2007: Return of the dot-com IPO?YouTube chose to sell out to Google instead of testing the public's appetite for social networking stocks. Other startups may also shun the IPO route.NEW YORK (CNNMoney.com) -- Dot-com mania is back...kind of. Sure, shares of Yahoo! (Charts), eBay (Charts) and Amazon (Charts) have all tanked this year. But small-cap Internet stocks, those with a market value of less than $2.5 billion, are up nearly 20 percent on average, this year, according to figures from Thomson Baseline.

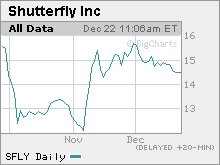

YouTube sold out to Google (Charts) in October for $1.65 billion. Private digital media firms like social networking companies Facebook and Bebo and online video companies Metacafe and Heavy.com are generating a lot of buzz. With all this in mind, should investors expect a new wave of Internet initial public offerings in 2007, especially from companies with a foothold in the whole user-generated media phenomenon? Opinions are mixed. On the one hand, the increasing popularity of social networking companies could lead more privately held firms to try and cash in through an IPO. After all, there clearly is global investor demand for these types of companies. In September, Japanese social networking site Mixi went public on Tokyo's Mothers exchange, a place where many start-up companies list, and shares doubled from their IPO price on the first trading day. "There is continued interest in not just social networking but companies that are using technology to create real communities," said Jonathan Silver, managing director with Core Capital Partners, a venture capital firm based in Washington, D.C. "There will be a lot of interest around sites that incorporate video in a creative way." Silver said his firm has not funded any social networking sites as of yet. He added that Core Capital is looking at two or three that it is interested in and hopes to make an announcement within the next month or two about an investment. But so far, few U.S.-based digital media companies have tested the public waters. Online photo service Shutterfly (Charts) went public in September and its stock is sticking around its offering price of $15 a share. Why aren't we seeing a replay of the dotcom IPOs of the late '90s? Executives from several U.S.-based start-ups said that going public doesn't have the same allure as it once did. Even if there is legitimate investor interest in digital media firms, the cost of being a public company may be prohibitively expensive to some firms. Due to the Sarbanes-Oxley laws that were passed by Congress in 2002 in the wake of the Enron and WorldCom accounting scandals, it has become more costly for companies to remain compliant with the new rules. "Sarbanes-Oxley prevents a lot of companies from going public. Now you need to be in the range of $30 million to $100 million in annual revenues before it makes sense to go public," said Max Levchin, chief executive officer of Slide, a company that enables people to personalize photos and other digital content. Slide raised its most recent round of financing in November and is backed by prominent VC firms Mayfield and Khosla Ventures. And Levchin has prior experience bringing companies public. He was the co-founder of PayPal, which went public in 2002 and sold out to eBay later that year. Others noted that there is no rush to go public. Many digital media companies are spending little, if anything, on marketing and are letting word of mouth increase their visibility. So companies aren't burning through as much cash as they were in the late '90s. To that end, Alex Welch, chief executive officer of Photobucket, a video and photo hosting site that boasts 32 million users and is backed by venture capital firm Trinity Ventures, said his company has barely tapped into the $10.5 million it raised from it most recent round of financing in May. "The site's growth is purely organic. No marketing is involved. We don't feel that we need to do so since the product markets itself," Welch said, adding that the company has no plans to go public next year but that an IPO in 2008 is not out of the question. Konstantin Guericke, chief executive officer of jaxtr, a startup that sets up private phone numbers that allow people on social networking sites to click and call other users for free, agrees. "I foresee some IPOs but you don't need one to raise money," said Guericke. He added that jaxtr has not received any VC funding yet -- the company has been funded by its co-founders -- but that the company has had talks with interested investors. Guericke recently left LinkedIn, a popular site that makes it easy for business people to contact each other, to take the top spot at jaxtr. LinkedIn is a company with backing from prominent VC firms Sequoia Capital and Greylock Partners that many have speculated could take a stab at a public offering. Nonetheless, Guericke said he doesn't think big VC firms are in a hurry to cash in on investments like LinkedIn or other social networking firms. "Many companies have been around for only two, three four years so VC investors don't feel the pressure to do something yet. They would rather wait," Guericke added. "Big investors like Sequoia are not interested in selling something for a couple of hundred million dollars. They want to build billion dollar companies." As such, one VC said it may be premature to expect a wave of social networking or online video IPOs next year. "If you look at the characteristics of companies going public, you need to be north of $50 million in annual revenue and profitable or one or two quarters away from being profitable. There are not that many companies in consumer digital media that fit that bill," said Michael Brown, principal with Partech International, a venture capital firm based in San Francisco. Brown, whose firm has invested in Dailymotion, an online video site based in France, and Wazap.com, an online gaming community site that is popular in Germany and Japan, said that Facebook could conceivably go public next year and that Videoegg, a company that develops tools to make it easier for people to publish videos online, is another private firm worth watching. Another reason going public has lost its allure is that many technology and media companies have been willing to pony up healthy prices for digital media startups. In addition to Google's purchase of YouTube this year, Viacom (Charts), Sony (Charts), Time Warner's (Charts) AOL and General Electric's (Charts) NBC all bought online video or community-oriented sites in 2006. "The acquisition market has been pretty frothy. Buyers have made it attractive to sell so if you are a startup you want to entertain those offers," said Brown. Geoffrey Arone, co-founder of Flock, an open source Web browser that makes it easier to search for and share photos, videos and other forms of media, concurs. "There are some benefits to going public and huge disadvantages. If a company needs a quick infusion of growth capital, an IPO could make sense but for many, acquisitions are a more sensible alternative," Arone said. "Take YouTube for example. By selling to Google, they didn't need to go on a costly road show and have to talk to institutional investors." Arone, whose firm is backed by Bessemer Venture Partners and Catamount Ventures, agreed with others in that many companies are still simply too green to be considering an exit strategy. He said he's more focused now on attracting users and not thoughts of an eventual sale or IPO. And at the end of the day, even though many think that the current wave of dot-com start-ups is not analogous to the Internet funding bubble from the late 1990s and early 2000, there is still a growing sense that there's too much money chasing too few really groundbreaking ideas. "The consumer could be a fickle arena. VCs are happy since they've had some wins there but overall, it's a very risky area to invest in," said John Taylor, vice president of research with the National Venture Capital Association, a trade organization based in Arlington, Va. "But there can only be so many social networking sites. It's time to move on."

The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

Sponsors

|