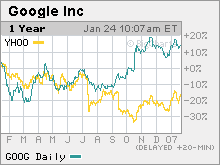

Google stock: Breaking the $500 barrierThe world's top search engine may face more of a threat from Yahoo! later this year, but analysts still think Google is a better bet.NEW YORK (CNNMoney.com) -- Yahoo! pleased investors, even though its sales and profit guidance for 2007 was a bit disappointing. And if Yahoo was able to get Wall Street excited, just imagine what the reaction may be when Google reports its fourth-quarter results on January 31. Google (Charts), the world's leading search engine, is expected to report revenue, excluding ad sales it shares with partners, a figure known as traffic acquisition costs or TAC, of $2.19 billion. That's a 70 percent increase from the same period a year ago. What's more, Google's earnings, excluding various items such as stock compensation expenses, are expected to come in at $2.90 a share, up 88 percent from the fourth quarter of 2005. And considering that Yahoo, despite the disappointing forecast, reported fourth-quarter results that exceeded Wall Street's estimates, it seems safe to predict that Google's numbers will also be better than anticipated. "You can read a lot into how Google did from Yahoo. My sense is that all online advertising companies are doing well. Everybody had a good fourth quarter," said Sasa Zorovic, an analyst with Oppenheimer & Co. In fact, the question probably shouldn't be will Google beat estimates but by how much? Google has surpassed Wall Street's consensus earnings estimates in all but one quarter since the company went public in August 2004. And it has beaten quarterly earnings projections, on average, by about 15 percent. Simply put, Google is firing on all cyber cylinders right now while Yahoo is still playing second fiddle to Google in search. Yahoo (Charts) is in the process of rolling out a new search platform, called Project Panama, that the company hopes will lead to more efficient searches for consumers, more effective leads for advertisers and, in turn, more revenue per search for Yahoo. The main reason Yahoo's stock rallied following its earnings report was due to bullish comments from Yahoo's two top executives - chief executive officer Terry Semel and chief financial officer Susan Decker - about the launch of Panama and the positive financial impact it is expected to have later in the year. Google, on the other hand, has maintained its sizable lead over Yahoo in search. comScore Networks, which tracks Web traffic, recently reported that Google's U.S. search market share was 47.3 percent in December compared to 28.5 percent for Yahoo. And Nielsen//NetRatings reported Tuesday that Google's market share in search last month was 50.8 percent, compared to 23.6 percent for Yahoo. A key ad-sharing partnership with News Corp.'s (Charts) popular social networking site MySpace, inked last year, should also be a boon for Google. Google will be the exclusive provider of search results on MySpace for the next few years. "Fine, Yahoo is starting to get it right with respect to online text search advertising. But Google is dominant in online text search advertising and moving into video and other markets. Yahoo is obviously still stumbling to catch up," said David Garrity, director of research with Dinosaur Securities, an independent research firm. But perhaps more importantly, Google is expected to also muscle its way into other lucrative areas of advertising where Yahoo currently has a bigger presence. Google is looking to expand in the area of so-called display advertising business, selling ads through banners, videos and other graphical forms (i.e. anything that isn't text-based). To that end, Google purchased online video kingpin YouTube late last year in order to augment its nascent online video advertising business. Online video has the potential to be a very big advertising opportunity, particularly as more major media companies like Walt Disney (Charts), CBS (Charts), and my parent company, Time Warner (Charts), embrace broadband video. But one analyst said that Google actually stands to gain from video in a less sexy way that has more to do with search and less with YouTube. Martin Pyykkonen, an analyst with Global Crown Capital, said he thinks that more advertisers will be willing to place video ads tied to keyword searches on Google. For example, a travel-related company may find that a video ad for a destination could have more appeal than a bland text ad. And Pyykkonen said the best thing about video ads is that advertisers would probably pay a higher price for them since they have the promise of being more effective. "What will really benefit Google is the whole area of video search. Increasingly, sponsored links will be video links since clips tied to a keyword search will be more compelling. They will pop up more often and there should be a pricing premium for those types of ads and that is independent of YouTube," Pyykkonen said. Other analysts expect Google to continue looking for deals that could help the company broaden beyond online search. As such, Google bought privately held firm dMarc Broadcasting, a firm that automates the process of buying radio ads, last year. The company is also said to be in talks to purchase Adscape Media, a privately held firm that specializes in advertising in video games. Scott Devitt, an analyst with Stifel Nicolaus & Co., said this deal makes sense and that Google is likely to pursue similar acquisition opportunities that could allow the company to offer more services to advertisers. But Devitt also expects more discipline from Google this year. During the past few years, some analysts have said that Google has launched too many products just to see what would stick. This year, Devitt said he expects fewer new releases from Google and more of a focus on strengthening existing products, such as its Checkout feature, an online payment service that is viewed by many as a legitimate threat to eBay's (Charts) PayPal. "In 2007, Google's cards are on the table. The key products have all been created and Google knows where it's headed with them. Now it's just about executing," he said. So what's this all mean for the stock? Shares of Google currently trade at about $485, only 5.5 percent below their all-time intraday high of $513. The stock gained 11 percent last year and is up nearly 6 percent so far this year...not to mention the fact that Google has surged 470 percent since its IPO. Still, even though it would appear that Google is quite the expensive stock, several analysts say it still looks reasonably valued. Google trades at 35 times 2007 earnings estimates and earnings are expected to increase 34 percent this year and 32.5 percent for the next few years. "The good news for investors is that it's trading at a reasonable price," Pyykkonen said. "I'm not saying Google's cheap, but considering its growth rate, it's attractively valued." Yahoo, on the other hand, trades at 48 times 2007 estimates and profits are expected to rise 28 percent this year and 25 percent, on average, over the next few years. And given that there is a lot of uncertainty about how successful Panama will really be for Yahoo, Devitt said it's a no-brainer for investors to bet on the current market leader. "If I had only a dollar of capital to put to work, I'd rather put it in Google than Yahoo," he said. So with that in mind, all those seemingly frothy price targets for Google don't appear to be that illogical. After all, for Google's stock to hit $600, it would only need to rise 24 percent from current levels. Plus, Google, at $600, would still be trading at a discount to Yahoo...even if current earnings estimates don't move higher. And that's a highly unlikely scenario. Google, which does not provide earnings or sales guidance, could very well wind up being more of a bargain after earnings are reported since analysts will probably raise their 2007 forecasts following the fourth-quarter release.

Analysts quoted in this story do not owns shares of the companies mentioned and their firms have no investment banking ties with the companies. The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

| |||||