-Japanese CEO, Sony's stock has gained about 15 percent, largely due to hopes of higher profits fueled by cost-cutting. But investors may be starting to lose some patience with Sony as the stock continues to slide in what has been a good market environment for other electronics makers and media companies. Shares of Dutch consumer electronics company Philips Electronics (Charts) are trading near a 52-week high, as are media firms Walt Disney (Charts) and News Corp (Charts). Sony has been hit by concerns about shortages of the PS3 (only 400,000 consoles were available in the U.S. due to manufacturing problems) as well as a massive recall of batteries used in laptops from Dell (Charts), Apple (Charts) and other PC makers. Evan Wilson, an analyst with Pacific Crest Securities, said that he doesn't think this past weekend's news will help Sony all that much. Wilson argues that the main reason the PS3 sold out was simply because there weren't that many available. "The launch of the PS3 was dictated by supply, not by demand. The fact that it sold out isn't really significant news. I continue to think that overall, Sony has a difficult row to hoe," he said. To that end, Sony will face a tough challenge from another new game console that just came out, Nintendo's Wii. "The Wii is giving them stiff competition. As we go into 2007, we'll get a better picture for demand for the PS3," said Martin Kariithi, an analyst with Technology Business Research, an independent research firm based in Hampton, New Hampshire. There also have been reports of glitches which make it difficult for the PS3 to play some older games that were originally made for the PS2. And even though Sony has had a solid year at the box office - the company's movie studio currently has the market share lead in U.S. ticket sales - that might not be enough to help the company's financial results. Sony's pictures division, which produces television shows as well as movies, reported an operating loss for the first two quarters of the current fiscal year. And the business only accounts for about 11 percent of Sony's overall sales. What's more, there may be some disappointment about the widely-hyped Bond, which featured a new actor, Daniel Craig, replacing the popular Pierce Brosnan. Although "Casino Royale" had the second best opening weekend of any Bond flick, it failed to do better than the Bond movie that immediately preceded it: 2002's "Die Another Day." That movie, the last 007 film featuring Brosnan, debuted with a $47 million take and went on to gross $160.9 million in the U.S., making it the biggest Bond hit of all time at the box office, according to figures from Box Office Mojo, a movie industry research firm. In addition, "Casino Royale" actually finished second at the box office this weekend. The computer-generated animated film "Happy Feet" narrowly beat out Bond with $42.2 million in ticket sales. "Happy Feet" was released by Warner Bros., which like CNNMoney.com, is owned by Time Warner. Nonetheless, Kariithi said he expects Sony's film and television business to generate a profit during its fiscal third quarter, which ends in December, thanks to strong worldwide ticket sales for "Casino Royale" as well as solid box office returns from "Open Season," a CG animated movie that came out in late September. But even if PS3 sales pick up and the movie business continues to do well, Kariithi said Sony's fate lies with its consumer electronics business. If Sony sells a lot of LCD television sets, camcorders and digital cameras during the holidays, then that, more than big numbers from James Bond, will boost the stock.

Analysts quoted in this story do not own shares of Sony and their firms have no investment banking ties with the company. The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

|