Apple: Is Jobs' job on the line?New reports about Apple's options backdating have investors concerned about how much CEO Steve Jobs knew. But analysts doubt Jobs will have to step down.NEW YORK (CNNMoney.com) -- Investors expressed concern Thursday regarding the latest reports about options grants made to Apple Computer's enigmatic chief executive officer Steve Jobs. The Financial Times reported that Apple's board gave Jobs 7.5 million stock options in 2001 without the approval of the company's board, and said the company later falsified documents that purportedly showed a full meeting of the board had taken place to approve the options grant. The newspaper also reported that Jobs later surrendered the options without exercising them.

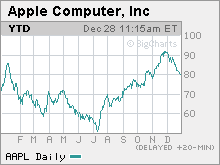

The company had no comment about the report in the Financial Times. Shares of Apple (Charts) fell about 1.1 percent Thursday afternoon on the news after sliding as much as 2.3 percent earlier. This comes a day after an online legal publication, The Recorder, reported that Jobs has already hired a lawyer to represent him in the event of any federal probe against him or Apple. Apple's stock sank as much as 5.8 percent Wednesday before rallying to close up a penny for the day. Apple is one of many companies that have come under fire this year for so-called options backdating - manipulating the dates of options grants to boost their value. Other well-known tech firms, including Broadcom (Charts), Novell (Charts), McAfee (Charts) and CNET (Charts), have been caught up in options backdating woes as well as non-tech companies such as insurer United Health Group (Charts). Apple has already launched its own internal investigation into this issue and has said that it will restate its earnings for periods in which backdating took place. According to reports, Apple could file such a statement with the Securities and Exchange Commission by the end of this week. Despite the fact that Jobs' name has surfaced more prominently in the most recent accounts of Apple's options problems, Wall Street analysts largely shrugged off the news and said that it's highly unlikely that Jobs would be forced to leave Apple. "Any time a CEO is at risk of being, for lack of a better word, forcibly removed, then investors should be concerned. But do I believe that Steve Jobs' job is at risk? That's an unequivocal no," said Jonathan Hoopes, an analyst with ThinkEquity Partners. Apple, more so than many other companies, is a firm that is widely associated in investors' minds with its CEO. Jobs, who co-founded Apple, left the company in the mid-1980s and Apple hit a rough patch shortly thereafter. Jobs returned in 1996 and took over as interim CEO a year later. Since then, he has been widely credited with making the company relevant again with products such as its iMac computer and the ubiquitous iPod media player and iTunes online store. But Hoopes said he did not think that there was much in the way of significant new disclosures about Apple in the past few days and blamed the sell-off on the inexperienced traders working the holiday week. He added that since the company has previously announced that it is investigating the matter and is planning on restating results, investors shouldn't fear any major bombshells. To that end, Apple said in a press release in October that "in a few instances, Apple CEO Steve Jobs was aware that favorable grant dates had been selected, but he did not receive or otherwise benefit from these grants and was unaware of the accounting implications" and added that independent investigators "found no misconduct by any member of Apple's current management team." "Is there anything new here? I don't think so. Are people more aware of it today? Sure. But there is limited liquidity in the markets due to the holidays," Hoopes said. "You got a Christmas present to buy the stock yesterday and if it's down again today, you have another Christmas present." Another analyst wrote in a report Thursday that since the options backdating problems have affected so many companies, it's unlikely that Jobs will get singled out by the SEC for any wrongdoing. "Our sources estimate that options backdating is a widespread and commonplace problem in the Fortune 500, affecting potentially as many as 30-35 percent of companies. Given the widespread nature, we doubt the SEC and Department of Justice will pursue a broad 'witch hunt' forcing key executives to step down that would undermine the recovery of the U.S. economy," wrote American Technology Research analyst Shaw Wu. "Not to sound like conspiracy theorists, but we do not believe it makes sense for the U.S. government to nail AAPL and Steve Jobs, one of the most respected American companies and businessmen of the past 100 years," Wu added. Shebly Seyrafi, an analyst with Caris & Co., agreed that unless Jobs is found to be directly responsible for approving any misrepresentation of company records, then it's unlikely that he will need to resign. "The possible falsification of documents for Steve's compensation package is disturbing, but we'll see how out of hand this gets. I think the allegations would have to get out of proportion for Jobs to step down," he said. Seyrafi added that the recent sell-off in Apple's stock is not a big surprise since many investors may be looking to book profits before the year is over. Shares of Apple have gained more than 40 percent since June and are up nearly 15 percent year-to-date. Both analysts said that the stock's future performance will probably depend more on the company's business prospects, as opposed to further speculation about Jobs and the options brouhaha. As such, Hoopes thinks investors have many reasons to be excited. He said he expects Apple to continue gaining market share in the personal computer market as more iPod owners decide to switch to Macs, a phenomenon many have dubbed the iPod halo effect. He said that new software, such as upgrades to Apple's iLife suite, which includes photo, movie and music editing tools, as well as Apple's latest version of its operating system for Macs, dubbed Leopard, should give a big boost to Apple's sales and profits next year. But perhaps the biggest catalyst for Apple's stock could be the release of a cell phone, which has been widely anticipated for months. Some have speculated that Apple could unveil its phone at the Macworld Expo, an event held every January that Apple has often used to showcase new products. Macworld will run from January 8 through January 12 in San Francisco. Seyrafi said that if Apple does not announce the phone at Macworld, the stock could take another hit. But he does expect a phone to be released sometime next year since he has heard that contract manufacturers - companies that build products for brand-name tech firms - are working on it. With that in mind, Seyrafi thinks that as long as Wall Street once again begins to focus more on the company's new products, the stock will eventually bounce back. "Apple investors care more and more about the business. Roll with the punches is the way to think about it. This is the latest punch," he said. Correction: An earlier version of this report incorrectly indicated that Dell had faced options backdating problems. The company has delayed regulatory filings due to investigations into its accounting practices but the company has not reported any options backdating issues. CNNMoney.com regrets the error. Analysts quoted in this story do not own shares of Apple and their firms have no investment banking relationships with the company. |

Sponsors

|