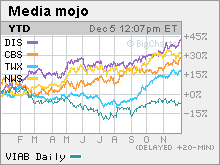

Stay tuned for some media stocksAnalysts don't expect the sector to collapse in 2007 as it did in 2005. But Wall Street cautions investors not to expect a repeat of this year's strong returns.NEW YORK (CNNMoney.com) -- Most major media stocks bounced back sharply this year after a dismal 2005. Now investors are wondering if this is just the beginning of a prolonged rally or if media companies will struggle next year.

This year, with the notable exception of Viacom (Charts), whose stock has sunk 6 percent, has been a fantastic one for shares of the big media conglomerates. Shares of CBS (Charts) have gained 16 percent while Time Warner (Charts), which owns the nation's second largest cable provider, AOL and the Warner Bros. movie studio, has increased 17 percent. (Time Warner also is the parent company of CNNMoney.com.) Meanwhile, News Corp (Charts) has surged 35 percent thanks to optimism about its Fox TV and movie businesses as well as its popular social networking site MySpace. And shares of Walt Disney (Charts), which owns ABC and ESPN as well as a top movie studio, have shot up nearly 40 percent. Next year, however, could be more challenging, analysts said. Robin Diedrich, an analyst with Edward Jones, said it may be difficult for media companies to replicate this year's gains. Investors should not expect the entire sector to perform well and should instead try and find the best companies in the group. "We will probably see some separation in performance between the media companies next year," she said. But she said that as long as the economy holds up, media companies should be able to report decent increases in advertising sales, especially companies that are positioning themselves to take advantage of the robust growth opportunities in online advertising. Diedrich adds that valuations for most media companies are also relatively low, which gives the stocks some room to grow. However, the shift to digital media could also hurt the traditional media companies, according to Bear Stearns analyst Spencer Wang. In a report from last week, Wang wrote that big media firms are going to need to step up their pace of acquisitions in order to compete with more nimble competitors like Google (Charts) and Apple. And acquisitions, if they prove too costly, could hurt the media firms' return on investment and profits in the near term. "We are somewhat concerned that recent valuation multiple expansion in the group may prompt management teams to lose financial discipline and re-embark on another wave of consolidation, particularly as most have highlighted a 'digital strategy' as a top priority," Wang wrote. "In most cases, we find that acquisitions can dampen near term returns as they are digested as synergies may take time to emerge." So which companies make sense as investments? Diedrich said Disney, which has been the strongest performer in 2006, has a good chance of staying on top in 2007. She points out that the company's broadcast business (ABC), cable operations (ESPN and Disney), and its theme park and movie divisions are all doing well and should hold up next year. "Disney is hitting on all cylinders. Next year, there should be no real weak points. In terms of other media companies, you can't say that," she said. Diedrich points out that for Time Warner, the turnaround at AOL is still a big question mark. She thinks Viacom could be hurt by continued struggles at its Paramount movie business. And CBS, despite a strong 2006, could be hurt by a slowdown in the ad growth rates for TV and radio advertising. One fund manager who owns several media stocks also thinks Disney is the best bet. "Disney is not as cheap as it was earlier in the year but we're still really happy with it," said Michael Cuggino, who owns Disney in the Permanent Portfolio and Permanent Portfolio Aggressive Growth funds. "It was a brilliant move for them to go with Bob Iger as CEO last year. He's done a phenomenal job." But one analyst said investors should probably stick with News Corp. In addition to its success in the nascent online media world, it also has arguably the most diversified media business since it also owns a book publishing unit and newspaper group in addition to its online, broadcast TV, cable and movie business. "It's important for companies to have diversified revenue streams and embrace online. So those who would stand out are News Corp. It can weather a downturn better than others," said Andy Baker, an analyst with Cathay Financial. And Cuggino said he still is a fan of other media companies as well, including Viacom, CBS and newspaper publisher Tribune (Charts), which is currently in the process of looking for a buyer. "I like the media sector in general because there is not a of lot high cost from materials and overall this is a business with pricing power," he said. As for Viacom, Cuggino concedes that he's growing restless with how poor the stock has done this year. But he thinks the stock, trading at about 17 times 2007 earnings estimates, looks like a good value when compared to other media stocks. To that end, Bear Stearns' Wang also likes Viacom. In his research note, he wrote that the stock looks like a good bargain now due to this year's "lackluster share performance." Still, the biggest question facing media companies in 2007 will be whether or not "old" media will be able to make more inroads online. The largest conglomerates, for the most part, appear to be taking steps to increase their digital presence and have been rewarded by Wall Street. But many other media companies, particularly those with ties to the radio and newspapers businesses, are likely to struggle next year. Still Cuggino does not think that the traditional media business will go away. He said many traditional media firms could wind up as acquisition targets, particularly for private equity buyers, since media companies tend to generate a large amount of cash. As such, Clear Channel Communications recently agreed to be bought by a group of private equity firms. Cuggino also said investors may begin to grow increasingly skeptical of some newer media firms next year as expectations - and stock prices - continue to rise. For this reason, he said he does not own Google, whose stock recently surpassed $500 a share before pulling back. "I have a lot of difficulty buying a $500 cup of coffee even if it's some exotic blend from a faraway land. Google is a great business but the higher it goes, the less room for error you have," he said. Analysts quoted in this story do not own shares of the companies mentioned. Bear Stearns has performed investment banking for Time Warner and Walt Disney. The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

|