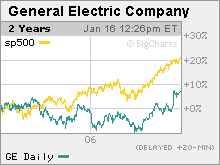

NBC: Must-see profitabilityGeneral Electric, the parent of NBC Universal, promised investors that NBC will generate earnings growth this year. Can the media division deliver?NEW YORK (CNNMoney.com) -- It's been a rough couple of years for NBC. But thanks to new hits "Heroes" and "Sunday Night Football" and a revival for stalwarts like "ER," the Peacock Network is actually in contention for the ratings lead among the key 18-49 year-old age group that's lusted after by marketers. According to Nielsen Media Research, NBC trails Walt Disney (Charts)-owned ABC and CBS (Charts), which are tied for first in this demographic by only a slight margin. But the question for investors is will NBC's revival help lift profits at its parent company, General Electric (Charts)?

In the third quarter, NBC Universal reported an impressive 20 percent increase in revenue... but a 10 percent decline in operating profits. Jeffrey Immelt, GE's chief executive officer, vowed during the company's third quarter conference call in October that the NBC Universal unit would report a profit increase during the fourth quarter. He cited improving ratings trends at the NBC broadcast network. GE will report its fourth-quarter results on Friday, January 19. NBC also announced last October that it was cutting back on development of scripted shows in order to reduce costs. Game shows like "Deal or No Deal" and reality programs such as "The Biggest Loser" have been ratings successes for NBC and are typically much cheaper to produce than scripted programs. What's more, Immelt said at the company's annual outlook meeting in December that earnings could increase as much as 5 percent in 2007 and that sales, excluding the effect of the Winter Olympics, which NBC aired last February, could increase by a similar amount. Immelt said the Olympics brought in between $900 million and $1 billion in revenue for NBC in 2006. One fund manager who owns General Electric thinks that NBC should not have a problem meeting Immelt's targets. "This is manageable and attainable guidance. We've already seen a number of positives in the works with NBC and they should be able to comfortably deliver on their outlook," said David Katz, manager of the Matrix Advisors Value fund. NBC Universal, which also owns cable networks Bravo, Sci Fi and USA, Spanish language network Telemundo and the Universal Pictures movie studio, is a relatively small, but not insignificant, part of General Electric. The division accounted for about 10 percent of GE's sales through the first nine months of 2006 and 11 percent of operating profits and one GE investor said a sustainable turnaround at NBC could help lift GE's stock price. "Even though it's a small piece of GE, NBC is what many people in the public think of when they think of GE. It always helps to have NBC doing well," said James McGlynn, manager of the Summit Everest mutual fund. And the unit has been a drag on GE's profit growth due to the network's poor ratings. That, some think, has hurt the stock. "The market of late has been penalizing a company because of its lowest common denominator. People have penalizing GE because of NBC," said Katz. During last year's upfront media negotiations with advertisers, NBC was said to have pulled in about the same amount of advertising commitments as it did in 2005, approximately $1.8 billion to $1.9 billion. But that's down significantly from 2004's total of $2.9 billion in ad revenue Still, with NBC's ratings on the climb, the network has a better chance of generating increases in ad sales heading into the 2007-2008 television season. "For quite some time, NBC's ratings were going south. Now they should be able to get better advertising rates," said McGlynn. However, NBC may have a tough time continuing its ratings success for the remainder of the current season, which ends in May. The network will no longer be able to rely on football on Sunday nights. In addition, "Heroes" will face tougher competition since News Corp.'s (Charts) Fox has just brought back "24", which also airs on Monday nights at 9. But another fund manager who owns GE says that NBC has done a reasonable job of stemming the ratings bleeding of the past years. And now that the network has some hits to build on, that's a good sign considering that the TV business is highly cyclical. In other words, NBC has been down so long that there's no place to go but up. "The ranking for the networks change places every three to five years or so," said Ted Parrish, co-manager of the Henssler Equity fund. "It's about time for NBC to reclaim the top spot." Investors will also be interested in hearing more about NBC's plans to bulk up in online media. Competitors, most notably CBS, Disney and News Corp., which owns social networking firm MySpace, have been aggressively increasing their presence online in order to compete more effectively against companies like Google (Charts), which owns the popular online video site YouTube, and Yahoo! (Charts) To that end, Immelt said in December that the NBC Universal unit should generate $1 billion in sales from digital media businesses such as iVillage, which GE bought last year. That's up from about $400 million in 2006. "There are a lot of positives for NBC Universal for the long-term. I see some great potential in digital," said James Denney, manager of the Electric City Value fund, which owns GE. NBC has taken other steps to boost its online presence, including the launch of DotComedy, a Web site that features clips from NBC Universal shows such as "Saturday Night Live," "The Tonight Show with Jay Leno" and "Late Night with Conan O'Brien." But McGlynn said he'd like to see NBC do even more in order to generate more ad revenue online. "NBC had one of the biggest online video hits with the 'Lazy Sunday' "Saturday Night Live' clip," he said, referring to a popular sketch from the TV show that many fans posted on sites like YouTube last year. "They know that they have a good product and now they are trying to make money from it as opposed to giving it away for free on YouTube." In addition to news about more online initiatives, investors are also waiting to find out what will happen in the NBC Universal executive suite. The unit's chairman, Bob Wright, who is also a vice chairman of GE, is expected to retire this year. According to several published reports, Jeff Zucker, who heads the NBC TV network, is expected to replace him. According to other reports, there has been some speculation that an outsider, such as Yahoo chief executive officer Terry Semel, could be brought in to lead NBC. NBC has also been faced with some key management defections lately as well. Randy Falco, a longtime NBC Universal veteran, left in November to take the top spot at AOL, which like CNNMoney.com is owned by Time Warner (Charts). And David Zaslav, who had been heading up NBC Universal's new media strategy, also left in November. He is now the chief executive officer of Discovery Communications, which owns cable networks Discovery, Animal Planet and TLC. Katz said, however, that he is not overly concerned about who the new NBC chief will be. "I haven't focused on that a great deal. GE has demonstrated the ability to have strong management and intelligent succession plans," he said. But Parrish said that after two years of underperformance, NBC needs to show sustainable signs of a ratings and profit turnaround or else investors will start to grow reckless. "NBC is always an important part of GE and their performance. But if they can't get it turned around this year, I would dare say that maybe it could be a business that GE looks to get rid of," he said. The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

Sponsors

|